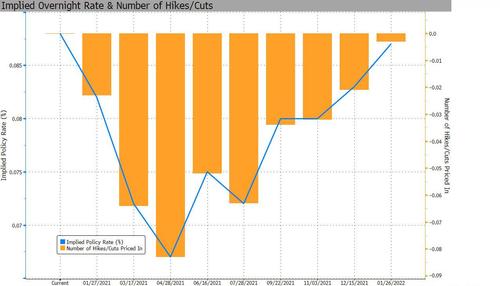

If one listens to the Fed, or looks at market-implied odds of subzero rates…

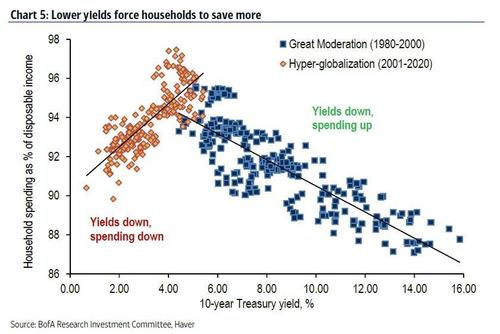

… the US will – unlike Europe or Japan – avoid the devastating central bank experiment that is negative interest rates, which not only does not encourage inflation but in fact ensures even greater savings, even less spending…

… even more disinflation and even greater bank losses as yield curves pancake.

Yet is there more than meets the eye here, and behind the optimistic facade of the imminent reflation trade, are the biggest US financial institutions quietly preparing for negative rates?

This is a question that bears asking, after this morning the Securities Industry and Financial Markets Association (SIFMA) issued a white paper to assist market participants with planning for the potential of a negative interest-rate policy in the US. The paper, titled “U.S. Negative Interest Rates Policy Checklist,” is co-authored by Sifma and Ernst & Young LLP

“While Sifma is not forecasting a U.S. negative interest rates policy, near term, our members do consider the need to prepare for such a possibility,” Sifma’s Charles DeSimone said in a press release accompanying the report. “While the probability is low, the impact would be high.”

And while Sifma – which is the biggest industry trade group representing securities firms, banks, and asset management companies – may not be forecasting negative rates, it was explicit enough in its intro to make it clear that NIRP remains a distinct possibility for the US:

The potential impact of a negative interest rate (NIR) policy in the US continues to be discussed by market participants. Federal Reserve Chairman Jerome H. Powell has previously stated that the US does not see negative interest rates as an appropriate policy response to economic disruption caused by the pandemic. However, the uncertainty of US economic recovery and the current 0% to 0.25% monetary policy target range for the federal funds rate continues to lead market participants to consider the future possibility of an NIR policy in the US.

Then, in a moment of bizarre absurdity, next to a photo of a jenga tower that is about to collapse (think The Big Short), the paper describes how certain capital markets products may be impacted in the event of negative interest rates in the US, followed by a checklist of considerations that can be used by firms seeking to mobilize negative interest readiness programs within their institutions. The checklist is structured across the following key themes: US NIR program governance and mobilization; financial exposure analysis; contract and counterparty customer analysis; portfolio strategies and profitability; technology and operations; finance, tax and accounting; and regulatory and policy considerations.

While we have discussed the myriad negative consequences that would result from NIRP previously, the paper did recap some of the potential horror stories that it now appears may be coming to the US (because otherwise, this paper would never have been published):

- NIR could result in derivative product floating rate payments (inclusive of any spread) becoming negative. For products such as swaps, this could result in one party having to pay (or receive) on both legs (i.e., the fixed leg and the absolute value of the floating leg)… Further, derivative trade capture and pricing models may need significant enhancements to account for negative payments, forward curves and negative strikes, and other models such as prepayment models and market risk, counterparty risk and margin models may need enhancements to handle negative rates. The impacts to third parties such as central clearing parties and exchanges will also need to be understood and addressed.

- Given that the repo rate is typically set based on a market benchmark interest rate, there is potential that repo rates could go negative if the US were to adopt an NIR policy. There is precedence of repo rates falling into negative territory in the US, but the driver historically has been high market demand of certain collateral (i.e., repo special issue trading). So, while operations and technology systems may have been tested and workarounds created for such events, additional challenges may arise if those solutions are not scalable or cannot handle large volumes of negative rate repos, as would be expected in an NIR environment.

- In a negative rate environment, clients could experience a negative yield on sweep balances, while additional management fees or expenses would further reduce incentives for investors to hold excess cash in such sweep products. Customers may chase yield and avoid sweep products with negative interest rates by moving funds to free credit balances, other sweep vehicles or products with a higher risk profile.

Read the full paper here.

Tyler Durden

Mon, 12/21/2020 – 18:40