When it comes to market euphoria, what can we say here that we haven’t already said countless time in the past two months:

- Dec 1: Market Euphoria Surpasses Dot Com Levels: What’s An Investor To Do?

- Dec 2: Citi Warns Most “Euphoric” Market Since Dot Com Bubble

- Dec 6: JPMorgan Warns Crowded Trades And Euphoric Consensus Are The Biggest Threats For Markets

- Dec 15: Record Wall Street Euphoria Triggers First BofA “Sell Signal” Since February 2020

- Dec 17: Euphoria Goes To 11: Futures, Global Markets, Bitcoin Soar As Dollar Collapse Continues

- Jan 9: Record Investor Euphoria Is Now Literally Off The Chart

- Jan 12: Investor Euphoria At “Record High” As Tailwinds For Stocks Could Soon Dissipate

- Jan 16: Goldman Sounds The Alarm On Stocks: When Euphoria Is This High, “It’s A Good Time To Reduce Risk”

- Jan 21: Futures, Global Markets Hit Record High Amid Unstoppable Trader Euphoria

Well, there is maybe one thing we can add.

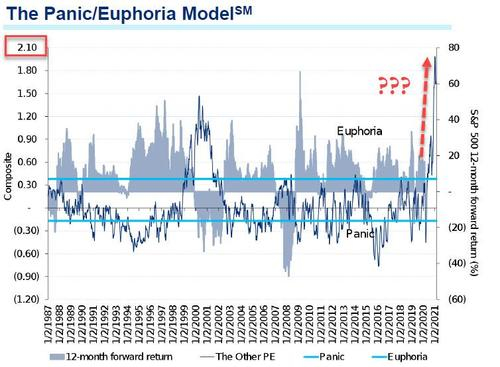

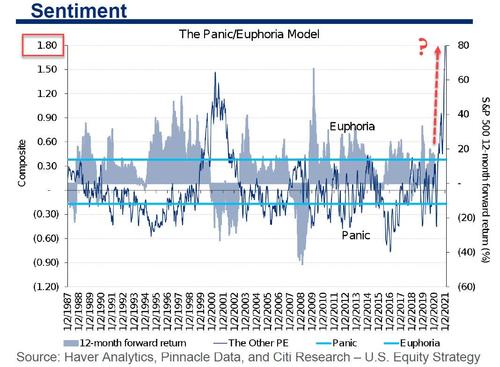

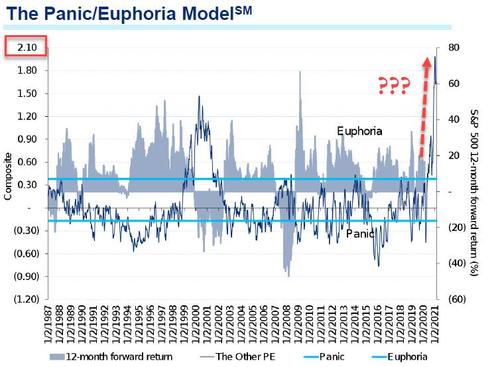

In late February, when looking at the latest Citi Panic/Euphoria index we noted that it is now “off the chart” and – to paraphrase a certain movie – Citi would soon need a bigger chart.

That’s precisely what happened, because in Citi’s latest Panic/Euphoria index as of Feb 12, the chart has indeed gotten bigger – literally – with the upper index bound on the Y-axis increasing from 1.80 To 2.10.

We expect this to keep increasing for quite some time – especially with hundreds of billions more in “stimmies” coming in, as DB’s Jim Reid previewed earlier today…

The upcoming stimulus checks may find their way into equity markets so if there is a bubble it may inflate more first before any correction.

… before the euphoria – and stocks – finally breaks.

Tyler Durden

Mon, 02/15/2021 – 18:00