CPI Prints Hotter Than Expected In April, Real Wages Tumble For 13th Straight Month

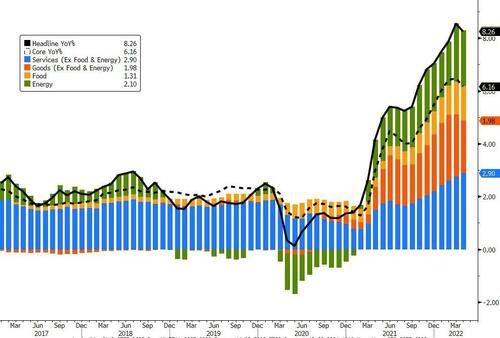

After March’s surge in consumer prices, analysts’ consensus is that CPI has peaked and April was expected to show a big slowing from +8.5% YoY to +8.1% YoY, however, CPI printed hotter than expected at +8.3% YoY…

Source: Bloomberg

Bear in mind that headline CPI is still at its second highest since 1982.

Core CPI was expected to rise 6.0% YoY in April (down from +6.5% YoY in March) but rose a hotter than expected 6.2% YoY and the 0.6% MoM spike in core is bigger than all 67 estimates in BBG business survey.

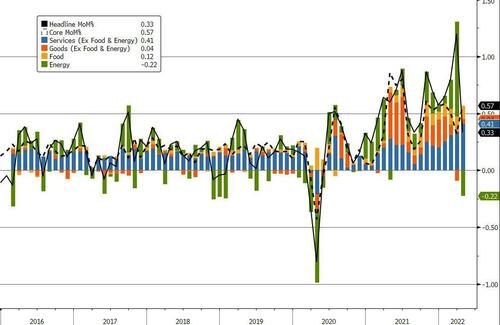

Energy inflation eased as Services prices soared MoM…

Source: Bloomberg

Increases in the indexes for shelter, food, airline fares, and new vehicles were the largest contributors to the seasonally adjusted all items increase. The indexes for medical care, recreation, and household furnishings and operations also increased in April.

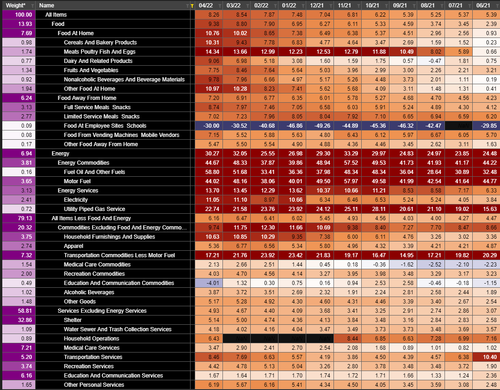

Here are some of the stunning, record price increases, first on a Y/Y basis:

-

The food at home index rose 10.8 percent over the last 12 months, the largest 12-month increase since the period ending November 1980.

-

The index for meats, poultry, fish, and eggs increased 14.3 percent over the last year, the largest 12-month increase since the period ending May 1979

-

The index for airline fares continued to rise sharply, increasing 18.6 percent in April, the largest 1 month increase since the inception of the series in 1963.

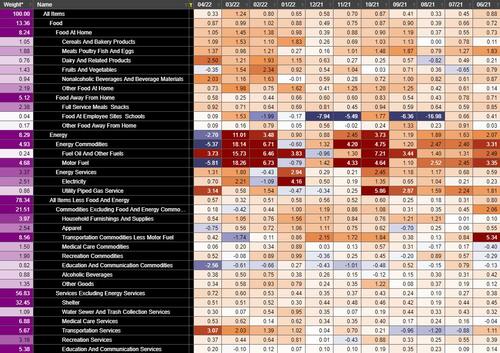

And monthly:

-

The food index rose 0.9 percent over the month as the food at home index rose 1.0 percent. The energy index declined in April after rising in recent months. The index for gasoline fell 6.1 percent over the month, offsetting increases in the indexes for natural gas and electricity.

-

The index for new vehicles increased 1.1 percent in April after rising 0.2 percent in March. The medical care index increased 0.4 percent in April.

-

The index for hospital services rose 0.5 percent over the month, the index for physicians’ services rose 0.2 percent, and the index for prescription drugs was unchanged.

-

The index for household furnishings and operations continued to increase, rising 0.4 percent in April after increasing 1.0 percent the prior month.

-

The index for motor vehicle insurance increased 0.8 percent in April.

-

Also rising over the month were the indexes for personal care (+0.4 percent), education (+0.2 percent), alcoholic beverages (+0.4 percent), and tobacco (+0.4 percent).

but, a few major component indexes declined in April.

-

The apparel index fell 0.8 percent over the month, ending a string of six consecutive increases.

-

The index for communication fell 0.4 percent in April, its third consecutive monthly decline.

-

The index for used cars and trucks also fell 0.4 percent over the month, its third straight decline after a long series of increases.

A full breakdown, YoY…

And M/M:

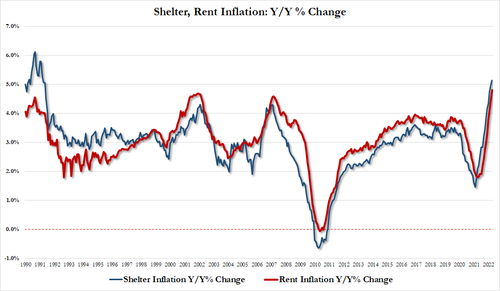

The cost of putting a roof over your head is soaring:

-

April Shelter inflation rose 5.14% Y/Y, up from 5.00% in March and the highest since March 1991

-

April Rent inflation rose 4.82%, up from 4.44% in March, and the highest since Feb 1991

As Goldman noted, strong Services inflation will likely keep CPI elevated while last year’s spike in goods prices will increasingly drop out…

Source: Bloomberg

Finally, perhaps most worrying for the average Joe, ‘real’ wages fell for the 13th straight month…

Source: Bloomberg

Matt Maley, chief market strategist for Miller Tabak + Co., says:

“Very simply, this high inflation number has dimmed the hopes for many investors considerably that we’ve reached peak inflation. Therefore, the Fed will remain hawkish and it just might put a 75 basis point hike back on the table.”

Looking ahead there is good news and bad news, from Katherine Judge at CIBC:

“Looking beyond April, base effects will help annual inflation continue to decelerate in the near term, but that will be limited by gas prices, which are heading higher again, and supply disruptions resulting from lockdowns in China, in combination with the tightening in the labor market and higher shelter prices.”

Get back to work Mr.Powell – and Mr.Biden, please stop whatever it is you are doing to ‘help’.

Tyler Durden

Wed, 05/11/2022 – 08:34