Article by Zerohedge

One certainly can’t blame the Fed for not doing enough to stabilize markets during the covid crisis: having expanded its balance sheet by over $3 trillion this year alone and injecting $120 billion in liquidity every month, the US central bank – which is also buying corporate bonds and junk bond ETFs – remains the first and last line of defense for any equity drawdown.

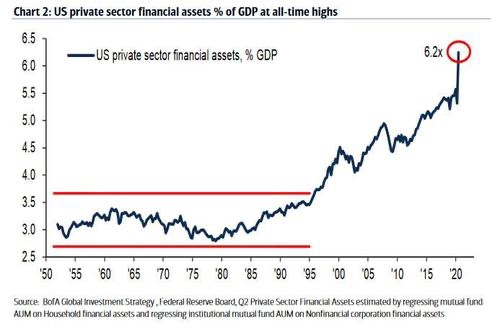

As an aside, and for those asking why the Fed continues to “confuse” markets with the economy, the answer is simple: since the value of financial assets in the US economy at a record 620%+ of GDP, for the Fed capital markets are the functional equivalent of the economy since a market crash would destroy the highly financialized US economy, and thus can never be allowed.

There is just one problem: after a year in which the US budget deficit hit a record $3.1 trillion, and with the US facing a deluge in new debt issuance in 2021 which has already led to the biggest October deficit on record and which at $284 billion suggests another full-year deficit of well over $3 trillion (assuming no further lockdowns)…

… the Fed’s current rate of debt monetization – read QE – is simply not enough.As Bank of America’s Michael Hartnett calculated in his latest Flow Show report published on Friday, over the next year, “Treasury supply will significantly outstrip Fed purchases in Q4 & Q1”, and this is even without factoring in the possibility of another major fiscal stimulus.The problem: while the Treasury faces net Treasury issuance of roughly $2.4 trillion, the Fed is expect to monetize less than half of this total, or $960 billion. Considering that in 2020 under the auspices of “helicopter money” (from which we remind readers there is simply no coming back) the Fed will have monetized virtually every dollar of net issuance, this is a huge cliff and one which could lead to a shock drop in Treasury prices if the market reprices (lower) its expectations for Fed monetizations.

In short: the Fed needs to more than double its scheduled monthly QE in 2021 just to catch up to where it was in 2020.

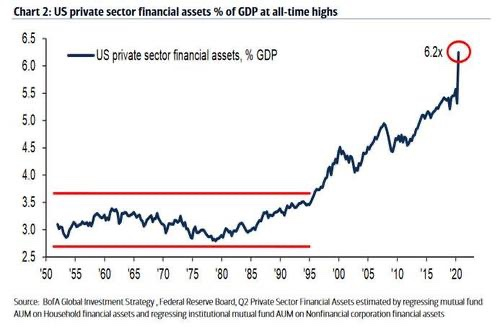

Of course, other central banks are facing the same challenge of insufficient monetization and some have already taken appropriate steps: recently both the RBA and BoE announced an expansion in their QE.

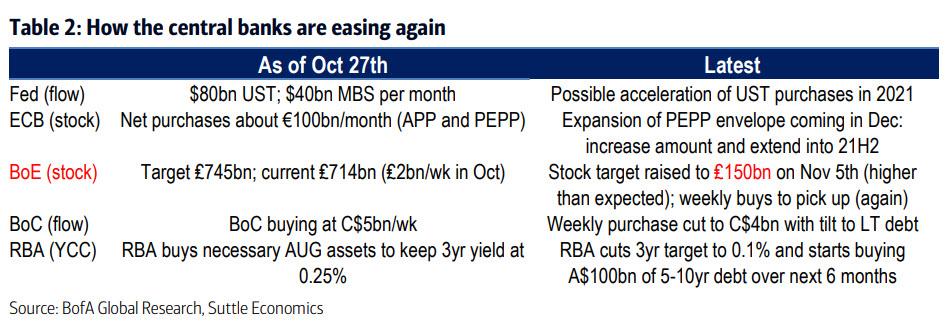

Just next month, the ECB is also expected to announce a dramatic expansion of its QE operations and as Variant Perception writes, the central bank “may end up absorbing all government supply in 2021″:

The ECB has provided a clear indication that additional stimulus will come in December. A further expansion of PEPP could result in the ECB purchasing most, if not all, of the EGB supply in 2021.

