A Flood Of Repossessed Vehicles Poised To Hit The Used-Car Market

Authored by Mike Shedlock via MishTalk.com,

Now is one of the worst times ever to buy a car. Wait six months or a year and things will be different.

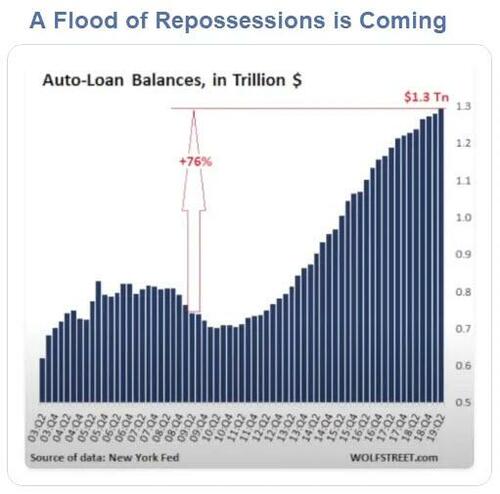

Image from Wolf Street via Tweet thread below

Auto Loan Bubble About to Burst

A pair of excellent Tweet threads explain what is happening with car prices and pending repossessions.

There has never been a worst time in the last 30 years to buy a vehicle. Within the span of 2 years, cars went from being the largest depreciating asset one owned, to doing better than most of our stock portfolios, and I’ll explain exactly why🧵

— Sully (@SullyOmarr) July 21, 2022

Worst Time to Buy in 30 Years

-

There has never been a worst time in the last 30 years to buy a vehicle. Within the span of 2 years, cars went from being the largest depreciating asset one owned, to doing better than most of our stock portfolios, and I’ll explain exactly why.

-

To get a better understanding of the insanity which is the car market, lets start with a number that we’re all familiar with: 9.1% (CPI for June). New & used cars are a large portion of that. New vehicles rose 11% yoy and used cars 7.3%.

-

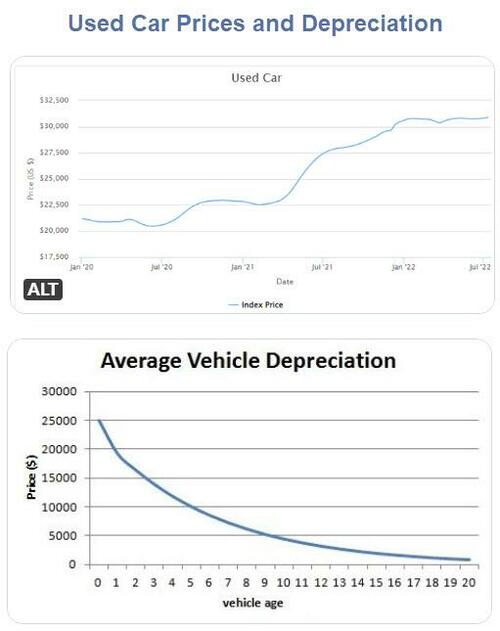

But percentages don’t do a good job at painting the whole picture so here are the raw numbers: 2 years ago: Average new car: 38k, Average used car: 20k. So what about 2022? Average new car: 50k (+24%)Average used car: 31k (+35%)[Used Car Image from Sully Below]

-

Not lookin so hot is it? We went from walking into a dealership, buying a brand new car with $5000 in incentives, to dealerships asking for 10k “market” adjustments on seemingly boring cars (Lookin at you RAV4 hybrid). The culprit?

-

Short supply combined with literally 0% rates caused many people to start buying any car that could “fit into their budget”. Why responsibly buy a 30k car, when you can finance a sick 100k truck at 84 months with 0% rate? I mean it’s free money after all. (this is a 7 year loan btw).

-

Dealerships saw this, and started to push higher and higher loan terms. Telling customers its "only 900$ a month". The average loan term right now? 72 months — an increase of about 33% since 2010 (48 months).

-

But the era of 0% loans was last year, when the fed thought inflation was errrrr transitory (lol), so what’s going on now? Same thing… which makes it even worse. Car loan interest has gone up quite significantly, which means people are financing their car at insane APR.

-

Imagine paying 7-8% interest on a 7 year loan for a car, and that is the scary part. People are literally paying hundreds of dollars a month just in interest for their car.

