David Rosenberg: "A Whole Bunch Of People Are Really, Really Wrong" About Inflation

With so much focus on the macro environment as stocks struggle to return to their all-time highs, MacroVoices invited seasoned Wall Street economist David Rosenberg, the chief economist and chief strategist of Rosenberg Research, on the show this week to discus the market’s topic du jour: inflation, and whether or not it will be "transitory," like the Federal Reserve says.

What followed was a thorough critique from Rosenberg, who just a couple of months ago was warning that rising Treasury yields would soon push the market to a "breaking point," of what he sees as flaws in the market’s pricing of lasting inflationary pressures.

Instead, Rosenberg essentially agrees with Fed Chairman Jerome Powell that the recent acceleration in inflation seen in April will be temporary.

What’s going on isn’t a fundamental "regime shift", but rather a "pendulum" swinging back to the opposite extreme following the sudden deflationary demand shock caused by the pandemic. We had three consecutive months of negative CPI prints last year, Rosenberg pointed out. To offset all that, April saw the biggest MoM jump in consumer prices since 1981.

Rosenberg argues that the factors that contributed to this surge in prices are already starting to fade. Commodity prices are falling back to earth, supply chain shortages are slowly being addressed, and leading indicators already show a dramatic increase in exports out of Korea and Taiwan, critical sources of semiconductors. Meanwhile, container ships that are "filled to the brim" are lingering outside the ports of LA and Long Beach, the two busiest ports in the country, as COVID concerns continue to delay the unloading of these ships. With all these signs that supply chain snarls are quickly being worked out, "to suggest that the supply will not come back to me is ridiculous," Rosenberg said.

On the demand side of the equation, federal stimulus has created a sugar high that Rosenberg expects will wear off by the fall. Around that time, Rosenberg believes, all the workers being kept out of the labor pool by generous government benefits will be forced to look for work again, and the "fiscal withdrawal" will emerge to suppress aggregate demand just as supply levels are normalizing. "The fiscal policy and the short term nature of the stimulus has just accentuated the volatility in the data. So I actually believe that come the fall, we will start to see the reopenings having a positive impact on aggregate supply at a time when we’re gonna see fiscal withdrawal having a downward impact on demand. And so a lot of the inflation we’re seeing today is going to reverse course I expect either by late summer or early fall."

Moving on, Rosenberg criticized economists calling for an inflationary "regime change" under the Democrats, claiming that similar arguments were made when both Trump and Obama took office. And while professional economists like to talk about the M2 money supply, Rosenberg argued there’s little correlation between Money Supply and inflation: "for the past 20 years, the money supply numbers have had no correlation with anything except maybe asset prices. And you’re quite right. We’ve had dramatic asset inflation. Well, look, there’s different ways even regulatory, that we can deal with that. That’s a big problem.

He then pointed to another theory of inflation that’s increasingly gaining credibility among economists: the notion that inflation isn’t correlated with money supply, but money velocity, which has been contracting for decades.

"But you cannot predict inflation with just the money supply because you have to take a look at money velocity and money velocity has been contracting for decades because we’re choking on too much debt. And it has impaired the credit multiplier. So I don’t see that that’s changed."

And as for all those claiming that McDonald’s and Wal-Mart hiking wages will lead to inflation on that end, Rosenberg joked that they clearly have forgotten a similar wave of wage-hike announcements a few years back after President Trump passed his tax cuts.

"Money supply against money velocity is not leading right now to an inflationary conclusion, oh, people are now saying, well look at wages. Look at all these companies announcing wage increases. And then of course, to lure these people that work in the consumer cycle industries, whether it’s restaurants, or in the hotel business, or theme parks. You know, once again, a little history goes a long way. I remember back after Trump cut taxes on the corporate side and allowed companies to repatriate tax free their earnings from abroad back home and all these companies. I listed 20 them in my morning note the other day. 4% of the corporate sector announced wage and bonus increases back in early 2018, some bellwether companies too. So where was the big inflation coming out of that?"

Moving on from all the inflation talk, Rosenberg said he’s more interested in productivity, which actually increased in 2020 as millions of workers retreated to their home offices. It’s a phenomenon that deserves more attention.

