Commodity Prices Set Records in May 2021

By Pam Martens and Russ Martens: May 17, 2021 — wallstreetonparade.com

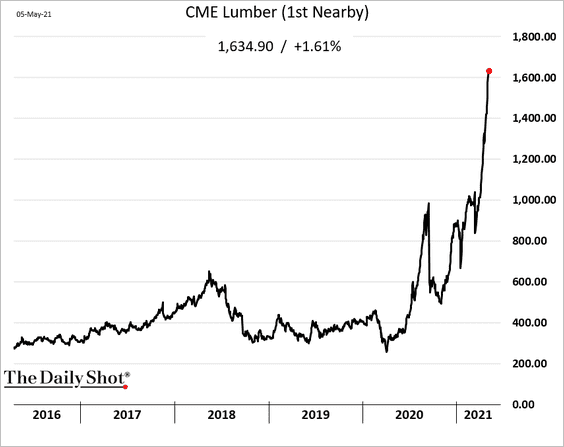

During the current month of May, 2021, the following commodities have all set record high prices: lumber, iron ore, steel and copper. The volatility in the price of lumber this month has looked not all that dissimilar to the crazy price swings in the shares of GameStop, which have been under investigation for months by the U.S. Senate Banking and House Financial Services Committees. Thus far, however, there have been no announced hearings into what is causing these wild moves in commodity prices.

From 2016 through 2019, lumber prices traded between $300 and $600 per 1,000 board feet. During just this month, however, lumber has spiked to as high as $1,733.50. It closed on Friday at $1,390.

These skyrocketing prices in commodities are more than a little peculiar. The federal government believes that the economy of the U.S. is at such grave risk that Congress needed to infuse $1.9 trillion into the economy in a stimulus bill passed just two months ago.

Just a year ago, GDP in the U.S. for the second quarter had plunged by 32.9 percent, a worse quarterly record than even during the Great Depression. The grave worry then was deflation.

All of these commodities that have been setting historic record prices have one thing in common: they all trade on futures exchanges owned by the CME Group.

On April 11, 2014, three traders, William Charles Braman, Mark Mendelson and John Simms brought a lawsuit in the U.S. District Court for the Northern District of Illinois alleging that the CME Group was allowing “clandestine” contracts between the futures exchanges and high frequency traders and that potentially as much as 50 percent of the trades on the exchange are “wash trades.” Wash trades occur when the same beneficial owner is both the buyer and the seller. Wash trades, also known as wash sales, can falsely suggest volume and price movement.

Fed Emergency Bank Bailout Facility Usage Hits New Record High; Money Market Funds See Small…

US Homeowner Equity Drops For First Time Since 2012 The housing bull market has peaked…

JPMorgan and Citigroup Are Using the Same Accounting Maneuver as Silicon Valley Bank on Hundreds…

At Year End, 4,127 U.S. Banks Held $7.7 Trillion in Uninsured Deposits; JPMorgan Chase, BofA,…

Do you really own something if someone forces you to make never-ending (and ever-increasing) payments…

Doug Casey On Why The US Is Headed Into Its 'Fourth Turning' Authored by Doug…