Latest Posts

Fed Emergency Bank Bailout Facility Usage Hits New Record High; Money Market Funds See Small Outflow

Fed Emergency Bank Bailout Facility Usage Hits New Record High; Money Market Funds See Small Outflow

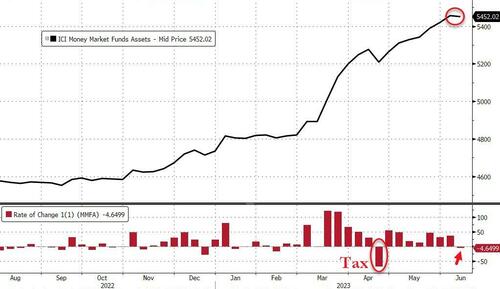

For the first time since the week of April 19th (related to tax payments), money market funds saw net outflows last week ($4.66 billion)…

Source: Bloomberg

Ignoring the usual tax-related outflow…

US Homeowner Equity Drops For First Time Since 2012

US Homeowner Equity Drops For First Time Since 2012

The housing bull market has peaked for now. Recent home price declines are leading to decreased tappable equity for homeowners.

A new CoreLogic Homeowner Equity Insights report shows homeowners with mortgages (roughly 63% of all properties) saw their equity decrease by a total of $108.4 billion in the first…

JPMorgan and Citigroup Are Using the Same Accounting Maneuver as Silicon Valley Bank on Hundreds of Billions of Underwater Debt Securities

By Pam Martens and Russ Martens: June 6, 2023 ~ As we reported yesterday, Silicon Valley Bank was not even on the “Problem Bank List” maintained by the Federal Deposit Insurance Corporation (FDIC) when…

At Year End, 4,127 U.S. Banks Held $7.7 Trillion in Uninsured Deposits; JPMorgan Chase, BofA, Wells Fargo and Citi Accounted for 43 Percent of That

By Pam Martens and Russ Martens: May 11, 2023 ~ If the dark secrets about the U.S. banking system that federal regulators have been keeping since the financial crash of…

The Disturbing Truth About the Home You Think You Own

Do you really own something if someone forces you to make never-ending (and ever-increasing) payments on it?

The post The Disturbing Truth About the Home You Think You Own appeared first on Doug Casey’s International Man.

Doug Casey On Why The US Is Headed Into Its ‘Fourth Turning’

Doug Casey On Why The US Is Headed Into Its ‘Fourth Turning’

Authored by Doug Casey via InternationalMan.com,

International Man: The economic, political, social, and cultural situation seems to have become increasingly volatile in the United States and more broadly in the West. Is this a unique situation or part of a recurring historical cycle?

Authors William…

This Housing Bubble Is Different: It’s Much More Precarious

This Housing Bubble Is Different: It’s Much More Precarious

Authored by Charles Hugh Smith via OfTwoMinds blog,

And what happens next? Bubble symmetry: valuations fall at the same rate as they rose, declining back to the starting point over a roughly equivalent time duration.

All speculative bubbles share certain traits: the abandonment of caution, the euphoria of seemingly endless…

SVB Latest Developments Live Blog: FDIC Auction Of Failed SVB Assets Underway

SVB Latest Developments Live Blog: FDIC Auction Of Failed SVB Assets Underway

As the countdown to the reopening of futures trading gets louder by the second amid episodic observations of bank runs around the US, news flow is starting to accelerate fast so this will be a placeholder post with updates until we get major…

Realtor.com Reports Weekly Active Inventory Up 61% YoY; New Listings Down 26% YoY

With new listings lagging behind year-ago pace, the growing number of homes for sale reflects longer time on market rather than an influx of sellers.

For 35 weeks now, fewer homeowners put their homes on the market for sale than at this time one year ago.

Black Knight’s January 2023 Mortgage Monitor

Collateral Analytics data from Black Knight showed January marking the fourth consecutive month of declines in for-sale inventory on a seasonally adjusted basis after seeing strong improvement in shortages early last year Months of supply has stagnated at approximately 3.1 …

Fed’s Balance Sheet Drops by $626 Billion from Peak, Cumulative Operating Loss Grows to $38 billion: Update on QT

Quantitative Tightening is starting to add up.

The Federal Government’s Interest Payments Go Parabolic

As the Federal Reserve embarks upon the path of raising interest rates, a new challenge will play out for the Federal Government; interest payments. While the Federal Reserve has raised interest rates at one of the fastest paces ever, historically the rate is still low, as interest payments are at screaming highs. RED LINE: Federal…

Wall Street Megabanks’ Multi-Billion Dollar Blunders Suggest Money Controls as Good as George Bailey’s Uncle Billy

By Pam Martens and Russ Martens: July 29, 2022 ~ What do you get when you mix federally-insured banks with Wall Street trading casinos? You get the potential for catastrophic risks for the U.S. taxpayer and astronomical riches for…

Lyn Alden (Fed Rate Hikes, Recession, Stagflation, Unemployment, Commodities)

Check out my private, online investment community (Rebel Capitalist Pro) with Chris MacIntosh, Lyn Alden and many more for $1!! click here https://georgegammon.com/pro