FOMC Minutes Confirm Tapering Begins Mid-Nov or Dec At $15BN Monthly, Several Preferred "More Rapid" Bond-Buying Cuts

Since the last FOMC meeting (September 22nd) – when Chair Powell began to detail the taper and rate-hike traajectory to come – bonds are down (yields higher) but stocks, gold, and the dollar are all up around 1%…

Source: Bloomberg

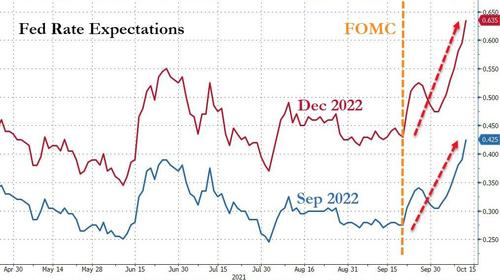

And even more notably, the trajectory (and initial timing) or rate-hikes has soared…

Source: Bloomberg

But the long-end of the yield curve is signaling that The Fed will once again commit a faux-pass…

Source: Bloomberg

So the big question the market is trying to glean from today’s Minutes is – just how ‘consensus’ is the imminent taper talk… and potentially a sooner than expected rate-hike? Especially after today showed that consumer price readings have come in at 5% or higher on a year-over-year basis for five straight months, undermining the "transitory" theme put forward by central bankers.

As a reminder, The Fed confirmed plans to begin reducing their bond-buying stimulus program in November and to possibly end the asset purchases entirely by the middle of next year – this was confirmed in the Minutes…

Participants also expressed their views on how slowing in the pace of purchases might proceed.

In particular, participants commented on an illustrative path, developed by the staff and reflecting participants’ discussions at the Committee’s July meeting, that gave the speed and composition associated with a tapering of asset purchases. The illustrative tapering path was designed to be simple to communicate and entailed a gradual reduction in the pace of net asset purchases that, if begun later this year, would lead the Federal Reserve to end purchases around the middle of next year.

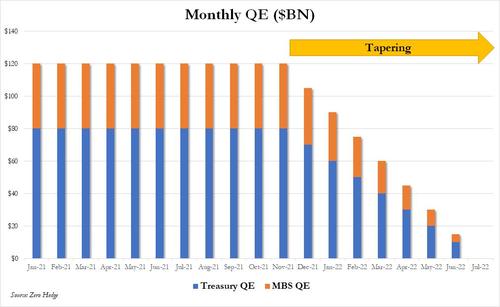

The path featured monthly reductions in the pace of asset purchases, by $10 billion in the case of Treasury securities and $5 billion in the case of agency mortgage-backed securities (MBS). Participants generally commented that the illustrative path provided a straightforward and appropriate template that policymakers might follow, and a couple of participants observed that giving advance notice to the general public of a plan along these lines may reduce the risk of an adverse market reaction to a moderation in asset purchases. Participants noted that, in keeping with the outcome-based standard for initiating a tapering of asset purchases, the Committee could adjust the pace of the moderation of its purchases if economic developments were to differ substantially from what they expected. Several participants indicated that they preferred to proceed with a more rapid moderation of purchases than described in the illustrative examples.

No decision to proceed with a moderation of asset purchases was made at the meeting, but participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate.

Participants noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December.

Several participants indicated that they preferred to proceed with a more rapid moderation of purchases than described in the illustrative examples.

This is what that looks like…

“Many” thought the progress test would be met “soon”

A number of participants assessed that the standard of substantial further progress toward the goal of maximum employment had not yet been attained but that, if the economy proceeded roughly as they anticipated, it may soon be reached.”

On rate-hikes:

“Various participants stressed that economic conditions were likely to justify keeping the rate at or near its lower bound over the next couple of years.”

On Inflation:

Some participants expressed concerns that elevated rates of inflation could feed through into longer-term inflation expectations of households and businesses or saw recent inflation data as suggestive of broader inflation pressures. Several other participants pointed out that the largest contributors to the recent elevated measures of inflation were a handful of COVID-related, pandemic-sensitive categories in which specific, identifiable bottlenecks were at play. This observation suggested that the upward pressure on prices would abate as the COVID-related demand and supply imbalances subsided. These participants noted that prices in some of those categories showed signs of stabilizing or even turned down of late. Many participants pointed out that the owners’ equivalent rent component of price indexes should be monitored carefully, as rising home prices could lead to upward pressure on rents. A few participants noted that there was not yet evidence that robust wage growth was exerting upward pressure on prices to a significant degree, but also that the possibility merited close monitoring.

On "Transitory" Inflation:

Participants noted that their contacts generally did not expect bottlenecks to be fully resolved until sometime next year or even later.

On Evergrande contagion:

Concerns over the period about the effects of COVID-19 developments on economic performance and, late in the period, about a heavily indebted Chinese property developer appeared to have only marginal net effects on financial asset prices.

…

On September 20, stock market prices fell notably and speculative-grade yield spreads widened amid rising concerns about the creditworthiness of a Chinese property developer, but these moves were mostly reversed during the following day, particularly in the stock market.

On the economy:

In discussing the uncertainty and risks associated with the economic outlook, participants noted that uncertainty remained high.

A number of participants judged that the uncertain course of the virus, supply chain disruptions, and labor shortages complicated the task of interpreting incoming economic data and assessing progress toward the Committee’s goals. Participants generally saw the risks to the outlook for economic activity as broadly balanced. Uncertainty around the course of the virus, the resolution of supply constraints, and fiscal measures were cited as presenting both upside and downside risks. In addition, some participants mentioned the risks associated with high asset valuations in the United States and abroad, and a number of participants commented on the importance of resolving the issues involving the federal government budget and debt ceiling in a timely manner. Most participants saw inflation risks as weighted to the upside because of concerns that supply disruptions and labor shortages might last longer and might have larger or more persistent effects on prices and wages than they currently assumed.

A few participants commented that there were also some downside risks for inflation, as the factors that had held inflation down over the previous long expansion were likely still in place.

There was complete unanimity in the decision to taper:

All participants agreed that it would be appropriate for the current meeting’s postmeeting statement to relay the Committee’s judgment that, if progress continued broadly as expected, a moderation in the pace of asset purchases may soon be warranted

Finally, there were 18 mentions of COVID in Sept Minutes, up from 3 in August.

* * *

Read the full FOMC Minutes below:

Tyler Durden

Wed, 10/13/2021 – 14:08