There are other types of stock market leverage, and no one knows how much leverage there is in total. Margin debt is the only reported indicator.

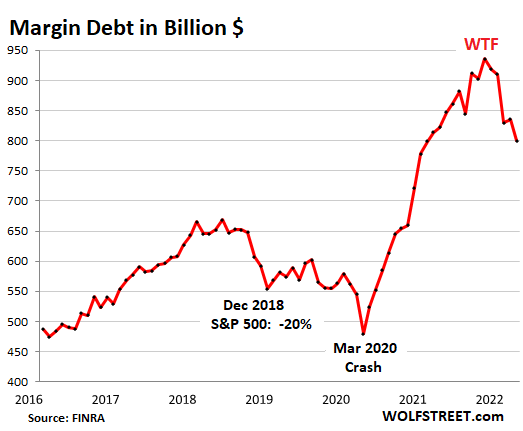

Margin debt – the only type of stock market leverage that is reported regularly – dropped by another $36 billion, or by 4.3%, in March from February, and by 12.4% over the past three months, to $800 billion, according to FINRA which collects this data from member brokers. Margin debt has now fallen below the year-ago level. But leverage is still gigantic and has a long way to go.

After peaking in October at $936 billion, margin debt started falling in November, which was also the month that the Nasdaq started falling. Margin debt has since fallen by 14.5%. The Nasdaq has fallen by 17.6%.

And many of the highfliers have collapsed by 60%, 70%, and even over 90%, some of which I track in my collection of Imploded Stocks. Stock jockeys that were margined in those trades got turned into forced sellers to raise the cash to pay down their margin debt. A margined portfolio specialized in these stocks can get wiped out.

Increasing amounts of stock market leverage provides new fuel for the market. But decreasing amounts of leverage removes that fuel.

The S&P 500 peaked on January 3, followed by a sharp sell-off and has since declined 8.8%. In the month of January, margin debt dropped by $80 billion, or 8.8%, the largest dollar-drop ever, and one of the largest percentage-drops ever.

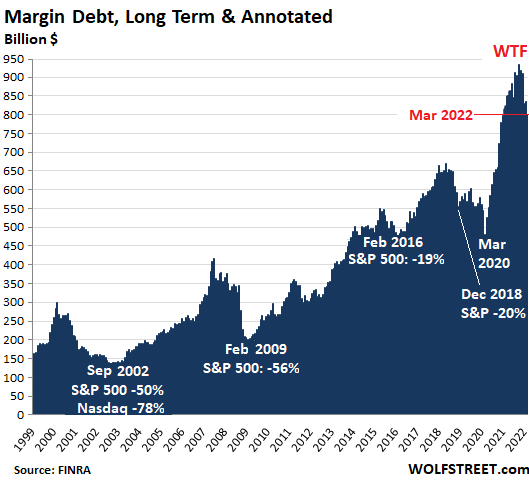

The percentage-drops that had been higher were:

- Covid crash (March 2020: -12.1%);

- Euro Debt Crisis (August 2011: -10.4%);

- Financial Crisis (May 2010: -9.1%, November 2008: -18.1%, October 2008: -19.7%, August 2007: -13.0%);

- Dotcom crash (March 2001: -12.1%; December 2000: -11.6%; April 2000: -10.4%.)

The stock market and margin debt are just about joined at their figurative hip. And drops in margin debt are associated with sharp declines in the stock market.

Margin debt is not the only type of stock market leverage. There are other types such as Securities Based Lending (SBL). Hedge funds can leverage at the institutional level. There is leverage associated with options and other equities-based derivatives, etc. No one knows how much leverage there is in the stock market.

Not even banks and brokers that fund this leverage know how much total leverage there is, or even how much leverage their own client has, which was the case when the family office Archegos, a private hedge fund, blew up a year ago and caused billions of dollars in damage to the prime brokers that had provided the leverage. The amount of leverage Archegos had used didn’t emerge until it blew up and the brokers had to sort through the debris.

But margin debt is an indicator of the direction of the overall stock market leverage. While total stock market leverage is far higher than margin debt, it likely moves in the same direction and is powered by the same dynamics as margin debt.

One thing we do know: High leverage in the stock market is one of the preconditions for a massive sell-off. In other words, a regular run-off-the-mill stock market decline can occur any time. But it’s hard to have a massive sell-off without massive leverage getting unwound, the opposite of when that leverage fueled the rally with borrowed money.

Margin debt and stock market “events.”

It’s not the absolute dollar amounts that matter over the decades because they’re skewed by the effects of inflation. What matters are the steep increases in margin debt before the selloffs, and the steep declines during the sell-offs that followed.

But no increase in margin debt was more breath-taking than the huge surge during the Fed’s $4.8 trillion money-printing binge in 2020 and 2021, neither in dollars nor in percentages, and this has now started to unwind:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.