-

And this is the ugly bit, when the car market starts to adjust. Normally most cars follow an inverse exponential curve, with the vast majority if the car losing its value in the first 1-3 years. That hasn’t been the case since 2020, and it seems like we’ve seemingly forgotten. [Depreciation Chart From Sully Below]

-

Eventually cars will once again, begin to depreciate like they always did. And guess what happens? Those who bought a USED vehicle at a 40% premium? They’re now significantly underwater on a car they financed for 7 YEARS.

-

Top it off with some good ol day-to-day inflation, layoffs, and potential recession and you get a recipe for disaster within the car market.

-

My bet is we’ll see a significant amount of repos and subsequent nuke of the car market. So pls unless you ABSOLUTELY need a car, try to avoid it for the next little while.

-

If you’ve made it this far, appreciate you reading this thread! Feel free to leave drop any questions you have. Also if you absolutely need to buy a car dm me! I’ll try to find something that’s reasonable in this market.

Used Car Prices and Depreciation

Images From Sully’s Tweet Thread Above

Auto Delinquencies Surging

The auto industry collapse has just begun and this would be one of the worst times for you to buy a vehicle.

In a normal market (pre-2020), Auto Loan delinquencies hovered at 2 to 3%.

Today that number is exploding with nearly 1 in every 4 loans in default in Washington DC👇

— Graham Stephan (@GrahamStephan) July 23, 2022

Graham Stephan Tweet Thread

-

The auto industry collapse has just begun and this would be one of the worst times for you to buy a vehicle. In a normal market (pre-2020), Auto Loan delinquencies hovered at 2 to 3%. Today that number is exploding with nearly 1 in every 4 loans in default in Washington DC

-

The key issue that caused this is how Auto Loans are issued. Currently, Americans owe more than $1.2 Trillion on auto loans (the highest in US history and a 75% increase from 2009). Given the fact that more than 85% of cars are financed, we are looking at a massive problem. [Lead chart from Wolf Street via Graham Stephan]

-

I did some digging and found out that over the last 10 years, car dealerships have begun making more profits from the financing of cars rather than the car sales themselves. Translating from auto sale to loan sale business has resulted in a loosely regulated grey market.

-

This was possible because dealerships successfully lobbied to have less oversight – meaning that there is no federal oversight with auto loans unlike Mortgages, student loans, and credit cards. Reduced oversight allowed them to lend money without proper background checks.

-

An investigation in late 2021 found that up to 50% of the loans were given to customers who might not be able to afford them. The income and employment verification only happened 4 percent of the time. All of this means that more and more customers are starting to default.

-

The best-performing state is Utah with 4.5% of loans in default whereas other areas are much worse. California – 8.7%, Texas – 10%, Washington, DC – 23%. Once payment is more than 90 days late, the lender can repossess your car.

If we continue with the same trajectory, we could be due for an 18% decline in used car value.

This is something @DougDeMuro also addressed in his recent tweet. https://t.co/h58kdIvBXR

— Graham Stephan (@GrahamStephan) July 23, 2022

Now let’s look at a Tweet Thread from Doug DeMuro. He makes YouTube car videos and runs @CarsAndBids.

2. Sellers who rejected our reserve offer 3, 6, even 9 months ago are coming back now to ask if we’ll still honor it. Meaning they’ve been trying to sell their cars for — in some cases — *the entirety of 2022* with no takers. Needless to say, we usually have to offer less. (3/4)

— Doug DeMuro (@DougDeMuro) July 7, 2022

By the way, as an aside: dropping prices seem to especially be affecting "gas guzzlers" like big SUVs (Land Cruisers, modded Jeeps, etc). No real surprise given gas prices, but worth a mention: your 100-Series probably isn’t worth what it was in August 2021.

— Doug DeMuro (@DougDeMuro) July 7, 2022

Used Car Price Crash is Coming

A used car price crash is coming.

And that will not bode well for the new car market either, especially with the Fed hiking like mad.

Finally, think about this in terms of retail sales as well as new car manufacturing.

Unleaded Gasoline Futures Declined 26 Percent, Has Inflation Peaked This Economic Cycle?

Yesterday, I asked Unleaded Gasoline Futures Declined 26 Percent, Has Inflation Peaked This Economic Cycle?

It’s safe to add used car prices to the list of price collapses.

* * *

Tyler Durden

Mon, 07/25/2022 – 09:40