Yesterday the U.S. Capitol building was breached with a storm of rioters who are supposedly upset with the election outcome. It was surprising to see the ease with which our nation’s Capitol could be overcome by a mob of angry citizens. People were in disbelief as they watched the scenes unfold and many compared it to the shock of 9/11. Yet as the events unfolded the headlines and reporting were mired in political opinion and debate. Most of the political opinion revolved around two common themes, as usual, since the two parties are excellent at simplifying every ordeal into two generalizations. The left says this was the fault of our Mad King, Donald Trump, and his supporters. The right, not able to rationally defend this behavior, drew on the past to compare the hypocrisy of the left during previous riots. Both parties are too biased to step back and take a look at the home they’ve built together brick by brick.

Inside this home, it appears as if Trump is to blame for these events. Ever since the Mad King moved in the ceiling and walls are cracking, the roof is leaking, and more problems are found every day. This political frat house seems to be crumbling and its members dividing into groups that attempt to escape responsibility and gain control by blaming others. Ultimately this is the result of a two-party system that decays morals and reason. Think about any political discussion you’ve had with family or friends that support the opposite party. If a Republican mentions Biden’s son, or Hillary Clinton’s emails, or whatever subject it is that you political degenerates discuss, is an action by Trump or some other republican brought into the discussion? This works both ways. You tend to not care about your parties’ wrongdoings as much as the others and are content supporting it because the other party is worse.

What happened at the Capitol may have directly been the result of Trumps actions but indirectly it is the result of Congress and every American. Choosing the lesser of two evils eventually leads to a horrendous outcome. Many on the left voted for Biden just because of Trump. Supporters of Trump in the first election did not make their choice by selecting the person they thought was best for the office or represented their values. It was in large part out of spite for the entire system.

I forgot that this was supposed to another article on wealth inequality… my point is we all need to stop settling.

Wealth inequality is an issue one party is attempting to address but both parties are going to make it worse. To be clear, wealth inequality is a necessary quality of any free and successful economy. However, when inequality becomes extremely concentrated it causes people to react. The right continues to defend the wealth of Bezos and Gates because they believe it is deserved; Amazon and Microsoft have benefitted all Americans and their wealth is a result of that. They usually accompany this statement with government regulations stifling business and innovation – they’re right but it’s a minor cause in this case. The left thinks it’s greed, corporations, and the result of unregulated capitalism – they’re right but it’s a minor cause in this case. Unfortunately, their solutions to solving this problem are going to come to fruition sooner than most people think.

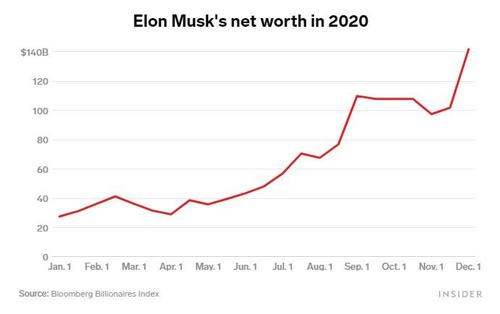

I have been extremely unsuccessful at convincing others of the role our monetary system has played in creating this. Today I came across the article below about Elon Musk “earning” the top spot for the richest person in the world. In less than one year, Elon’s wealth has risen an astounding 146 billion dollars.

ONE YEAR. 146 BUH BILLION. I must’ve missed the role Tesla and Spacex played during a year of the pandemic. Did Tesla come upon some grand innovation or consume the entirety of sales in the auto industry? I know, Tesla investors, it’s not an auto company!

Of course, wealth isn’t just the result of a companies profit or loss(only recently has Tesla become profitable…for now), sales or revenues, or the value someone or business has actually created – which is precisely the problem. There are several different ways wealth is created. The problem of wealth inequality in America is that so many of the rich are a result of the “Financialization” of the economy by a monetary system and policies of the Federal Reserve. This results in many CEO’s and board members extracting wealth way above what a market would actually deem their value to be or allow.

Tesla is a product of our monetary system. It would most likely not exist without this absurd structure that incentives greed, wild speculation, and business practices that are detrimental to society. This is one company out of many over the past two to three decades.

Is nobody seeing a problem with this?

This isn’t capitalism. It’s also not as simple as blaming the Federal Reserve for these problems. After all, Congress created the Fed and continues to allow no transparency under the guise that the Fed must remain independent – when the Fed uses 29 trillion during the financial crisis no citizen need know much about it. Trust them. I find that to be extremely bizarre considering the left constantly rails against Wall Street but is content with the Federal Reserve – a conglomeration of Wall Street and academics who are obsessed with controlling the economy under the belief their management is better than the Wild West of a free market – indirectly pushing, pulling, and steering the economy more than they ever could while essentially being accountable to nobody.

Hey, did you guys know… after the financial crisis the House supported an audit of the Fed by Ron Paul. Unfortunately, the senate led by a majority of the left(besides Bernie Sanders and Alan Grayson) would not support it and Bernie Sanders made a skinny version of the bill.

Right now the U.S. is going to experience the fasted growth in wealth inequality the nation has ever seen. Wealth taxes will not solve the issue. Corporate taxes will not solve the issue. Social programs will not solve the issue. These ideas, mostly by the left, are prescriptions for the symptoms but they do not fix the underlying issue – again, it’s the biggest cause of exorbitant wealth inequality but not the only one.

