Small Caps Tumble After JPMorgan Warns ‘Equity Rally Is Overdone’

Tyler Durden

Wed, 12/16/2020 – 11:04

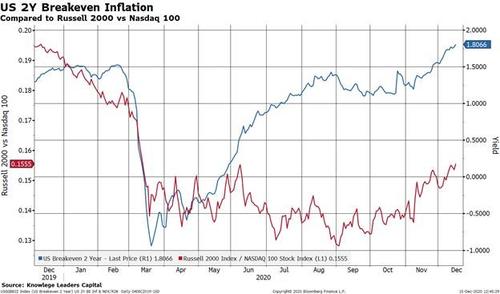

Small Cap stocks have been on a tear in the last month or so, massively outperforming big tech.

Small stocks tend to be more sensitive to changes in inflation than larger firms. Big tech companies are also notoriously volume monetizers, meaning incremental margin is acquired through volume gains rather than price increases.

That’s why the small cap to big tech ratio (red line above) is so important in the context of confirming inflation expectations.

But, this morning, Small Caps are taking a beating as JPMorgan says that global small and mid-caps should take a breather in the coming weeks, as the rally since November is overdone.

Specifically, strategists Eduardo Lecubarri and Siddharth Dash write that every time the global market cap has surpassed global GDP, the market has corrected, adding the ratio is not only above 100% but also at all-time high:

With many small and mid-cap indexes up double digits despite global GDP expected to fall 4% (and with technicals are at overbought levels), perhaps fear is about to come back into the market (or at least less greed and complacency).