By Pam Martens and Russ Martens: March 23, 2021 ~

Yesterday the Federal Reserve released its “audited” financial statements with the following caveat, among numerous others:

“Due to the unique nature of the Reserve Banks’ powers and responsibilities as part of the nation’s central bank and given the System’s unique responsibility to conduct monetary policy, the Board has adopted accounting principles and practices in the FAM [Financial Accounting Manual for Federal Reserve Banks] that differ from accounting principles generally accepted in the United States of America (GAAP).”

The Federal Reserve is the regulator of the largest bank holding companies in the United States and, since December of 2007, has been shoveling trillions of dollars at the trading houses owned by these bank holding companies almost on a non-stop basis, if you include Quantitative Easing (QE) programs 1, 2, 3 and 4 and the repo loan bailout that began on September 17, 2019 – months before there was any financial crisis due to the pandemic.

As of last Wednesday, the Fed’s balance sheet had climbed to $7.7 trillion (yes, trillion with a “t”) from $959 billion on September 11, 2008, the Wednesday before Wall Street blew itself up along with the U.S. economy as a result of lax Federal Reserve regulation. And the Fed can’t blame that $7.7 trillion on the pandemic because its balance sheet stood at $4.2 trillion on December 25, 2019 before there was any pandemic in the U.S.

Given the Fed’s history, one might think that Congress would be demanding transparency from the Fed on behalf of the American people. But that’s not the case. While the Fed has released monthly reports showing the names of recipients of its largesse under some of its bailout programs, it has refused to provide the names of the Wall Street loan recipients under the following four programs: the repo loan bailouts; the Primary Dealer Credit Facility (PDCF); the Commercial Paper Funding Facility (CPFF); and the Money Market Mutual Fund Liquidity Facility (MMLF).

The financial statements released yesterday by the Fed did nothing to shed any light on which Wall Street trading firms were in such dire liquidity straits that they needed billions of dollars from the Fed on a daily basis in the fall of 2019 and much of 2020.

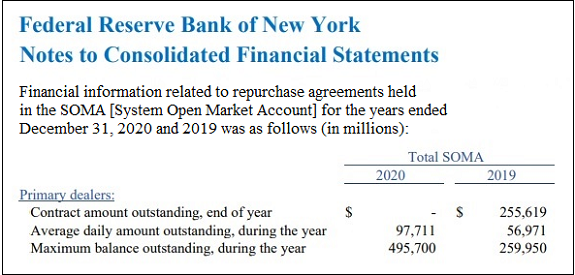

What we did learn, as shown from the graph above, is that one day last year, the Fed’s agent, the New York Fed, had lent out $495,700,000,000 under its repo [repurchase agreement] loan program versus an average daily amount of $97.7 billion. What we also know is that the only entities that are eligible to borrow that repo money are the Fed’s 24 primary dealers, which include the securities units of big U.S. banks like JPMorgan Chase, Citigroup, Bank of America and Wells Fargo. The primary dealers also include the U.S. based securities units of foreign banks like Deutsche Bank, Credit Suisse, and Societe Generale (SocGen).

The American people have a right to know if the five-count felon JPMorgan Chase is getting money from the Fed; or if Citigroup, which secretly received over $2.5 trillion in cumulative loans from the Fed during the 2008 financial crisis and its aftermath, is on the dole again; or if troubled foreign banks that are counterparties to Wall Street’s unreformed derivatives mess are back to getting secret handouts from the Fed as they were in 2008.

The American people also have a right to the granular details of financial dealings between the Fed and the Wall Street banks that make the case that the Fed is a captured regulator of the sprawling global banks that so convincingly demonstrated their ability to bring the U.S. economy to its knees in 2008.

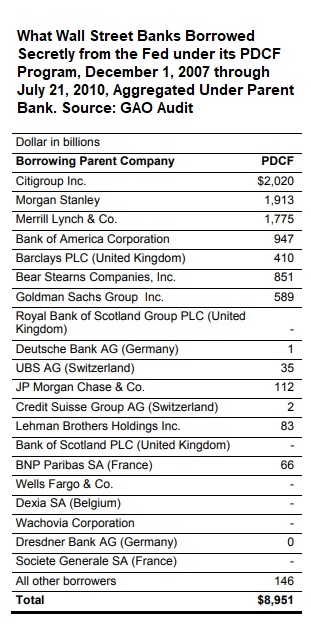

The program that the Fed used during the 2007 to 2010 financial crisis to secretly funnel a cumulative $8.95 trillion in below-market loans was called the Primary Dealer Credit Facility (PDCF), the same name the Fed is using for today’s secret facility. The Government Accountability Office (GAO) conducted an audit of the Fed’s lending programs and released the information on July 21, 2011. The GAO named names. (See chart below for where the PDCF money went the last time around.)

Fed Chairman Jerome Powell and U.S. Treasury Secretary Janet Yellen will appear at noon today before the House Financial Services Committee to answer questions on the Fed’s current emergency lending facilities. We’re not expecting to learn anything helpful about where the Fed money went under these four opaque lending programs.

If you believe American citizens deserve transparency on Wall Street bailouts, please call your members of the House and Senate today and demand to know the names of the recipients of these bailout programs.