Although the ECB left the monetary stance unchanged at their last Governing Council meeting, the press statement indicated that policy instruments will be recalibrated in line with new economic forecasts published in December – providing strong indication that fresh stimulus will be rolled out by year-end.

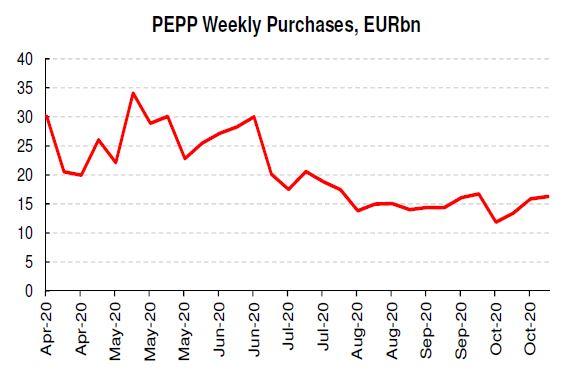

Given the slowdown in the rate of PEPP purchases over the summer (in part reflecting seasonal effects), there is still more than half of the existing capacity remaining in the current expanded envelope. As such, adding further capacity to the PEPP facility could result in the ECB absorbing all of the EGB supply in 2021.

According to VP, “so far the ECB has purchased €617BN through the PEPP facility, leaving €733BN for future purchases” and adds that it assumes “that the ECB expands the envelope in December by €500BN (a lower amount would not be material, while a higher amount would perhaps not be justified for now given the existing capacity) and extends the purchasing window by six months to end-2021.”

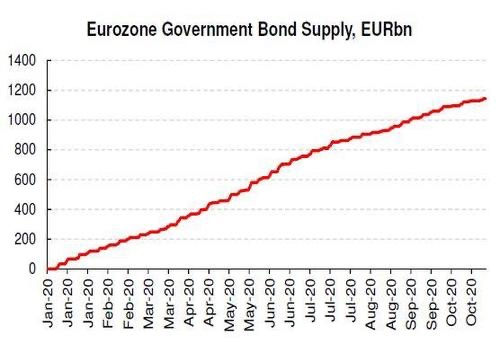

Putting this number in context, Eurozone governments have issued around €1.1 trillion of bonds YTD (including syndications), and even assuming a similar volume of issuance in 2021, this would fall in the ECB’s expanded PEPP envelope (at the current run rate, there would be €750bn in PEPP holdings by December, with a €500bn envelope expansion taking remaining capacity to ~ €1.1trn). d

And now that German opposition to out of control debt-funded stimulus has effectively been neutered, it is only a matter of time before Lagarde announces an expansion to QE which will ensure that the ECB monetizes 100% (if not more) of all net issuance in Europe (one caveat made by Variant Perception here is that “the ECB has had to repeatedly fend off recent criticism from some quarters that it is engaged in monetary financing. This argument will become more difficult to make if the ECB finds itself buying up all of the EGB supply that comes to market” although we doubt this will be a major hindrance if Lagarde can sell the alternative as a doomsday scenario, something central bankers are quite good at).

Which brings us back to the Fed: with the RBA, BOE and ECB all set to monetize 100% of domestic net issuance – in other words, central banks will henceforth fund the entire sovereign budget deficit which is what MMT and helicopter money is all about – it’s only a matter of time before Jerome Powell will join the club, and we expect that at some point in the next 3-4 months, the Fed will announce it too will double its monthly rate of debt purchases.

The only question is what crisis will be used as a scapegoat for the next massive QE expansion: as a reminder, the covid pandemic emerged in at a very convenient time for the central bank – just as the business cycle was set to go into contraction, with the Fed having launched “Not QE”, and with rates at a tiny 1.50 (which are now back to zero). And thanks to the $3 trillion “covid” liquidity injection, the Fed has effectively reset the business cycle for the foreseeable future. It just needs to do so again, and we are completely confident that Powell and company will be completely successful in finding the right crisis to blame it on.

Furthermore, now that we have Congressional gridlock for at least 2 more years (absent a dramatic victory for Democrats in the Georgia Senate race runoffs in January), the Fed’s much desired multi-trillion fiscal stimulus will simply not come, leaving it as the only source of potential stimulus for the foreseeable future, effectively ensuring that (much) more QE is just a matter of when not if.

In fact, one can argue that the creeping economic shutdowns, first at the state level and soon at the Federal, have just one purpose: to catalyze the next crash… and next bailout by the Fed.