Blow Off…

Tyler Durden

Tue, 11/24/2020 – 14:40

Authored by Sven Henrich via NorthmanTrader.com,

Four vaccine announcements. Janet Yellen to the Treasury. Donald Trump opening the path to a transition. Fed and ECB signaling more stimulus to come and yet, no new highs on $SPX and $NDX. Rather the bull target identified in October and again discussed in All In still stands having been reached on November 9th.

I find it notable in context of all the bullish boxes being ticked off and the continuous sentiment of euphoria permeating markets. Now I’m not saying the top is in, but I’m noting a certain lack of of progress in the overall market.

At the same time we are witnessing blow off action in several other indices and I’d like to highlight to small caps here.

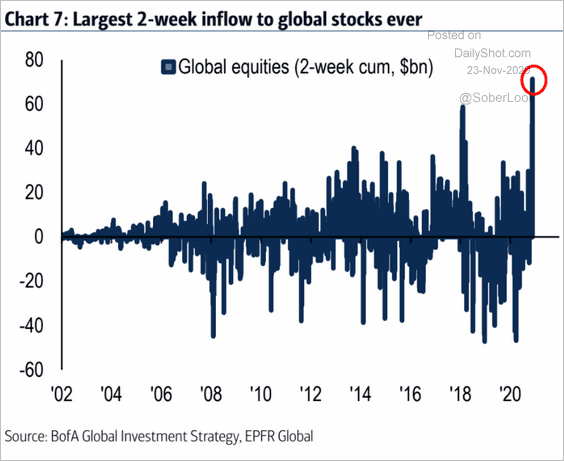

A ripping 21% up from the November lows and up nearly 29% since the September lows. “Smooth market functioning” the Fed calls the asset bubble they have unleashed. I call it asset price inflation run amok as people abandon all caution and are piling into stocks no matter valuations:

Capitulation in the face of overwhelming liquidity?

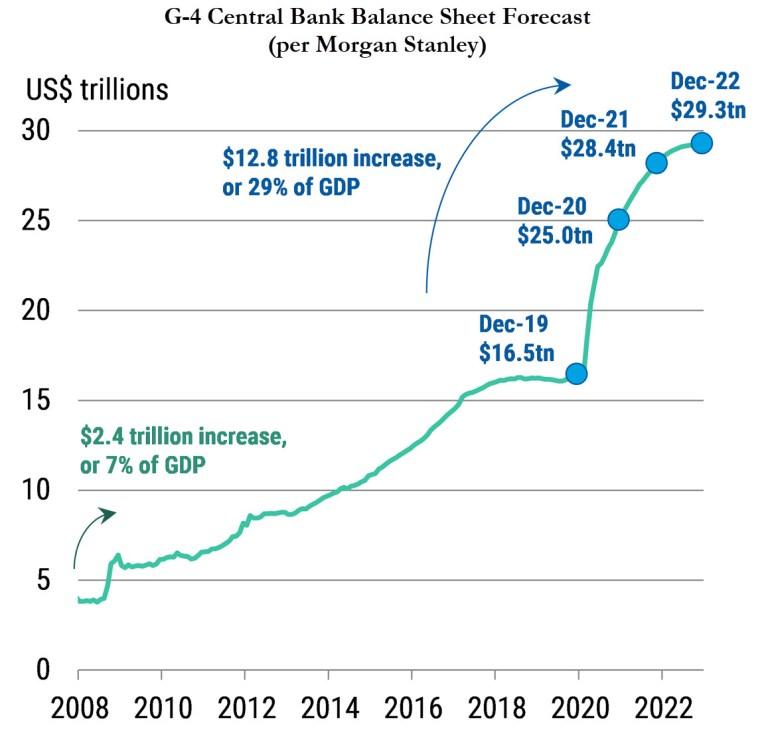

After all 21% of all US dollars have been created just this year:

21% of all US Dollars were printed in 2020. https://t.co/wFcRxPxN9G

— Sven Henrich (@NorthmanTrader) November 24, 2020

With no end in sight it seems:

The printing will continue until morale improves.

