The Top 10 Takeaways From JPMorgan’s Conference Call On Asset Bubbles

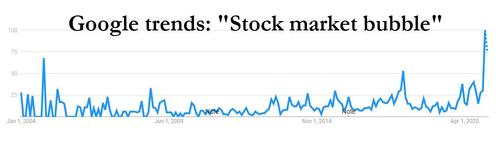

On Tuesday, we pointed out something which we hoped was only unintentionally ironic: at the same time as the first day of Jay Powell’s highly anticipated Congressional Testimony (which, to loosely paraphrase Gabriel Garcia Marquez was titled "inflation love in a time of Treasury cholera") was set to begin, JPMorgan was holding a conference call "on potential asset bubbles" – all of which have been sparked by the abovementioned individual – which included the who is who of sellside JPM research, including the bank’s heads of global equity and credit research, the top quants, and so on.

During the call, which had thousands of JPM clients dialing in and which was riddled with technical difficulties, JPMorgan traders and researchers discussed their outlook for global markets in the context of what virtually everyone now sees is one massive bubble…

… including the implications of growing retail participation in US equity markets, the increased acceptance and adoption of bitcoin and possible market consequences.

For those who missed it, here are the bank’s own highlights of its top ten takeaways (a replay can be found here) while the accompanying presentation is at the bottom:

1. We do not see a broad equity market bubble but rather certain pockets of the market that are experiencing hyper growth such as electric vehicles and renewables. While there is a lot of talk about bubbles, it is hard to see one in the broad equity market, where a dominant group (FANGs) practically hasn’t moved for 6 months despite massive amount of stimulus and an expected economic recovery, Financials that have barely recovered 2020 losses, and Energy that is still down 25% from last year despite a commodity bull market. We do see some relatively contained market segments that appear to be in a bubble related to Electric Vehicles (EV), renewable energy and innovations stocks. These sectors only make up a small part of the market (e.g., electric vehicles make up only 2% of the S&P 500), but we do see segments that remain cheap such as energy where positioning remains heavily underweight. We believe that this is only the first inning of the market rally, and that the rotation into cyclicals could play out for the next year. The broad rotation into cyclicals has contributed to an increase in intraday volatility as realized volatility of the S&P 500 has gone down to 5. If we want to be thorough in our search for bubbles, there is another asset that is currently in a bubble—the VIX. The VIX is now disconnected to underlying short-term S&P 500 realized volatility, indicating a bubble of fear and demand from investors looking to hedge or profit from a hypothetical market selloff. Given the VIX is at a near-record premium to actual equity volatility (~400-500% above the ‘fair value’), we think selling the “VIX bubble” represents a good market opportunity.

2. We remain constructive and sanguine on the outlook for the S&P 500, and the strong rotation and outperformance to Value from Growth which should continue and taking into account client positioning. Although the topic of reflation has been top of mind for most clients in the past few weeks, we have seen investors starting to position for higher interest rates by reducing exposure from high multiple and momentum names. However we remain positive and constructive on the market outlook. We distinguish between a positive vs. negative rise in yields and remain constructive as the Covid-19 recovery is on track, ongoing fiscal and monetary support will be forthcoming with a new stimulus bill and a possible infrastructure bill in the pipeline, and equity positioning remains low. There is strong interest for reopening names such as cruise lines, transports, casinos and hotels from both hedge funds and real money accounts and also growing interest in financials and energy.

3. There has been a strong rebound in global gross exposures across equities, up ~11% month to date, or 9% year to date. Short gamma positions have increased, but we see that as a secular phenomenon as retail activity has increased. Despite some warning of a ‘VAR shock’ what we are seeing now is ‘VAR inflows’ with volatility targeters/risk parity funds adding (rather than reducing) ~$1.5bn in equity exposure daily and gamma hedging reducing S&P 500 volatility, and long VIX positioning (e.g. via ETPs, limiting VIX upside).

4. The overall flow impulse by US retail investors is important to monitor as retail flows appears to have been the driving force of the risk market rally since November; however, tracking flow data remains difficult. Tracking the retail flow into equities on a high frequency basis is difficult as this retail impulse does not reverberate via equity funds, but rather via purchases of individual equities or call options on single names. Over the past year, there has been a preference change with US retail investors shifting their equity buying away from equity funds towards individual equities or call options on individual equities. After rising to record highs in the last week of January, this call option buying metric appears to have stabilized at close to record high levels, and we see no signs yet of any material slowing in this option flow metric.

5. We do not see Credit markets in a bubble but see credit spreads having the capacity to move tighter from current levels. Credit spreads could potentially overshoot our year-end targets and move back to levels last seen in the first half of 2018. In particular, US High Grade spreads could go a lot tighter as spreads are currently trading within the 10th percentile of their 20 year range. We calculate a spread floor of 79bp for ratings-sensitive investors in a base-case scenario while for non-ratings sensitive investors, we calculate a spread floor of 31bp.

6. In Credit, we position (or hedge) for orderly versus disorderly reflation via buying strangles to take advantage of low volatility. From a market outcome perspective, we think it’s important to differentiate between what we term orderly and disorderly reflation dynamics. We think differentiating between these two outcomes naturally lends itself to derivative strategies like strangles, which are motivated by the idea of capturing or hedging against tail outcomes.

7. The best hedges for a too-hot economy should consider historical performance in higher-inflation regimes plus current valuations and carry. On these criteria, the best are a Commodity index, Oil, Agriculture, Energy Equities & EM commodity FX; the worst are Base Metals, Gold & G10 commodity FX; and the in-betweens are TIPS & Mining Equities.

8. The rally in Bitcoin continues, with current prices well above our most recent estimates of fair value, as Tesla, BNY Mellon, Mastercard and PayPal announced measures that point to growing acceptance and adoption, pushing Bitcoin’s market cap up by $700bn since end-September 2020 on the back on just $11bn in institutional flows, which accounts for only a 1.5% increase in market cap. Current prices are well above our most recent estimates of fair value based on mining costs and risk capital equivalence in gold.

9. Bitcoin does not have any kind of value as a hedging vehicle in the current environment given the same investors drawn to Bitcoin are typically the same type of investors drawn to single name stocks in equity markets. The mainstreaming of Bitcoin is raising its correlation with equities. Since holders of Bitcoin and single name stocks have the same risk preference around macro shocks such as in interest rates, there is a risk of simultaneous deleveraging in both of these assets.

10. The correlation between Bitcoin and equities has risen meaningfully over the past year and looks to likely be sustained. In a multi-asset portfolio, investors can likely add up to 1% of their allocation to cryptocurrencies in order to achieve any efficiency gain in the overall risk adjusted returns of the portfolio. However, cryptocurrencies are investment vehicles and not funding currencies, so when looking to hedge a macro event with a currency, we recommend a hedge through funding currencies like the Yen or USD instead. If looking to hedge against weak growth, then investors should look to buy 30-year US Treasuries or US dollar versus EM currencies. To hedge inflation, look to take exposure to commodities.

And here it the presentation JPM handed out to all call participants

Tyler Durden

Wed, 02/24/2021 – 15:09