As Oil Soars, Former NHL Player Turned Hedge Fund Manager Says “Inevitable” It Will Go Higher

Tyler Durden

Tue, 11/24/2020 – 10:58

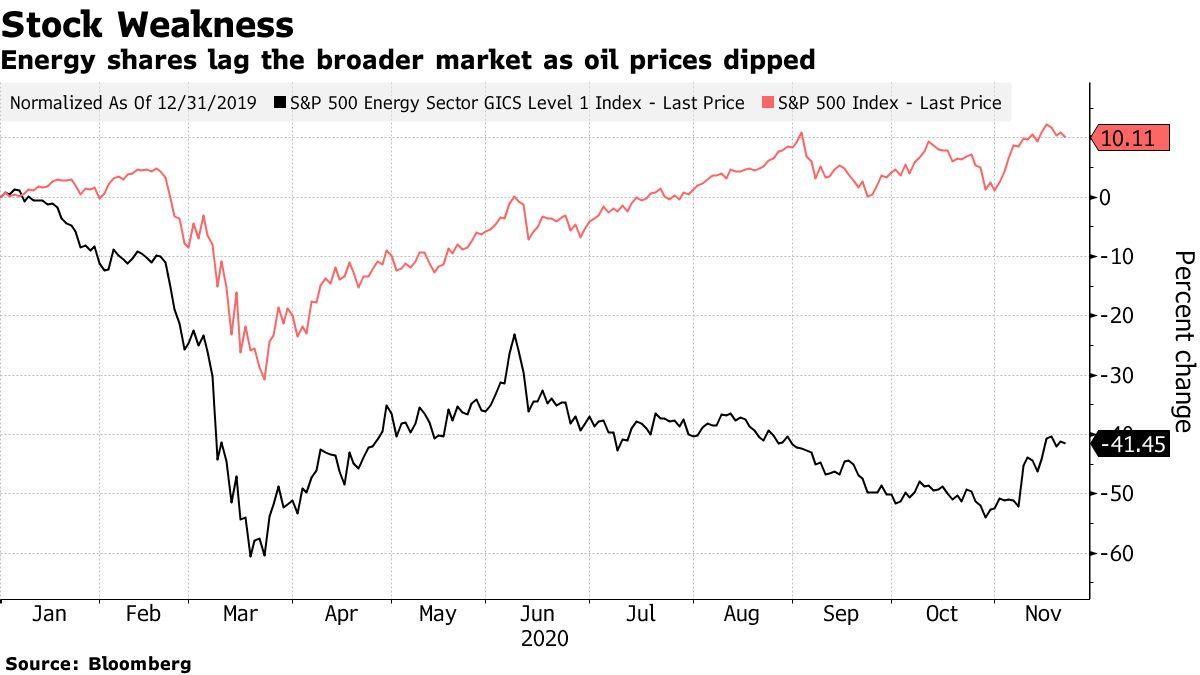

Update (1100ET): WTI just broke above $45, and Brent tagged $48, up 34% in November, as today’s move goes vertical.

This is the highest price for oil since March, which is remarkable given that Cushing storage is near capacity.

* * *

If you’re bullish on oil, we’ve got good news and bad news. The good news is that one hedge fund manager is finally taking an outsized bet on oil and is making headlines. The bad news is that the “hedge fund manager” isn’t exactly Sam Zell or Steve Cohen, but rather a former professional hockey player.

Regardless, Xavier Majic, who founded Maple Rock Capital in Toronto – and who manages $700 million – says that he thinks oil is becoming a better bet as the pandemic ends. His firm recently upped its exposure to energy to 38%, which marks the highest it has been since the fund’s inception.

He told Bloomberg:

“Covid has done things to oil demand that were unimaginable to a commodity investor. It’s inevitable that oil prices have to go much higher.”

The fund’s exposure to energy stood at about 4% at the end of March. Heading into Q3, his fund has 15 positions in energy, ranging between a 0.2% and 4.3% weighting. His firm recently posted a 5.7% stake in SM Energy Co. last week.

The firm is forecasting a return of 150% to 200% for the funds holdings if oil can reach $55 – a relatively small tick higher from current crude levels around $43. Some of the companies it owns are cash flow neutral with oil at $40, he told Bloomberg.

For now, Majic is right, as oil just reached its highest level since March, buoyed by the start of the U.S. presidential transition process and with the demand outlook strengthening after a string of positive COVID-19 vaccine breakthroughs.

”The oil market is tightening because of strong Asian demand and production curtailments, leading to falling inventories,” said Carsten Fritsch an analyst at Commerzbank AG.

“We are still far away from normal. It will take some time to vaccinate the population.”

And Majic hasn’t quite caught on to the EV boom that is driving the rest of the market. He says that EV production would still have to rise 10x from here to have a meaningful impact on oil demand. He noted that EV sales only make up 3% of all new car sales and also says hydrogen is still 25 years out.

“I feel like we are some of the only people at the table here that are even playing poker,” he said of the industry’s outlook on oil.

We wonder if anyone has ever informed him that oil supply, however, is essentially unlimited and under the control of the Middle East and Russia, who can basically choose to set the price wherever they’d like – whenever they want.

Majic founded his firm in 2014 after playing for the Vancouver Canucks and Team Canada.

We hope OPEC and Putin are Canucks fans.