The trend in wealth inequality typically begins at the end of the 70’s or early 80’s(see charts below) – it depends on which data is used. In my opinion, the elimination of the gold standard and Congress amending the Federal Reserve Act are at the core of this issue. This is not to say that the Gold Standard or the monetary system didn’t have problems. Nor is it a claim that these two changes were the sole cause of wealth inequality. There are were many regulations(often decided upon or changed by the Fed or Congress) that impacted the financial industry and the economy. However, I do believe once these changes were made it allowed many of the other contributing factors to take place.

Those who disagree have to explain the correlation between the growth of the financial sector and an insurmountable amount of research and evidence that shows this industry made a majority of those in the top .1%. Those who attribute it to capitalism have to explain why this would randomly begin in the 1970s and continue until today. Is it a coincidence that our entire system is so fragile that the big financial institutions cannot fail without bringing down the entire economy? Is it a coincidence that interest rates have been in decline since 1980 and the Federal Reserve will never be able to successfully raise rates?

Unfortunately, it’s most likely too late for the U.S. to save the dollar and the country. This topic has and probably will never be mainstream. As it continues to go unaddressed and the issue worsens, and it will worsen, events that occurred at the Capitol will become more frequent. Riots, looting, and disruptive behavior is going to be the norm in the U.S. I fear that average Americans are going to suffer from the upcoming inevitable economic disaster and be forced to settle for any help they can get from the Federal Government. Congress and big business will take advantage, just as they have during this pandemic, as they expand government control and steadily reduce the rights of individuals. The U.S. will be reduced to two classes and one of them will control the other. Congress and the ultra-rich will be the same – eventually, the big corporations will be apart of the Federal Government but this will be a slow phase – and everybody else will be in the lower class. Those apart of the government will not have to obey the rules or laws the lower class does. The pandemic is a tiny glimpse of our future. It will seem as if a crisis is always occurring and may never end.

This is when the rise of a real Mad King will occur.

Update 1025 EST: With Tesla rising in early trading on Thursday, CNBC is now reporting that Musk is now the richest person in the world with a net worth topping $185 billion.

TESLA CEO ELON MUSK IS NOW THE RICHEST PERSON IN THE WORLD, PASSING JEFF BEZOS – CNBC

“Musk’s wealth surge over the past year marks the fastest rise to the top of the rich list in history,” the report said.

—

Nothing exemplifies the Central Bank-run system that buoys the rich, decimates the middle class and rewards corporations without regard for their ability to consistently turn a profit more than Elon Musk and Tesla.

And now, because of the poorly regulated non-free-market system that Musk has had the luxury of starting his car company in, he is on the precipice of passing Jeff Bezos as the world’s richest man.

Tesla’s continued stock price rally – a tonic made up of what we believe to be analyst capitulation and mysterious call buying – has propelled Musk to the top of the list of richest people in the world. As of Wednesday of this week, his net worth stood at $184.5 billion, which was slightly short of Jeff Bezos.

In the past year alone, Musk’s net worth has risen $146 billion, which Bloomberg called “possibly the fastest bout of wealth creation in history”. Meanwhile, revenue and net income at Tesla hardly show a similar story of what Musk would undoubtedly call “exponential growth”.

Musk is currently sitting on $41.1 billion in unrealized paper gains on vested stock options from grants he received in 2012 and 2018. He also owns about 20% of Tesla, which is now being valued at a market cap of $715 billion. Assuming all things stay equal for Amazon stock, Musk could surpass Bezos’ net worth if Tesla winds up in the $790 to $800 per share range, according to Celebrity Net Worth estimates.

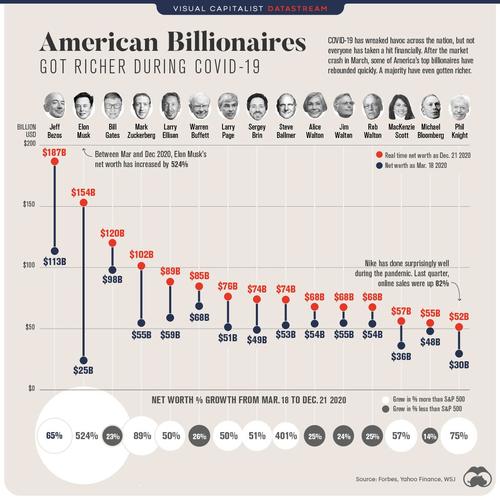

As we noted in December, isn’t the only billionaire who saw their wealth balloon while the rest of the world suffered an economic recession this year. While job loss persists for Americans making less than $20 an hour, the rich have gotten richer. More specifically, the most wealthy American billionaires have seen their net worth bounce back dramatically, thanks to strong stock market performance.

Here’s a look at who’s gotten richer since the market bottom in March 2020, and just how much their net worth has increased since then:

Between March’s market bottom and December 2020, the billionaires included on this list grew their wealth by 57% on average. Interestingly, that’s about 10 percentage points higher than the overall growth of the S&P 500 index during the same time period.

Musk saw the highest increase during this period, with a $129 billion boost in net worth—that’s a whopping 523% in gains.

Jeff Bezos saw the second highest growth in net worth with a $74 billion increase. This isn’t surprising, given that Amazon’s stock price has climbed 69% since the beginning of 2020.

It’s not just the billionaires on this list that have increased their wealth. In fact, during the pandemic, billionaire wealth on average has increased 27% worldwide. Growth has been exceptionally strong in tech and healthcare.

Thanks, Jerome Powell.