Futures Soar Just Shy Of Record Highs As Meltup Returns Ahead Of Powell Hearing

Tyler Durden

Tue, 12/01/2020 – 07:54

S&P futures and global stocks started the last month of the year on a euphoric note, rallying to just below all time highs following a freak one-day selloff (perhaps on pension-rebalance selling) to close November after robust China data boosted expectations of a recovery from the COVID-19 downturn and as drugmakers seek fast approval for their vaccines and authorities look set to keep stimulus support.

E-mini futures jumped 1%, more than reversing all of Monday’s losses while the MSCI world equity index was up 0.4%. News that Tesla would be added to the S&P500 all in one move on Dec 21 propelled the stock to new record highs above $600 and boosted the broader Nasdaq. Meanwhile work from Home darling Zoom dropped despite reporting stellar results and guiding higher than forecast.

The risk-on mood carried across other markets. Bitcoin was on the verge of $20,000 before it was hit with a sharp selloff, while futures on the Russell 2000 Index outperformed the tech-heavy Nasdaq 100 Index. Breakthroughs in vaccine developments from Pfizer, Moderna and AstraZeneca last month along with news that Janet Yellen would head the Treasury helped the world equity index surge the most on record, up 12% to new all-time peaks.

On Monday, Moderna applied for U.S. emergency authorization for its COVID-19 vaccine after full results from a late-stage study showed it was 94.1% effective with no serious safety concerns, while in the latest vaccine news, this morning Pfizer and partner BioNTech sought regulatory clearance for their Covid-19 vaccine in the European Union, putting the shot on track for potential approval there before the end of the year.

“We believe the rally can continue, with the current pipeline of expected vaccine rollouts in line with our central scenario of widespread availability in the second quarter of 2021,” said Mark Haefele, Chief Investment Officer at UBS Global Wealth Management in Zurich. “We also believe that a divided U.S. government – which looks the most likely outcome – is no impediment to a rising market.”

Europe’s Stoxx 600 Index was 0.7% higher lifted by banks, miners and energy firms. U.K. stocks were up almost 2% after Goldman Sachs Group strategists called them a buy ahead of a Brexit trade deal. Stocks ignored the latest disappointing PMI data which found that Euro zone factory growth cooled last month as renewed coronavirus lockdown measures hurt demand, leaving the bloc lagging many Asian peers who recovered further from the COVID-19 crisis, surveys showed on Tuesday.

The euro zone is on track for its first double-dip recession in nearly a decade, according to a recent Reuters poll of economists, and IHS Markit’s final manufacturing Purchasing Managers’ Index fell to 53.8 in November from October’s 54.8. The Euro area manufacturing PMI for November was revised up by 0.2pt from its flash estimate of 53.6, reflecting upward revisions in both France (+0.5pt) and the periphery (+0.4pt), with a modest downward revision in Germany (-0.1pt). In the UK, the manufacturing PMI rose by more than was initially reported. However, both the Italian and Spanish manufacturing PMIs declined, surprising expectations to the downside, showing a sequential weakening across most subcomponents.

“Manufacturing is not that bad considering the pressure on the economy, but it’s all about services which have lost a lot of momentum,” said Peter Dixon at Commerzbank. While the region’s manufacturing sector continued to expand, an earlier flash reading of the overall survey showed growth in the dominant service industry contracted last month as COVID-19 restrictions were imposed to quell a second wave of infections.

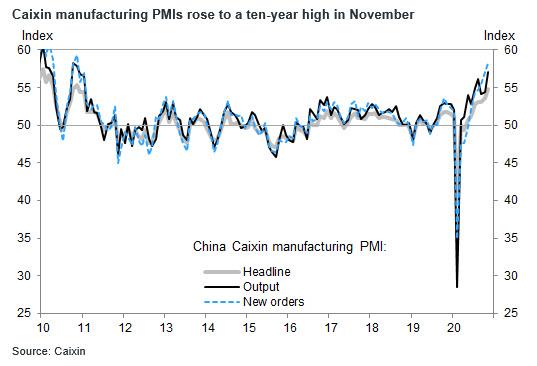

Earlier the MSCI’s broadest index of Asia-Pacific shares outside Japan added 1.3%, while China’s Shanghai Composite Index rose 1.8%, driven by China Merchants Bank and ICBC after the latest Markit (or is that S&P) survey showed on Tuesday activity in China’s factory sector accelerated at the fastest pace in a decade in November.

