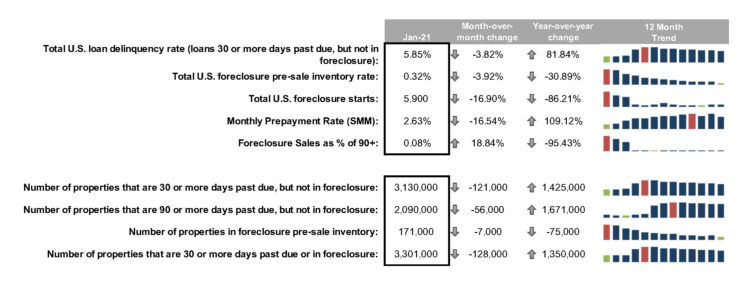

Just a few days ago Blackknightinc had reported delinquency rates had continued to barely nudge down.

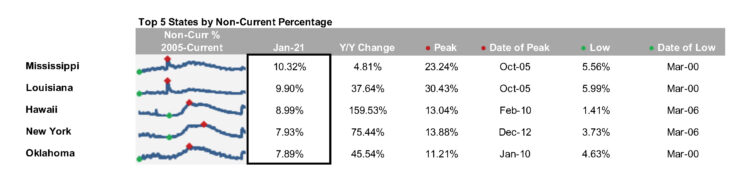

Viewing delinquency rates by state shows a few areas that have been impacted the greatest by the pandemic. In Mississippi, more than 1 in 10 borrowers are delinquent.

New data from our McDash Flash Forbearance Tracker shows that the last full week of February saw the number of active forbearances climb once again, increasing by 21,000 (+0.8%). With this weekly increase, the number of homeowners in a forbearance plan rose above 2.7 million once again after falling below that threshold for the first time since April 2020 earlier this month.

Portfolio-held and privately securitized mortgages saw the largest weekly forbearance increases, growing by 16,000 (+2.4%), followed by FHA/VA mortgages, which increased by 7,000 (+0.6%). The number of outstanding GSE forbearances fell by 2,000 (-0.2%) from last week.

Despite the weekly increase in active forbearances, the monthly rate of decline remained steady at -2% month-over-month, continuing the trend of very slow but steady improvement.

As of Feb. 23, 2.7 million (5.1% of) homeowners remain in forbearance. This number includes 9.3% of FHA/VA mortgages, 3.2% of GSE mortgages, and 5.2% of portfolio/privately held mortgages. 160,000 forbearance plans are scheduled to expire at the end of February, providing limited incentive for significant declines in forbearance volumes in coming weeks.