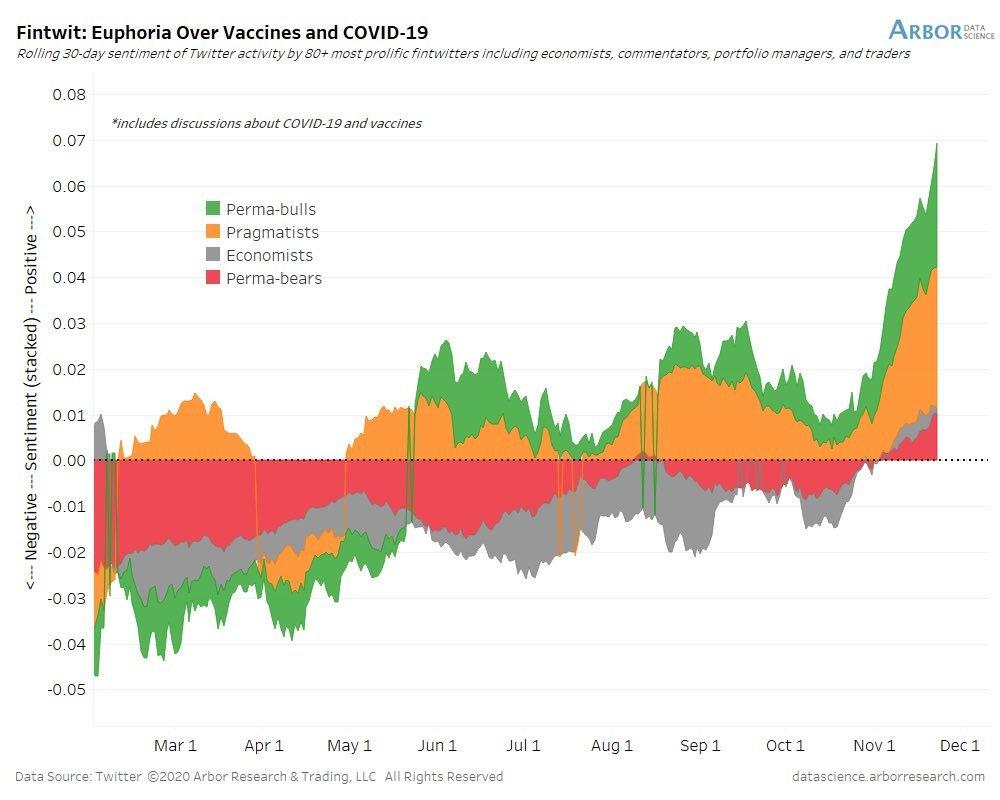

Well congratulations, fin twit is as bullish as ever was, even the bears are throwing in the towel:

And small caps encapsulate this sentiment:

“He’s going vertical. So am l. – We’re going ballistic, man.” – Maverick Top Gun

Moves like this are momentum and short covering pure and they come with consequences. Namely reversion risk and sustainability.

