Low Interest Rates, Inventories Affect Housing Affordability

March 30, 2021

Key points:

- Home ownership affordability in U.S. fell 2.6 percent in past year

- Home prices have reached record levels

- Bridgeport, Connecticut, among cities with largest declines in affordability

A key measure of housing affordability from the Federal Reserve Bank of Atlanta suggests the dream of home ownership is becoming less realistic for U.S. median-income households as both new and existing house prices have risen sharply.

National affordability

The Atlanta Fed’s Home Ownership Affordability Monitor (HOAM) index shows that homes continue to become less affordable. Supplies of existing and new homes have failed to keep pace with demand driven by historically low interest rates. Consequently, home prices have climbed sharply, greatly affecting what the average household can buy in today’s market.

A HOAM index below 100 indicates that the median-priced home is unaffordable to the median-income household given the current interest rate. In December, the HOAM index fell below 100, indicating that the median-income household cannot afford the median-priced home. At 99.36, the December HOAM index was below its 101.71 reading a year earlier. Home ownership costs in December as measured by principal and interest, taxes, and insurance accounted for 30.1 percent of the annual median income of the average U.S. household, slightly above the 30 percent affordability threshold set by the U.S. Department of Housing and Urban Development.

Relatively low interest rates have had a positive impact on affordability. In December, the 30-year fixed mortgage interest rate dropped to 2.68 percent, 9 basis points lower than November and a decline of about 104 basis points from December 2019. Meanwhile, throughout the pandemic, the projected national median household income remained stable, increasing by only 0.6 percent to end the year at $63,726. Still, any benefits from low interest rates and stable household incomes continue to be offset by rapidly rising home prices. The national median existing home price (three-month moving average) peaked at $307,552 in December, up 2.07 percent from a revised $301,297 for November. However, compared with a year ago, home prices rose 16 percent in December.

Regional affordability

In most regions, lower interest rates have helped keep housing affordable. Only about 17 percent of metro areas in the United States had a HOAM index below 100 in December. For the most part, high-cost metro areas on the West Coast as well as in the Northeast and south Florida were among the least affordable, while metros in the middle of the country, particularly in the Midwest, tended to be the most affordable. Even so, the affordability trend in many regions is eroding. In December, 33 percent of metro areas saw a decline in affordability from the year earlier as higher home prices and flat income growth took their toll.

Changes in affordability

Despite the national decline in affordability, the cities of St. Louis, Missouri; Harrisburg, Pennsylvania; and Youngstown, Ohio, recorded the greatest improvement in affordability over the past year among metro areas with populations above 500,000. A slower rate of price growth and declining interest rates helped increase affordability in these areas. Meanwhile, Bridgeport, Connecticut; Spokane, Washington; and Milwaukee, Wisconsin, had the biggest reductions in home ownership affordability over the past year, mainly because of rising home prices. The median home price in Bridgeport climbed by 32.5 percent over the past year, while prices in Spokane and Milwaukee rose by 28.8 percent and 29.7 percent, respectively. The increase in home prices in these regions was more than enough to offset the positive effect of lower interest rates.

Key Issues

Going into 2021, the housing market was surging despite the negative effects of the COVID-19 pandemic in other sectors of the economy. The key driver of demand continues to be historically low mortgage rates, which led to a surge in refinance and purchase activity through most of last year. As of January, existing home sales rose 23.7 percent from last year, according to the National Association of Realtors (NAR). In many markets, demand continues to greatly exceed supply. According to NAR, housing inventory dropped by 25.7 percent in January from a year ago, and the home supply stood at a historic low of 1.9 months.

As a result of the shortage of existing homes, demand for new construction continues to increase, leading to optimism and expectations for growth in 2021. As with existing homes, new home prices continue to move upward, with the median-priced house now costing more than $340,000. Though low interest rates have helped offset rising prices for some homebuyers, many builders caution that accelerated demand may stretch capacity within the sector, which will in turn lead to higher prices.

