The other day, I briefly discussed the Wallstreetbets story because many people in their “community” are upset with a few Hedge Funds and broker-dealers such as Robinhood. I wanted to point out that this corruption by these firms and Wall Street has a cause which needs and deserves the attention these few funds are currently getting. Of course, they’ve earned their scrutiny but whenever there’s an opportunity to bring attention to the Federal Reserve – the source of their evil – I will take it.

Anyhow…

Robinhood prevented their customers from buying $GME and other stocks the WSB community were involved in and this fueled speculation about who was responsible for this decision. Shortly after these events, discussions about RH’s phony business model trended on Twitter and then in the media. Robinhood profits from practices that are the exact opposite of what their founders claim. Their customers orders are their main source of revenue and a majority of this comes from Citadel – I believe everybody knows the story by now. Since I’ve been using the WSB story to highlight the crimes of the Big Banks and the Federal Reserve bailouts, I figured at the very least I could cover the crimes of Citadel. Using FINRA’s website, here is a list of Citadels disciniplary actions which may help provide insight into this idea of whether or not they’re “front running” trades – Citadel claims they’d never do such a thing! You may want to read an article I posted yesterday(from wallstreetonparade.com) which explains how Robinhood is only 1 of 9 brokerages Citadel purchases order flow from.

Before I share all of Citadels trade violations, here are a few employees of Citadel that are responsible for compliance or supervision in some manner.

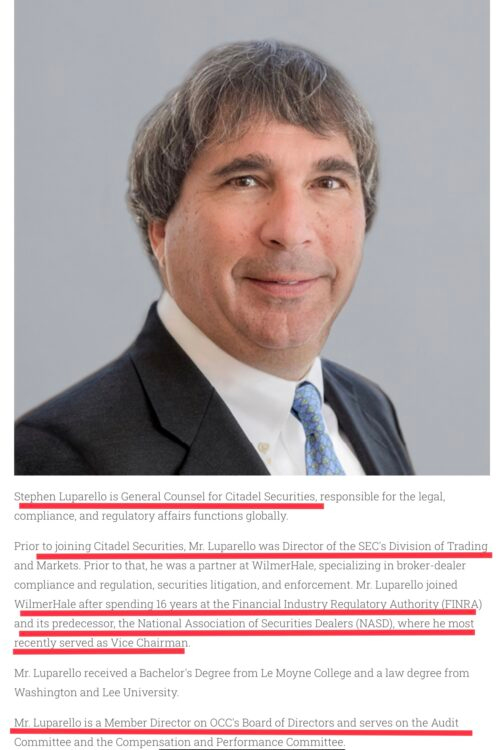

Stephen Luparello – General Counsel for Citadel:

- Former Director of the SEC’s Division of Trading and Markets

- Formerly employed at the Financial Industry Regulatory Authority(FINRA)

- Formerly employed at the National Association of Securities Dealers (NASD)

- Current Board Member of the OCC…. What does the OCC do? Picture below

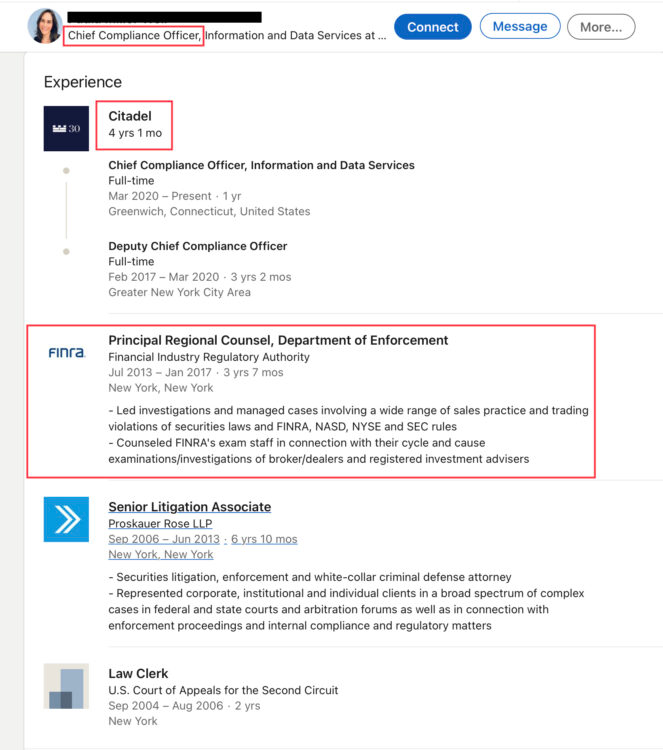

Chief Compliance Officer: Former FINRA employee

Senior Deputy General Counsel at Citadel:

- – Senior Legal and Policy Advisor to the Chair of the SEC

- – Deputy Associate Counsel…. White House…

These are just a few examples I came across with a quick Google search. It is not a complete list.