"So here we have a situation which nobody talks about what’s really important, which is that we just got last week, a first quarter productivity number that’s showing that productivity is running over a 4% annual rate. Now, whether that’s a secular or structural change, I’m not sure. But you know, everybody talks about regime change in an inflationary way. But nobody talks about the fact that in the weakest year for the US economy since 1946, it was the best year for productivity in a decade. Companies actually realized for all the lamenting of shortages and job shortages and job shortages and job shortages. The reality is that the corporate sector actually had its best productivity performance in a decade in the same year that we had the worst year for employment since the 1930s."

Still, "it’s really hard to tell if that’s noise, or a more fundamental shift," Rosenberg added.

But the takeaway for all this is that, as Rosenberg sees it, the big focus on an inflationary "regime shift" has caused the market narrative to shift in a way that Rosenberg believes is somewhat overzealous.

We’ve got some inflation right now, because the economy is having trouble getting started up and responding quickly to demand, it’ll all come back out and we’ll be back to what we’ve been used to for the last several years. That’s the way you see this playing out. If that’s right, it means a whole bunch of people are really, really wrong. And that means market opportunity, because a whole bunch of things have moved quite a long ways in a inflation is coming and not just inflation, but secular inflation is coming. If people are wrong about thinking that, and we don’t really have secular inflation coming. What’s the best trade to kind of play the crowds got it wrong? Well let me just say that I’m not gonna actually say that the markets have anything particularly wrong. What I’m saying is that the narrative that you’re reading and hearing about day in day out, that narrative is wrong. You know, look, The Wall Street Journal runs with an editorial that uses as its inflationary thesis, the one year, the one year inflation expectation component out of the University of Michigan index, which just came out on Friday for May.

A quick glance at the TIPS market shows that most inflation expectations being priced in are still "very near term", and that spreads between twos and fives, fives and tens, and twos and 30s shows there’s been "no big outbreak of longer term inflation expectations."

What they don’t tell you is that if you back out the two to five year inflation expectation, because the one year is just if you plot the one year inflation expectation against gasoline prices, that’s your story. But the two to five year, the two to five year hasn’t moved, it’s still in the range. For that particular metric, it’s 2.7%. It’s still in the range. The two to five years, if you go into taking a look at the TIPS market, or the breakeven inflation levels out of the bond market, you’ll see that most of the inflation expectation is still a very near term. Like really out to the next two years. If you take a look at the breakeven spreads between twos and fives and fives and 10s and twos and 30s. You’ll see that there’s been no big outbreak of longer term inflation expectations. That’s actually very encouraging. They’re just telling you that right now we have a tremendous dislocation. And yes, it’s going to probably gonna last a few more months. It’s not just your base effects. There is some real price increases coming into the fore. But what would you expect? I mean look, we just had a 10% increase in airfares and the CPI index, they’re still down 20% from where they were pre-COVID. You know, the sports tickets and the like that were up 10% in April. You know they’re down significantly for where they were pre-COVID. And so there’s still tremendous amount of distortions.

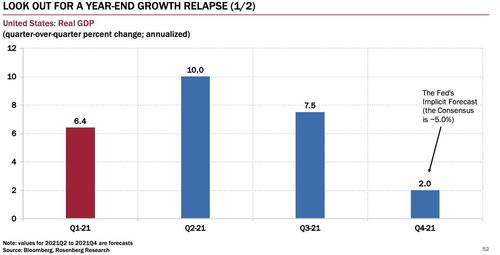

In a chart-filled slide deck shared alongside the interview, Rosenberg argues that neither inflation or an early Fed taper are the main risks to the stock market and other risk assets. In reality, Rosenberg expects a post-stimulus growth shock in Q4 could lead to widespread re-pricing.

Source: Rosenberg Research, MacroVoices

For what it’s worth, a quick glance at the "stale" Fed minutes released this week show Fed insiders still see inflationary risks as "balanced."

More confirmation that inflation is just "transitory"

The staff continued to view the risks around the inflation projection as balanced.

… even as some concede that supply chain collapse can lead to higher prices for longer:

A number of participants remarked that supply chain bottlenecks and input shortages may not be resolved quickly and, if so, these factors could put upward pressure on prices beyond this year. They noted that in some industries, supply chain disruptions appeared to be more persistent than originally anticipated and reportedly had led to higher input costs.

But investors like Jeff Gundlach aren’t so sure, arguing that the Fed’s "transitory" rhetoric is the result of mere guesswork.

Readers can listen to the full interview below:

And find the transcript here:

MV272 David Rosenberg Interview on Scribd

For a look at Rosenberg’s chart book, check out MacroVoices.com.

Tyler Durden

Sun, 05/23/2021 – 20:00