By Ian Lyngen of BMO Capital Markets

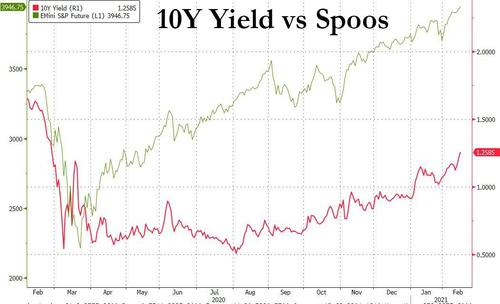

10-year yields broke through 1.25% during the overnight session on what can best be described as pressing a crowded trade. We’re certainly onboard with a challenge of 1.25% and 1.273% (March 19th peak) beyond there, if for no other reason than late-Friday’s selloff has created more questions than answers – suggesting the underlying momentum evident during the overnight session must run its course before any retracement is in the offing.

Moreover, the lack of an immediate bearish trigger also implies the recent bout of weakness has taken on a different character than had the march toward higher yields been accompanied by a fundamental data event or an influx of Treasury supply. In fact, the relatively smooth takedown of the February refunding left investors with the impression the supply concession in place prior to the auctions themselves would be sufficient. It’s the reemergence of the bearish trend in the absence of an identifiable catalyst that makes the selloff particularly notable.

Given the fact rates are edging higher on a combination of bearish underpinnings as opposed to a distinct driver, the technical landscape is useful in gauging the extent to which any repricing may extend. Beyond 1.273%, there is little support for 10s until an opening gap from 1.431%-1.471% that was established in late-February. 1.50% also holds obvious significance, however a 25 bp selloff driven by a series of already known bearish factors is difficult to envision, leaving us to anticipate dip-buying will emerge long before the overhead opening gap with an eye on anything >1.30% as sufficient incentive for any demand not sated by last week’s auction of $41 bn 10s at 1.155%.

To be fair, there are plenty of factors supporting a durable repricing toward higher Treasury yields;

We’d be remiss to argue against the intrinsic bearishness of these factors, rather the challenge is gauging the extent to which any repricing can sustainably press before running up against the bullish concerns.

Chief among the influences expected to keep yields from returning to an environment in which 2-handle 10s are back on the table is the overhang of slack in the labor-market resulting from the initial hit to the front-line service sector. While jobs have been recovered and the unemployment rate dropped dramatically, there remains a large segment of sidelined workers that will require more than simply vaccinations and reopenings to be reengaged. This structural underemployment will keep wages contained for years and without upward pressure on wages, it will be a struggle to achieve the true, demand driven inflation the Fed seeks. This isn’t to suggest investors won’t be faced with pockets of idiosyncratic inflation via the reversal of the initial pandemic impact, however the base effects will distort the more modest monthly gains as the March-May period unfolds. With transitory and supply side inflation more a tax on the consumer than enduring trends, we’re cautious against assuming the bearishness currently underway in Treasuries will prove sustainable.

The interplay between higher rates and equities also warrants a nod; particularly as >1.25% 10s and record high stocks reflect a shared optimism that risks conflicting with the ‘low rates drive higher valuations’ narrative that has been in play throughout much of the pandemic. Needless to say, there is a level 10- and 30-year yields at which the equity market wobbles, financial conditions tighten, the Fed takes notice, and the low right environment is reinforced either through forward guidance or changes in QE. As it stands, such an extreme appears to be further out on the macro horizon – at least for the time being. In the interim, we’re content to watch the cheaper and steeper trade get pressed and suspect this episode will serve to redefine the upper bound for the rates trading range once again as opposed to establishing a new floor for Treasury yields.

Tyler Durden

Tue, 02/16/2021 – 09:10

Fed Emergency Bank Bailout Facility Usage Hits New Record High; Money Market Funds See Small…

US Homeowner Equity Drops For First Time Since 2012 The housing bull market has peaked…

JPMorgan and Citigroup Are Using the Same Accounting Maneuver as Silicon Valley Bank on Hundreds…

At Year End, 4,127 U.S. Banks Held $7.7 Trillion in Uninsured Deposits; JPMorgan Chase, BofA,…

Do you really own something if someone forces you to make never-ending (and ever-increasing) payments…

Doug Casey On Why The US Is Headed Into Its 'Fourth Turning' Authored by Doug…