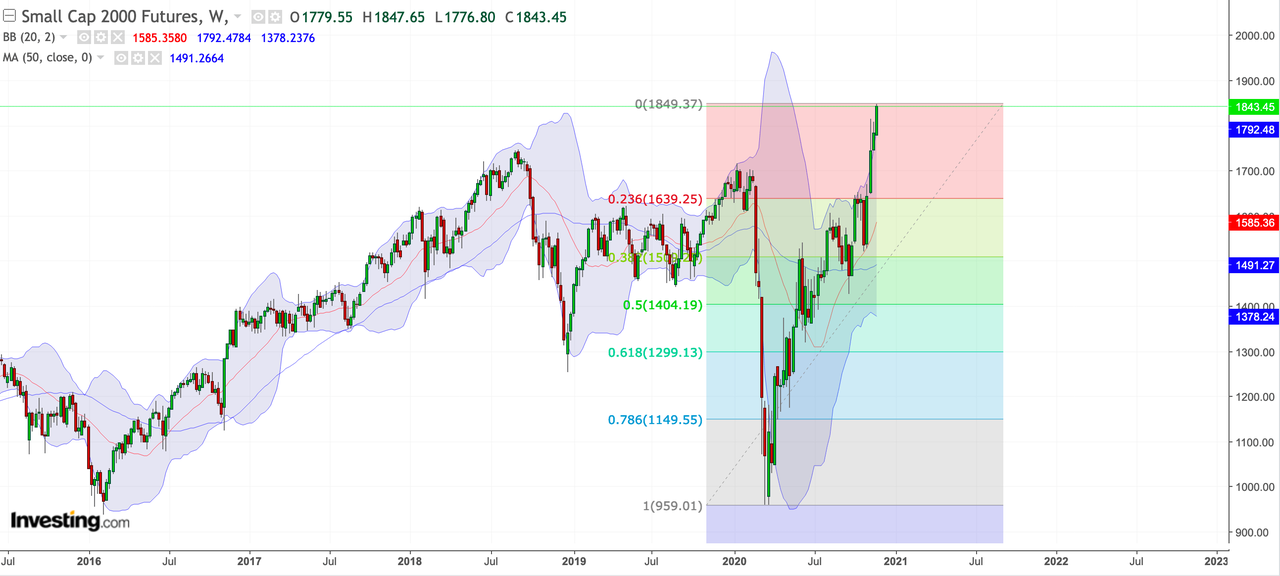

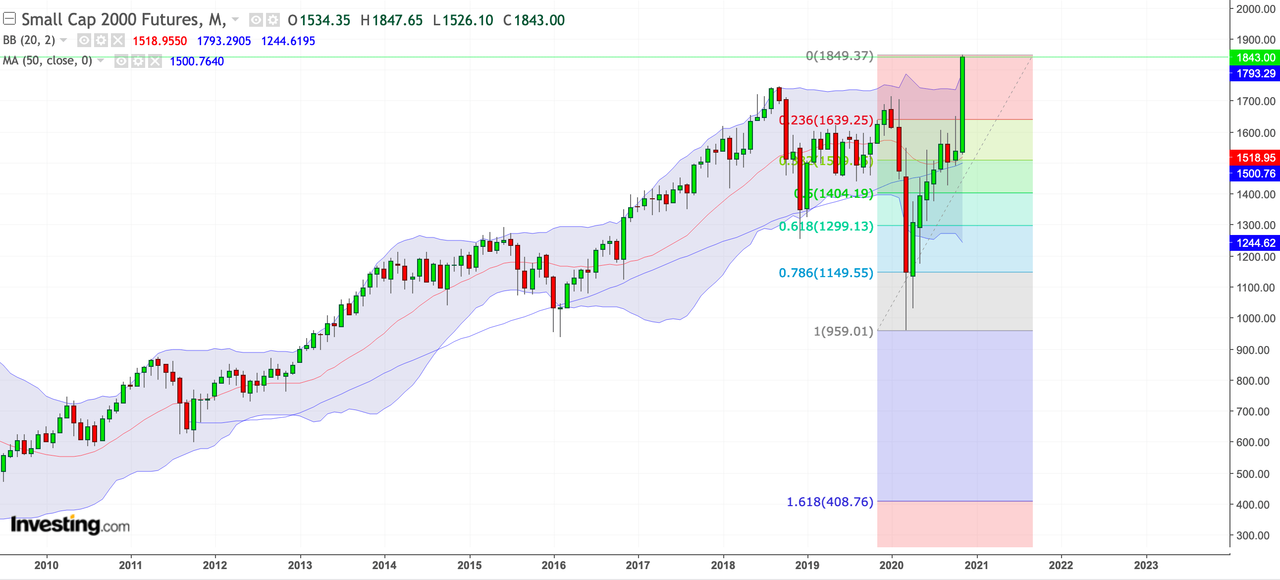

Firstly note how completely incompatible with history this move in small caps is. Here is the monthly candle:

Not only is it the largest monthly upside candle in memory it is also poking far above the monthly Bollinger band. If anything this candle looks similar to the capitulation candle we saw to the downside in March during the crash. Small caps appear to be literally crashing upward.

