Square And PayPal Helping Bolster Bitcoin’s Boost, New Analysis Claims

Tyler Durden

Wed, 11/25/2020 – 19:30

A new analysis out this week suggests that clients of FinTech companies PayPal and Square are responsible for helping drive the recent boost in Bitcoin, as it approaches $20,000. But we’re not entirely sold on that analysis, and we’ll explain why.

First, a primer. Square clients have made up 40% of the buying of new bitcoin entering the market over the last two years, Hedge Fund Pantera Capital suggested to CNBC this week. PayPal has also driven demand, as denoted by a spike in volume on Paxos’ exchange, which is crypto firm that has partnered with PayPal.

Volumes on Paxos have “more than tripled” since PayPal’s service went live, the analysis notes, stating that PayPal clients were buying “roughly 70%” of new Bitcoin supply hitting the market. About 800 to 900 Bitcoin are hitting the market on a daily basis, as the total number of outstanding Bitcoin marches to its terminus at 21 million.

Dan Morehead, founder and chief investment officer of Pantera Capital said: “It’s having a significant increase on price. You bring on two corporates that are already buying all of the newly issued bitcoins — supply and demand says the price has to go up.”

CNBC talking head Brian Kelly says that the spike is about new demand, as FinTech companies make it easier to buy the crypto: “It’s now easier to buy and transact with, and it’s opening up new demand by taking down a barrier to entry.”

But we’re not entirely sold on this analysis and we believe that institutions are playing a major role in keeping a bid under the crypto. As we noted over the weekend, large established banks like JP Morgan are starting to experiment with cryptocurrencies as Yahoo Finance reported:

“Indeed, at the DealBook Summit on Nov. 18, (Jamie) Dimon said, “The blockchain itself will be critical to letting people move money around the world cheaper. We will always support blockchain technology.”

In May, JPMorgan went a step further when it began allowing customer transfers to and from Coinbase and Gemini, two U.S.-based regulated crypto exchange sites. And Dimon on Wednesday acknowledged that some “very smart people” are investing in bitcoin these days.”

This stands in contrast to Dimon’s comments in 2017:

“In September 2017, about three months before bitcoin hit an all-time high of nearly $20,000 per unit and crashed shortly thereafter, Dimon dropped a bomb on the crypto world. He called bitcoin a “fraud.”

But, despite the naysyers, JPMorgan admits that Bitcoin continued to rally strongly over the past two weeks, nearing the $19k mark, challenging their previous assessment that bitcoin’s overbought positions by momentum traders such as CTAs could potential trigger profit taking or mean reversion flows over the near term. Other major investment banks have also released bullish scenarios for the crypto, including Citi who leaked a $300,000 possible target.

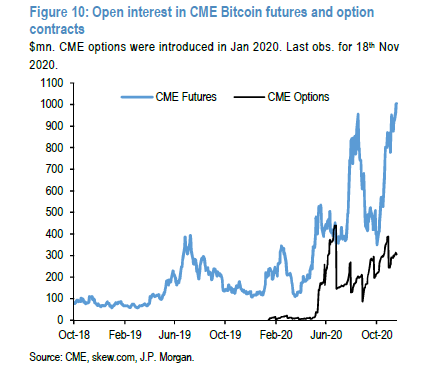

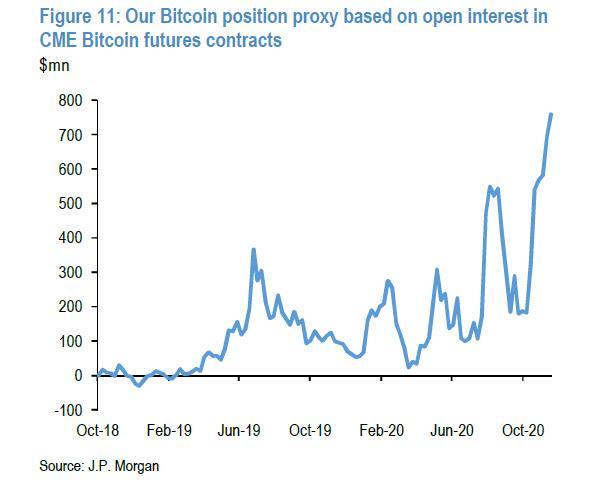

This is shown in the chart below by the open interest of CME bitcoin futures contract, a likely vehicle used by momentum traders such as CTAs, which continued to rise steeply over the past two weeks pointing to position build up rather than position unwinding.

The failure to see mean reversion flows kicking in in recent weeks might reflect the smaller role of momentum traders such as CTAs in bitcoin trading vs. their role in more traditional asset classes, such as gold and other commodities.

Indeed, the exponential ascent of the Grayscale Bitcoin Trust in recent weeks suggests that other institutional investors who look at bitcoin as a long-term investment have been playing perhaps a bigger role in recent weeks than quantitative funds, such as CTAs.

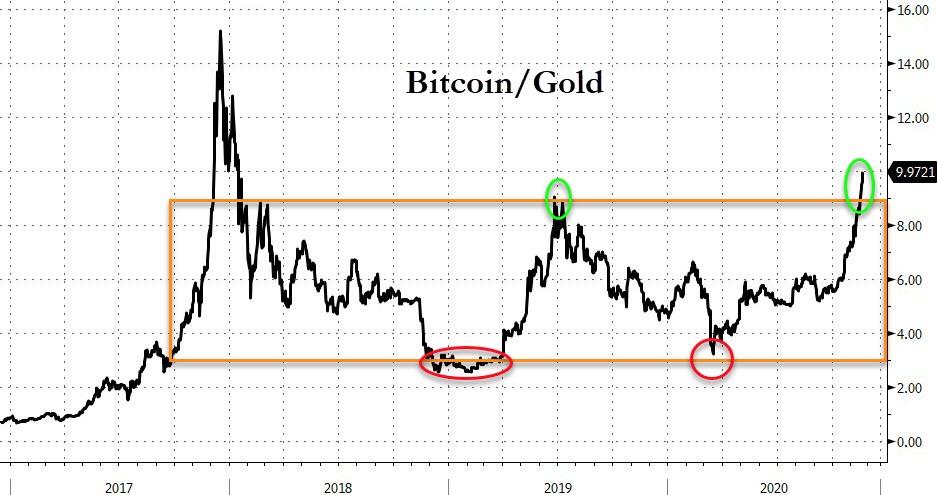

There is also the idea that some investors that previously invested in gold ETFs, such as family offices, may be looking at bitcoin as an alternative to gold.

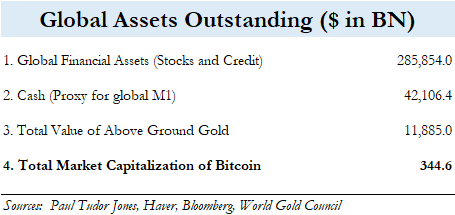

As JPMorgan previously highlighted, the potential longterm upside for bitcoin is considerable if it competes more intensely with gold as an “alternative” currency, given that the market cap of bitcoin (at $340B) would have to rise 8 times from here to match the total private sector investment in gold via ETFs or bars and coins which stands at $2.6T.

“the potential long-term upside for bitcoin is considerable we think as it competes more intensely with gold as an “alternative” currency given that Millennials would become over time a more important component of investors’ universe.”

While it may be easy for CNBC or Pantera to cop out with the same “retail momentum” analysis they used for Bitcoin’s first run up to $20,000, as @BullyEsq recently noted, it is different this time…

2017 was marked by unsustainable retail FOMO driven by scammy ICOs.

2020 is being driven by institutions.