Trading volume for MSCI Asia Pacific Index members was 22% above the monthly average for this time of the day. The Topix added 0.8%, with Daikin and Shin-Etsu Chemical contributing the most to the move. Japan’s Nikkei rose 1.3% while Australia’s S&P/ASX 200 gained 1.1% after Australia’s central bank said the country’s economy would need fiscal and monetary support “for some time”.

“What we are seeing today is that upward trend reasserting itself, given the positive news on the vaccine front, China’s growth picking up, and the tremendous faith in the ability of central banks to keep the markets afloat,” said Stephen Miller, market strategist for GSFM Funds Management.

It’s not all good news though. Fed Chair Jerome Powell is expected to caution lawmakers that the U.S. economy remains in a damaged and uncertain state. In testimony released ahead of a Tuesday hearing before the Senate Banking Committee, Powell gave no indication how the central bank may respond to those worries when it conducts its next policy meeting even as he warned that a slowing recovery and a surging pandemic meant the U.S. was entering a “challenging” few months, with the potential deployment of a vaccine still facing hurdles.

In foreign exchange markets, the dollar was under pressure after closing out its worst month since July with a little bounce and as investors reckon on even more U.S. monetary easing. The Bloomberg Dollar Spot Index dropped 0.3%, near a fresh two-year low, as the pound rose to the highest level since early September as officials sounded an optimistic tone on negotiations over a U.K. trade deal with the European Union. Sweden’s krona led gains after posting its biggest drop in a month versus the dollar on Monday. Australia’s dollar gained as the central bank pledged to continue supporting the recovery. The yen was little changed as gains in stocks dented demand for haven assets. The ZAR lead gains in EM FX, while TRY faded losses after a short-lived move above 7.90/USD.

As the dollar slide continued, China’s yuan surged the most in two weeks in offshore trading, bolstered by surging risk appetite globally, equity inflows from overseas, and signs that exporters were selling dollars to start the month. The offshore yuan rose as much as 0.49% to 6.5519 versus the dollar, the biggest gain since Nov. 16. The rebound came after the currency weakened a total of 0.32% in the last three trading days of November, its longest losing streak in a month.

The U.S. bond market was steady, as the U.S. Congress began a two-week sprint to secure government funding and avoid a possible shutdown amid the coronavirus pandemic. U.S. 10-year Treasury yields were up slightly at 0.8438%. Germany’s benchmark 10-year bond yield hovered near three-week lows, a touch lower in early trade at -0.574%, close to Monday’s three-week low of -0.60% while peripheral European bonds were briefly rattled by words of caution from ECB’s Schnabel, who warned against hopes for blockbuster stimulus although traders later dismissed his warning saying the it does not signal a game-changer.

In other markets, and reflecting the upbeat mood, copper prices rose with Shanghai prices hitting a more than eight-year high, helped by the robust Chinese data. Oil prices however were slightly lower after leading producers delayed talks on 2021 output policy, while the coronavirus pandemic continued to sap fuel demand. OPEC+ delayed talks on output policy for next year until Thursday as key players still disagreed on how much oil they should pump amid weak demand; gold advanced back over $1800.

Looking at the day ahead there are a number of highlights including the release of the November manufacturing PMIs from around the world, Fed Chair Powell testifying with Treasury Secretary Mnuchin before the Senate banking Committee, and ECB President Lagarde speaking at an Atlantic Council event. Otherwise, data releases include the ISM manufacturing reading in the US, the flash estimate of the Euro Area’s CPI for November and Canada’s GDP for September. Other central bank speakers include the Fed’s Brainard, Daly and Evans.

Market Snapshot

- S&P 500 futures up 1% to 3,657.75

- STOXX Europe 600 up 0.8% to 392.40

- German 10Y yield rose 0.8 bps to -0.563%

- Euro up 0.4% to $1.1975

- Italian 10Y yield rose 3.2 bps to 0.515%

- Spanish 10Y yield rose 2.0 bps to 0.101%

- MXAP up 1.1% to 191.28

- MXAPJ up 1.3% to 629.67

- Nikkei up 1.3% to 26,787.54

- Topix up 0.8% to 1,768.38

- Hang Seng Index up 0.9% to 26,567.68

- Shanghai Composite up 1.8% to 3,451.94

- Sensex up 1.3% to 44,710.59

- Australia S&P/ASX 200 up 1.1% to 6,588.54

- Kospi up 1.7% to 2,634.25

- Brent futures up 0.6% to $48.18/bbl

- Gold spot up 0.9% to $1,792.98

- U.S. Dollar Index down 0.2% to 91.69

Top Overnight News from Bloomberg

- President-elect Joe Biden is setting up his first confirmation fight with Senate Republicans by choosing Neera Tanden — a sometimes-acerbic Democratic policy wonk with an often-partisan Twitter feed — to serve as his White House budget chief