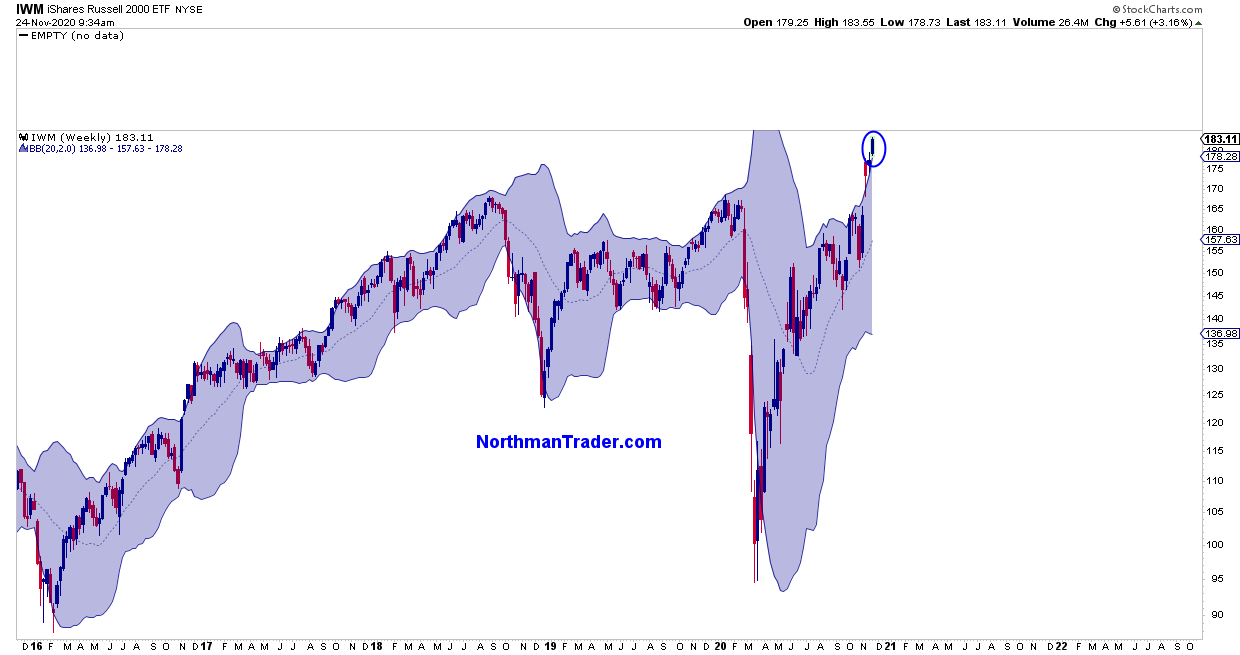

So outsized is this move in small caps price is now entirely outside the weekly Bollinger band:

Not normal, let’s agree on that. Sustainable? Questionable. Especially in context of a rally ever more dependent on open overnight gaps:

Not normal smooth market functioning behavior. Open gaps have been the hallmark of this market and while the market is persisting on this unprecedented path it continues to inform the coming downside risk.

