Futures Fly To All Time High Of 4,023 Ahead Of Blockbuster Payrolls Report

While US cash markets are closed for Good Friday today, S&P futures continued their Thursday ramp higher, and after rising above 4,000 for the first time yesterday were last trading at 4,022, up 0.3%, ahead of the March payrolls data (preview here) expected to show the biggest increase in jobs in five months (and potentially much more). While cash bonds are open, most other markets were also closed for Good Friday.

As previewed yesterday, if it is a big outlier, the jobs report will likely roil the bond market as trading volumes will be extreme thin during today’s holiday-shortened session and all trades will be focused in rates as Treasuries will be the only asset open (until noon) while the New York Stock Exchange is closed today.

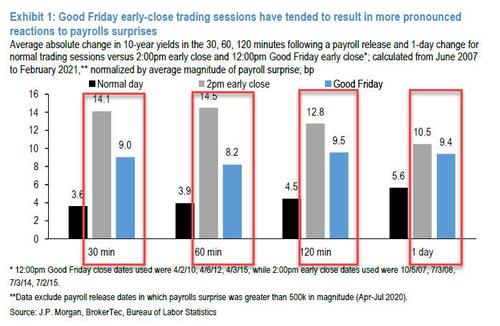

In previewing the potential for a big move, JPMorgan showed the chart above which shows the average absolute change in 10-year yields over various periods around payrolls releases, normalized by the average size of payrolls surprise, during various types of trading sessions. The data show that in the hours following payrolls releases on Good Friday 12pm early-close sessions, Treasury markets appear to be approximately 2 times more volatile than observed during a normal session, for a given magnitude of surprise, and in 2pm early close sessions, they are roughly 3 times more volatile than that of a full session following releases. Looking ahead, JPM concludes that "these results suggest that Treasury yields could exhibit greater volatility in response to a surprise in the employment report on Friday."

Even the lack of a blockbuster beat could send yields sharply higher: as Bloomberg notes, the median estimate points to 660,000 gain in non-farm payrolls, which would indicate that the economy is powering ahead as more people get vaccinated. That could push benchmark 10-year yields back toward a recent one-year peak of 1.77%.

Meanwhile, progress on the covid front continues: “The vaccination program is continuing apace across the U.S. along with a slowdown in the rise in virus cases, hospitalizations, and deaths,” said Michael Hewson, chief market analyst at CMC Markets UK. "There are certainly plenty of reasons to be optimistic about today’s payrolls number."

Investors are also cheering other signs of strength in the U.S. economy. Manufacturing growth roared ahead in March and President Joe Biden’s plan to rebuild infrastructure strengthens the outlook, though questions remain about how much of it can actually be delivered.

European markets were mostly closed, while stocks in Chima, Japan and South Korea advanced, helped by chipmakers.

After weeks of trading in the doldrums, China’s benchmark gauge rose Friday as appetite for risk improved, taking its gain this week to the biggest since mid-February. The CSI 300 Index closed up 1%. That extended the weekly advance to 2.5%, the most in seven, when the gauge hit near-record highs before going on a five-week losing streak. Consumer staples were the top performers with a nearly 4% increase, adding 6.4% for the week. The jump was mostly led by Kweichow Moutai’s 5.8% rise on the second day of a winning streak. Information technology were also among the gainers amid local reports of price hikes at foundry Semiconductor Manufacturing International Corp.

“There seems to be renewed risk appetite for all sectors,” said Zhang Fushen, senior analyst at Shanghai PD Fortune Asset Management. But he cautioned the move was not supported by any change in fundamentals. “I expect today the market is near the end of the recent gains.” China’s main gauges have drifted within a tight trading band over the past two weeks, as the worst of the pull-back from February’s peak, sparked by valuation and liquidity jitters, subsided. The sideways moves have been accompanied by dwindling volumes, with the average turnover in Shanghai and Shenzhen this week at the lowest in five months. The Shanghai Composite Index climbed 0.5% Friday, and the ChiNext Index was up 1.3%.

Japanese stocks climbed for a second day as record-high U.S. shares and lower Treasury yields spurred demand for riskier assets. Electronics makers and telecommunications providers were the biggest boosts to the Topix, helping the gauge pare its second weekly loss. The Nikkei 225 Stock Average climbed for the sixth day in seven as SoftBank Group and Fast Retailing advanced. Toyota Motor gained 0.5% after its first-quarter sales in North America surged 22% from a year earlier. Volumes were almost 25% below the 30-day average with many markets closed for holidays.

”Economic data are strong these days amid the anticipated economic normalization and impact from extra stimulus measures,” said Shogo Maekawa, a strategist at JPMorgan Asset Management in Tokyo. “On yields, the pace of the rise has slowed, so overall, local equities are likely to continue their upward trend, centering around cyclical stocks.” Mizuho Financial Group fell as much as 1.6%, sliding for a fifth day. The bank faces about 10 billion yen ($90 million) in potential losses tied to Bill Hwang’s Archegos Capital Management, a person with knowledge of the matter said. Summary

In other news, Biden’s top national security and economic advisers plan to meet April 12 with semiconductor and auto companies to discuss the global shortage of microprocessors, according to people familiar with the matter.

In rates, the yield on 10-year Treasuries fell seven basis points to 1.67% on Thursday. Keep a close eye on this in case we get a stellar report as it is likely to surge if we get a 1MM+ print.

In FX, the yen climbed 0.1% to 110.49 per dollar. The offshore yuan added 0.1% to 6.5679 per dollar while the euro traded little changed at $1.1775.

In commodities, oil climbed after the OPEC+ alliance agreed to increase production more gradually over the next three months than some had feared. Brent was last trading at $64.5 while Gold was stuck in the doldrums at $1730.

Tyler Durden

Fri, 04/02/2021 – 08:02