- Bitcoin has shot to a record just as billions of institutional dollars have fled gold. The the debate is now heating up on whether the world’s largest digital currency can one day rival bullion as an inflation hedge and portfolio diversifier

- German manufacturing recorded solid growth in November. Factories are benefiting from a rebound in global trade after a slump earlier in the year. Respondents to IHS Markit’s monthly survey pointed to export demand across Europe and from China

- U.K. house prices rose 6.5% last month from a year earlier, the fastest pace in almost six years, as the property market defied a wider economic slump

- U.K. Prime Minister Boris Johnson battled to win support for his coronavirus strategy from lawmakers in his Conservative Party after they threatened to undermine his authority in a vote in the House of Commons scheduled for Tuesday

Asian equity markets traded positively as strong data releases helped the region shrug-off the weak handover from US where stocks were pressured by month-end flows in which cyclicals underperformed and most major indices finished in negative territory, although the DJIA still notched its best monthly performance in more than 3 decades with a monthly gain of almost 12%. ASX 200 (+1.1%) advanced from the open with broad optimism across its sectors aside from energy following similar underperformance stateside and with the OPEC+ meeting postponed to Thursday to provide additional time for talks amid disagreements regarding extension of current production levels. Nikkei 225 (+1.3%) benefitted from more favourable currency flows which provided reprieve for Japanese exporters, while the KOSPI (+1.7%) was boosted after the upward revision to South Korean GDP for Q3 which was increased to 2.1% Q/Q from the preliminary 1.9% growth. Hang Seng (+0.9%) and Shanghai Comp. (+1.8%) conformed to the upbeat mood following the blockbuster Caixin Manufacturing PMI data which printed at a decade high of 54.9 vs. Exp. 53.5 and spurred Chinese markets to pick up from the slow start after the PBoC drained liquidity and with China’s new export control laws taking effect today, while Hong Kong had also announced further COVID-19 restrictions to curb the latest wave of the virus. Finally, 10yr JGBs saw mild gains despite the positive risk tone and mixed results at the 10yr JGB auction, as prices extended on the rebound from support through the key 152.00 level.

Top Asian News

- RBA Keeps Key Rate, Yield Unchanged, as Seen by All Economists

- Armenia Withdraws From Key Azerbaijani Region Under Truce Deal

- China’s Top Watchdog Vows ‘Special’ Oversight of Fintech Giants

- Hong Kong Virus Surge Scuttles Travel Bubble, Sends Bankers Home

Major European bourses see gains across the board (Euro Stoxx 50 +1.1%) as the region added to the modest upside seen at the cash open after taking its cue from positive APAC session. State-side, US equity futures hold onto gains seen overnight in a retracement of yesterday’s month-end induced losses – with ES +0.8%, NQ +0.7% and YM +1.1%, RTY +1.5%. On the COVID-19 front, distribution of a vaccine is seemingly unlikely this year as the European Medicine Agency (EMA) is to express an opinion on the Pfizer/BioNTech vaccine on December 29th, according to sources cited by FT whilst Moderna’s shot discussion will take place on January 12th and AstraZeneca’s vaccine will not be scrutinised before January. Back to Europe, the region experiences broad-based upside with sectors also higher across the board and with a pro-cyclical bias vs. the mixed performance seen at the open. As such, Basic Resources, Banks, Oil & Gas and Autos top the charts whilst Healthcare, Staples and Utilities reside on the other end of the spectrum. As such, the SMI’s (+0.1%) gains are hampered given its heavy exposure to the pharma sector. The energy sector meanwhile rose from the ashes amid the price action in the energy complex. In terms of individual movers, UniCredit (-6.2%) share remain pressured after following CEO Mustier is to step down following clashes with the board over strategy. Mustier will remain in his post until either the end of his term of until a successor has been appointed. Elsewhere, Munich Re (+1.7%) shares saw a leg higher after setting FY20 targets whilst noting the pandemic impact on next year’s financials will be considerably lower.