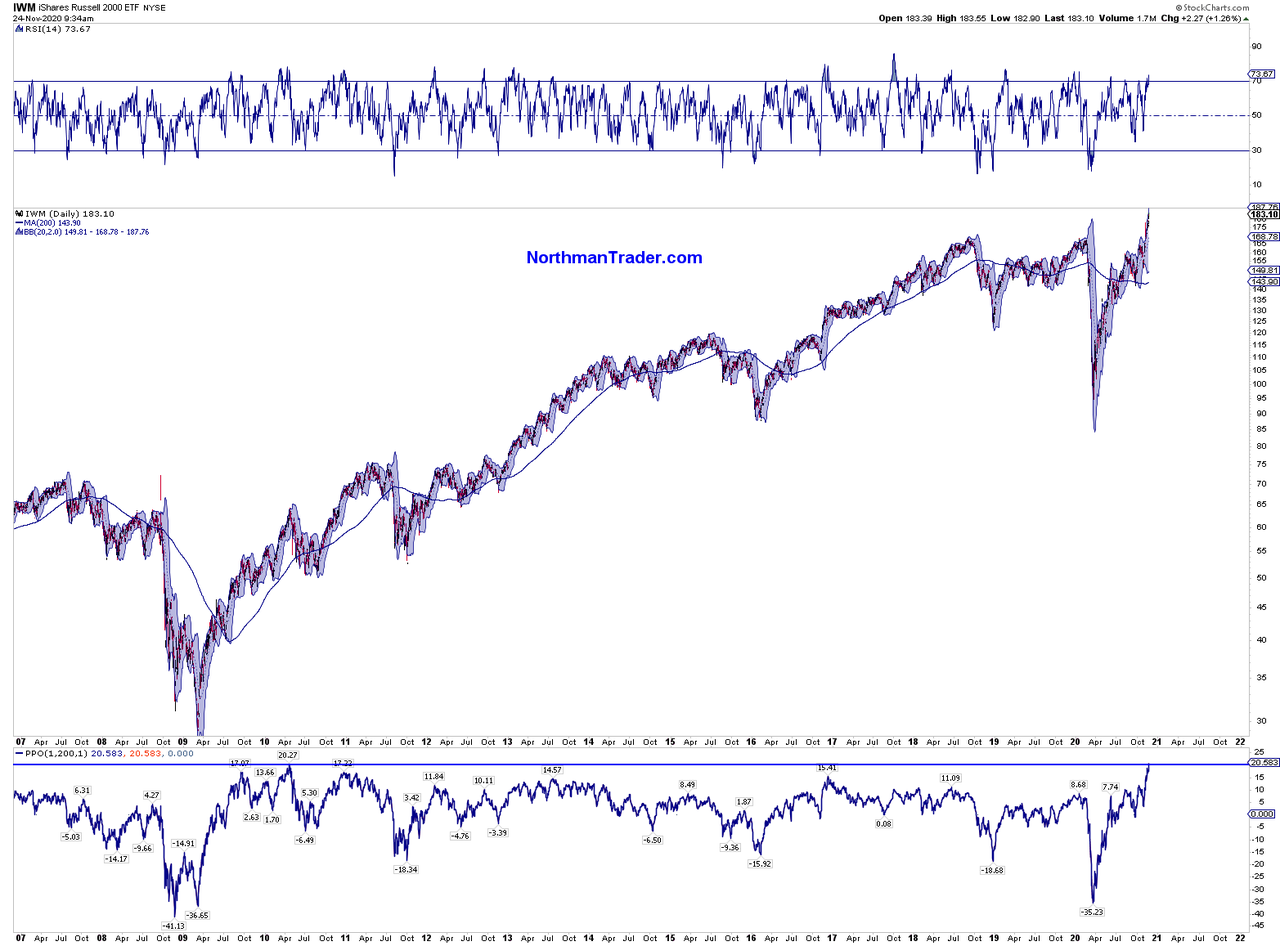

As does the $IWM’s disconnect from its 200MA reaching 27% this morning:

The oscillator reaching above 20 seen last following the rally off of the 2009 lows. But even that rally proved too much and resulted in an eventual reconnect with the 200MA and a move below.

With a daily RSI on $RUT now reaching into the 74 level small caps are setting up for reversion risk of size:

Note also the rising wedge. I’m not saying the $RUT will top here, what I am saying it could reverse at any moment for any reason and when it does it comes with reversion risk of size. Hence buying long here is dangerous in my view and some may argue shorting it is as well as these momentum moves can defy reason.

But abandoning reason and embracing recklessness is what central bankers in their self conceited wisdom have bestowed on these markets yet again while failing upwards:

Imagine declaring 2% inflation to be your long stated policy goal, then printing more money than God and yet failing to reach your goal for 13 years in a row but still getting uncritically elevated to God status anyways. pic.twitter.com/MbQXB7X11m

— Sven Henrich (@NorthmanTrader) November 21, 2020

Financial stability they call it. There’s nothing stable about the $RUT or the global distortions created in capital markets. I call it speculative excess in context of a historic liquidity bubble. And investors have embraced it hook, line and sinker. Watch out.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.