JUNKie

BONDs

Note

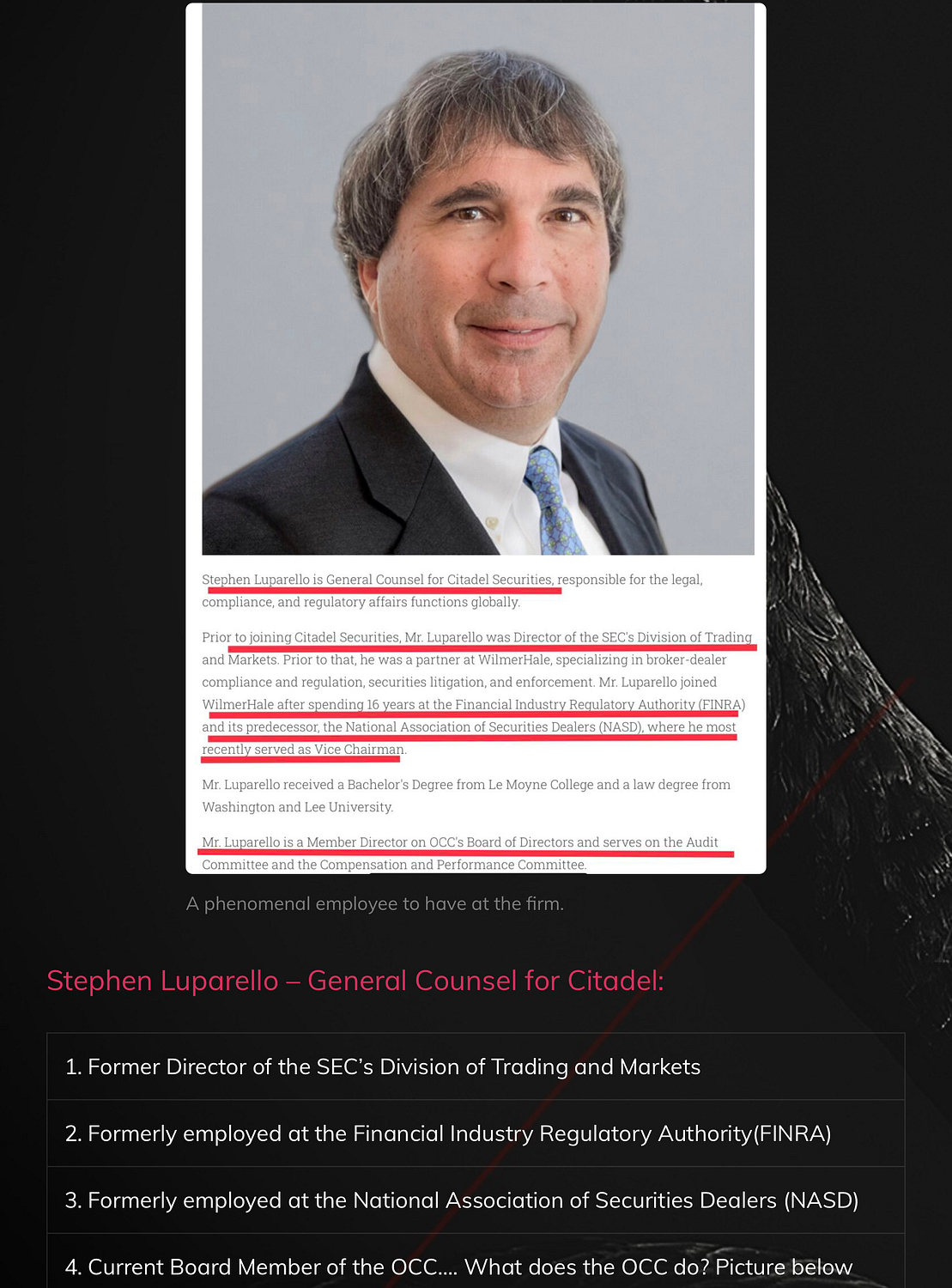

The article below announces another move by a former regulator whom is now employed at Citadel. At the start of February, when the $GME and Wallstreetbets story was consuming the financial news, I posted an article that summarized violations committed by Citadel. The article includes a few of the employees who have ties to financial regulatory agencies and other areas of interest. Here is one of Citadels best…

Article is from bettermarkets.com

April 1, 2021 Contact: Pamela Russell at 202-618-6433 or press@bettermarkets.com

Washington, D.C. – Dennis M. Kelleher, President and Chief Executive Officer of Better Markets, issued the following statement in response to reports that the most recent Chairman of the Commodities Futures Trading Commission (CFTC) was just hired by Citadel Securities:“The announcement that the most recent Chairman of the Commodities Futures Trading Commission (CFTC) has been hired by Citadel Securities as its Chief Legal Officer is just the latest regrettable example of a senior government regulator appearing to sell out his public service to big finance via the revolving door. Recent ex-regulator hires at Robinhood, Coinbase, D.E. Shaw, Apollo Global Management, Spring Labs and many others preceded this latest revolving door hire by Citadel.

“This is little more than legal corruption and bribery. That’s why the revolving door used to be looked down upon as disreputable and sleazy, often referred to as ‘influence peddling.’ This undermines the trust and confidence in government by the American people and it demoralizes the many hard-working public servants who sacrifice to actually serve the public.

“Out of hundreds of millions of Americans in the workforce, it is implausible that these people are being hired solely on the merits. They appear to be purchased, at least in part, for the insider knowledge, access, and connections they obtained while purportedly serving the public. These revolving door purchases are examples of how Wall Street uses its economic power to buy political power to keep the financial system rigged to enrich themselves at the expense of retail investors, the financial system and, ultimately, the country. This corruption disgusts the American people and Congress should outlaw it by prohibiting former regulators from working directly or indirectly for any entity within their jurisdiction while in government for not less than five years.”

###Better Markets is a non-profit, non-partisan, and independent organization founded in the wake of the 2008 financial crisis to promote the public interest in the financial markets, support the financial reform of Wall Street and make our financial system work for all Americans again. Better Markets works with allies – including many in finance – to promote pro-market, pro-business and pro-growth policies that help build a stronger, safer financial system that protects and promotes Americans’ jobs, savings, retirements and more. To learn more, visit www.bettermarkets.com.