A summarization of Citadels Disciniplary Actions(records of violations are below):

- Action – 11/13/20: Reported 6.5 million trades incorrectly; failed to have a Supervisory system; failed to have Written Supervisory Procedures

- Action – 09/03/20: Citadel failed to provide supplementary material for over 15,000 quotations – to simplify: Citadel traded non-exchange security(ies) without filing required documentation with finra. The firm failed to establish and maintain a system to supervise, including written Supervisory procedures.

- Action 07/16/2020: the firms otc desk removed hundred of thousands of mostly larger customer automated orders for “manual review.” In many cases the firms otc desk traded ahead of their customer orders and failed to display them as required by finra rule 6460.

- ACTION 04/07/2017: Firm again published quotations without having its records and information required by sec rule 15c2-11.

- ACTION 09/15/2016: FIRM MISREPORTS 181,541 SHORT SALE TRANSACTIONS; DID NOT HAVE ADEQUATE SUPERVISION, INCLUDING WRITTEN SUPERVISORY PROCEDURES.

- Action 07/27/2016: During review period the firm failed to implement policies that avoided displaying locking or cross quotations (same bid and ask).

- Action 10/23/2015: Firm failed to execute a substantial of marketable orders fully and promptly. Firm failed to preserve email communications for a period of not less than 3 years and in an accessible place. Firm failed to establish and maintain a Supervisory system reasonably designed to achieve compliance — from what I gather, Citadel is not big on compliance even while many of their compliance officers were formerly employed at regulatory bodies.

- Action 10/15/2014: Firm transmitted inaccurate information to the order audit trail system (OATS)

- Action 09/25/2014: the firm failed to report 22 Reportable order events.

- Action 06/16/2014: on 24 occasions Citadel used the exchanges clearly erroneous petition processes to obtain cancellations of erroneous customer orders that the firms Supervisory procedures and risk controls failed to detect and prevent. While firm was implementing a software update it caused the quoting system to aggressively send aggressively priced marketable sell limit orders. This release caused citadel to erroneously sell short 2.75 million shares of pc group during an eleven minute period AND the stock to fall 77%. Citadel released an updated version of its software with firms proprietary trading strategies. The release caused the strategy to enter into an order sending and cancelation loop(so it worked great?). Citadel applied inaccurate market data to firms order book when a data server dedicated to handling nyse arcs market data failed to start up properly. This failure caused Citadels proprietary trading desk to send, during a two minute period, erroneous hypermarketable limit orders in 16 different stock symbols to the exchanges.

- Action 12/23/2014: Firm fined for effecting 175 Transactions in 6 securities while a trading halt was in effect.

- Action 09/07/2013: Firm transmitted nine reports that contained inaccurate, incomplete, or improperly formatted data. Specifically, in seven instances the firm omitted special handling codes to oats(order audit trail system). The firm also failed to provide documentary evidence it performed Supervisory procedures concerning: best execution; use of multiple mpids(market participant identifiers); trade reporting; accepting matching trades In a timely manner; reporting trades on members behalf.

- Action 09/26/2013: Firm failed to report the correct symbol indicating the capacity in which the firm executed orders in Reportable securities in 172,922 instances.

- Action 05/28/2013: in 14 instances the firm had a fail to deliver at a registered clearing agency that was attributable to Market making activities & did not close out the fail-to-deliver position by purchasing securities of like kind and Quanity within the same time frame. In 49 instances the firm accepted a short sale order for another person, or effected a short sale for its own account, without first borrowing the security, and had a fail-to-deliver position at a registered clearing agency. (+ Further supervision violation)

- Action 05/28/2013: on August 17, 2007, Amex opened 70 minutes later than normal due to system problems. With the exception of a few securities that Citadel decided to trade on a manual basis, firm handled all orders on an automated basis. The firm held customer orders in-house on its book and sent identical customer orders to the Amex floor for execution. Citadel continued to accept new customer orders, and to send representative orders to the Amex, after receiving notice at 9:23am that the Amex was rejecting all new orders. The firm failed to hold memoranda of the cancelation of 1,195 brokerage orders for a period of not less than 3 years. In 1,587 transactions for or with a customer, the firm failed to use reasonable due diligence to ascertain the best inter-dealer market and failed to buy or sell in such Market so that the resultant price to its customer was as favorable as possible.

- Action 11/21/2011: Firm reported inaccurate or incomplete trade reports in 1,268 Instances.

- Action 9/24/2010: improperly marked 1,109 short sale transactions as short sale exempt

- Action 01/08/2019: on 23 occasions the firm failed to contemporaneously or partially execute 25 customer limit orders in nasdaq securities after it traded each subject security for its own market-making account at a price that would’ve satisfied each customer’S limit order. Firm transmitted inaccurate data to oats. Specifically, the firm submitted 1,172,226 limit orders with limit order indicator of “y”, indicating it had Recevied instructions from their customer that a non-block limit order should not be displayed when no such instruction had been received. Those orders represented 100% of the non-block orders received by the firm.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.