Top European News

- Swiss Economy Grew Most in Four Decades After Curbs Lifted

- Bayer Raises $1.6 Billion by Selling Most of Stake in Elanco

- VW Puts Audi at Center of Taking on Tesla With EVs, Software

- Macron U- Turn Leaves French Police Chief to Take Heat Over Abuse

In FX, and looking at the USD, that didn’t last long in terms of a recovery for the Greenback and price action suggests a classic short squeeze once the bulk of or residual month end rebalancing was out of the way. Indeed, the DXY only managed a fleeting appearance back above 92.000 late Monday before receding again and is back below the round number within a 91.964-603 range having rebounded from 91.504 to 92.051 amidst another upturn in risk sentiment at the start of December awaiting the final US Markit manufacturing PMI, ISM, construction spending and the first testimony from Fed chair Powell that has been somewhat pre-empted by the release of his text.

- GBP/EUR – The Pound has picked up the baton from the Euro in terms of testing psychological resistance vs the Buck, at 1.3400, but like the single currency it has failed to sustain momentum as Brexit trade talks remain stymied on the 3 key issues and UK Cabinet Minister Gove concedes that there may be no negotiated outcome. However, Eur/Gbp is holding around 0.8960 after touching 0.9000 yesterday following an upward revision to the final manufacturing PMI that marginally eclipsed the Eurozone upgrade after mixed individual member state readings. Hence, Eur/Usd remains capped below 1.2000 and 1 bn option expiry interest from the big figure up to 1.2010, albeit recouping losses after its reversal to sub-1.1930.

- NZD/CHF/CAD/AUD – All firmer against their US counterpart, but to varying degrees as the Kiwi consolidates off 0.7050 peaks in the run up to NZ trade data and Franc pivots 0.9070 in wake of stronger than forecast Swiss GDP and manufacturing PMI. Elsewhere, the Loonie is holding 1.3000+ status and eyeing crude prices in advance of OPEC for further direction and the Aussie is straddling 0.7350 post-RBA (unchanged policy settings in line with consensus so soon after aggressive easing last time) and conflicting leads via building approvals, current account and net export releases overnight. Next up, Q3 GDP before a speech from RBA Governor Lowe later on Wednesday.

- JPY – The Yen is still caught between stalls as it tracks Dollar moves in response to the overall market tone and its own standing as a safe haven, but has retreated through 104.00 to test support into 104.50 after several failed attempts to breach recent highs. Nevertheless, Usd/Jpy appears unlikely to threaten decent option expiries between 104.85-105.00 (1 bn) at this stage.

- SCANDI/EM – Contrasting fortunes for the Sek and Nok in keeping with the respective Swedish and Norwegian manufacturing PMIs, while the latter also looks apprehensive given the delay in scheduling for OPEC+ due to the lack of agreement within the cartel on extending output curbs. Meanwhile, the Cnh continues bounce with assistance from another strong Chinese PMI (Caixin manufacturing) and irrespective of the PBoC setting a softer Cny midpoint fix, in contrast to the Try after a slowdown in Turkey’s manufacturing PMI.

In commodities, WTI and Brent futures see a choppy session whereby the benchmarks nursed earlier losses seen in wake of the OPEC+ meeting postponement to Dec 3rd which was due to ministers being unable to reach concensus on potential tweaks to the Declaration of Cooperation (Doc), although ministers are set to meet today at 13:00GMT/08:00EST for further negotiations, and thus source reports throughout the day are expected (Note: the Newsquawk OPEC Twitter Dashboard is available via the website). Meanwhile, markets are yet to see the implications of Saudi Arabia resining from its role as chairman of the OPEC-plus alliance and co-chairman of the JMMC, with some speculation doing the rounds of increased risks of a price war. Eyes are also on UAE who seemingly has not commmitted itself to a particularly course of action, and with recent reports resurfacing that the Kingdom is may drop out of the OPEC alliance. In terms of recent commentary from members, the Algerian Energy Ministry struck an optimistic tone with regards to reaching an accord whilst Kremlin stated that President Putin will not consult with Russian oil companies ahead of the OPEC+ meeting. WTI Jan has reclaimed a USD 45/bbl handle (vs. low 44.81/bbl) whilst Brent Feb 21 sees itself on either side of USD 48/bbl (vs. low 47.40/bbl). Elsewhere, spot gold and silver prices are underpinned by the softer Buck as the former breached 1800/oz to the upside alongside its 200DMA ~1801/oz, whilst the latter re-gained a footing above USD 23/bbl. Finally, LME copper prices are bolstered by the softer Dollar and stock market gains as the contracts mimic price action seen in Shanghai futures.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 56.7, prior 56.7

- 10am: ISM Manufacturing, est. 58, prior 59.3; New Orders, prior 67.9; Prices Paid, est. 65, prior 65.5; Employment, prior 53.2