As median-income households cannot afford a median-priced new or existing home, the current boom in housing demand has been concentrated in households with incomes above the median. Consequently, households with more moderate means may continue to find it more and more difficult to secure a home they can afford should prices continue to climb.

Additionally, because the current surge in sales and refinance activity has been driven by very low interest rates, the housing market is becoming increasingly vulnerable to rate spikes. As seen in 2014 and in 2018, a sudden rise in rates tends to cause an immediate contraction in housing demand. As affordability declines with rising home prices, fewer homebuyers will be able to absorb higher rates. On the other hand, even if rates do increase over the next year, they remain near historical lows, a factor that could help maintain the current level of demand from higher-income households.

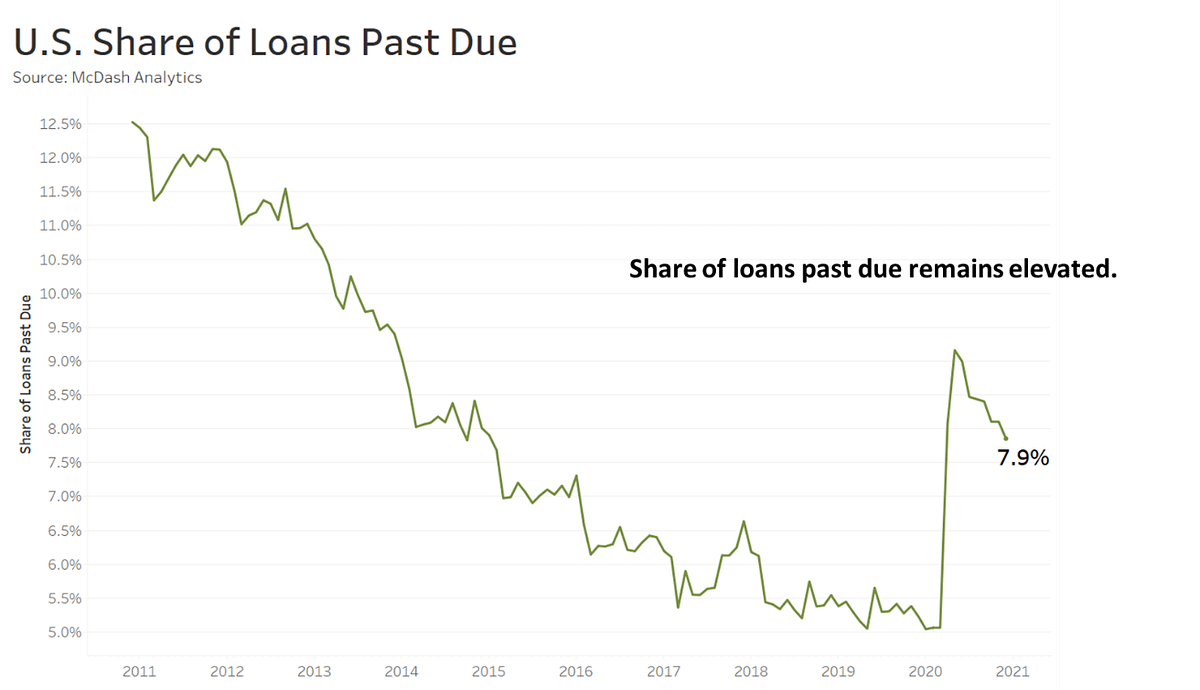

Finally, the share of mortgages that are currently past due has come down from but remains elevated. As of January, that percentage stood at 7.9 percent nationally, compared with more than 9 percent earlier in the pandemic. Although many of these past-due borrowers are likely participating in some sort of forbearance program, the risk of default remains a concern as these programs expire. Additionally, there is great disparity among regions and populations negatively affected by the downturn. For example, places with a concentration in tourism and hospitality sectors, such as Las Vegas, Orlando, and Miami, tend to have a higher rate of past-due mortgages. Additionally, submarkets within regions with higher minority populations also are likely to have a higher share of past-due loans.

For more details, including metro level analysis, please visit the interactive Home Ownership Affordability Monitor.