BofA’s Bonus Pool Flat For Traders Despite Soaring Revenue

Tyler Durden

Wed, 11/25/2020 – 09:31

As one of the most chaotic years on record comes to a close, the topic of conversation on Wall Street are bonuses. As we’ve noted (see: here & here), traders, analysts, and bankers are set to experience a flat to a slump in bonus payouts this year despite an explosion in trading and debt & equity underwriting.

The message from within Bank of America, according to Bloomberg sources, is that senior executives are likely to keep the bonus pool for sales and trading desks at last year’s level, despite a solid year in revenue, jumping more than 20% in the first three quarters of the year.

BofA’s top leadership is mulling over large bonuses because the virus pandemic has wreaked havoc over its consumer division department and added expenses.

Sources said some staff who expected to receive large bonuses for stellar performance are outraged.

“Executives still have time to lobby for larger payouts to top-performing desks, and may indeed wrangle more money,” the source added.

BofA’s final bonus decision will hinge on how the fourth quarter plays out. Already, conversations have prompted senior managers to decrease bonus expectations as they conduct year-end meetings with subordinates.

In a recent weekend briefing, a fixed-income manager told traders that they should expect bonuses that are flat compared with last year.

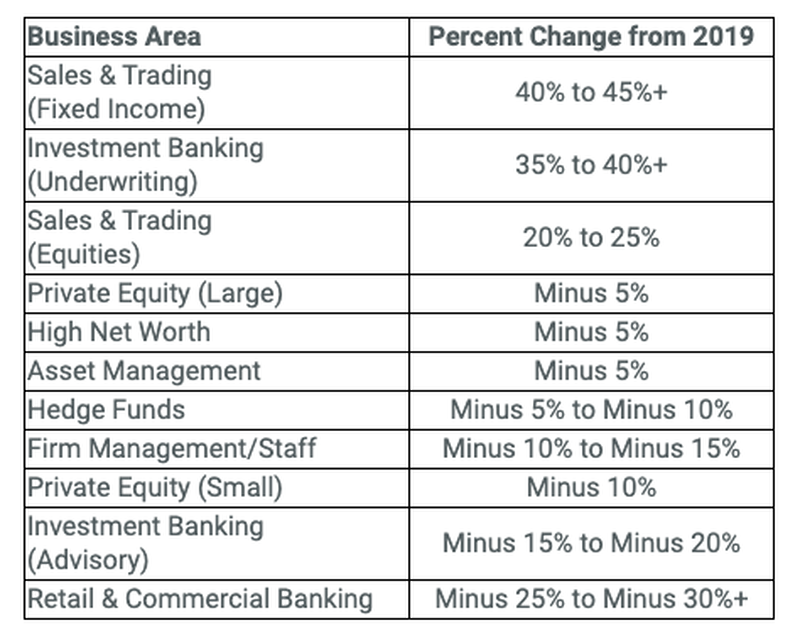

New York consulting firm Johnson Associates recently released a note showing how third-quarter compensation analysis points to overall year-end incentives, including cash bonuses and equity awards, will decline on the year for Wall Street.

“The pandemic is wreaking havoc on many parts of the U.S. economy this year, and the financial services industry is no exception,” said Alan Johnson, managing director of Johnson Associates.

While retail and commercial bankers and asset management firms are expected to see year-end compensation incentive declines, Johnson said, he noted fixed income and equities traders could see large bonuses, anywhere from 20% to +45% over the previous year.

For big Wall Street banks, the optics of big bonuses for traders may not be a good look as tens of millions of Americas have food and housing insecurity issues.