- 10am: Construction Spending MoM, est. 0.8%, prior 0.3%

- Wards Total Vehicle Sales, est. 16.1m, prior 16.2m

DB’s Jim Reid concludes the overnight wrap

I’ve hated Christmas for many more years of my life than I’ve enjoyed it but I’m going through a good relationship with the event at the moment. I’ve now heard Last Xmas, two Xmas trees are up at home, the advent calendars are awaiting the children this morning, and the twins are now old enough to get excited about Xmas and Santa. Oh and I’ve just bought myself an early Xmas present heavily discounted and second hand on eBay. Yes it’s is a golf trolley that follows you round the course via Bluetooth without you having to touch anything on it. This is my example of “revenge shopping” as after not playing for a month due to lockdown 2 I will be playing again on Saturday and wanted to treat myself. I’ll let you know on Monday whether the Bluetooth fails (it is second hand) and it runs off and rips up the green and gets me chucked out of my club.

So as advent calendars get popped around the world, we can reflect on the best month for some equities markets on record which is an astonishing statistic. We will publish our monthly performance review around 30 minutes after this goes out and you can view the sea of positivity that November brought. As a highlight the STOXX 600 in Europe capped off its strongest monthly performance in price terms (+13.73%) since the index was created, as did the small-cap Russell 2000 index (+18.29%) in the US. Meanwhile Bitcoin soared to an all-time record yesterday of $19,379, bringing its gains for the month to +42.08%, which itself follows a +27.39% rise in October. Haven assets were the place to avoid in November however, even as the dollar index rose slightly yesterday (+0.09%) just off a 2-year low, as gold shed a further -0.61% on the last day of the month to cap off the precious metal’s worst month (-5.42%) for 4 years.

Even though it was a record month, the last day was a little bit of a dampener on what went on before as investors paused for breath following the unprecedented rally. However futures are back up this morning wiping out yesterday losses at the moment. Before that yesterday saw a move back into some of the defensive large cap tech names, with Apple (+2.11%) for example, having a good day and helping US equities recover from the lows yesterday. By the close, the S&P 500 had fallen -0.46% from its Friday record, with a broad-based decline that saw 71% of the index moving lower, as the Dow Jones (-0.91%) moved even lower. The NASDAQ (-0.06%) nearly ended in positive territory though due to strong performance from Semiconductors (+1.66%), Tech hardware (+1.61%) and Biotech (+0.53%) to a lesser degree. In Europe most of the continent’s major indices including the STOXX 600 (-0.98%) moved lower. 18 of the 20 STOXX 600 sectors dipped as only Retail (+0.56%) and Health care (+0.07%) pulled out gains. Energy was the worst performer on both sides of the Atlantic, -3.43% in Europe and -5.37% in the US as the reflation trades lost ground in addition to the OPEC meeting not going as expected.

The OPEC+ meeting that was planned for today has been rescheduled until Thursday as the member nations needed “further consultations”. Yesterday’s meeting of the countries’ ministers appeared to reach a consensus on rolling the existing production cuts for a further three months though. However, some countries want that extension made contingent on all nations meeting their targets. OPEC+ is expected to continue discussions in the next two days to hammer out details ahead of the new meeting on Thursday. Oil prices whipsawed around the news of the extension, with WTI and Brent crude seeing multiple 2% moves in either direction all session long before WTI ended the day down -0.42% and Brent crude fell -1.22%, but the latter future had closed before the meeting extension news.

As discussed above markets are back to their recent winning ways overnight with the Nikkei (+1.41%), Hang Seng (+0.98%), Shanghai Comp (+1.31%), Kospi (+1.60%) and Asx (+1.09%) all up. Futures on the S&P are up +0.81%. In terms of overnight data releases, China’s November Caixin manufacturing PMI affirmed yesterday message from the official release as it printed at 54.9 (vs. 53.5 expected), the highest reading in 10 years. Japan’s final manufacturing PMI also came in 0.7pts above the flash at 49.0. Manufacturing PMIs for other countries in the region were also mostly strong with South Korea (at 52.9 vs. 51.2 last month), Taiwan (56.9 vs. 55.1) Indonesia (50.6 vs. 47.8) and India (56.3 vs. 58.9) all reporting robust prints. Vietnam was an exception with the PMI declining to 49.9 from 51.8 last month. We’ll see the European and US data later so all eyes on that.

In other news, Fed chair Powell said in testimony released ahead of today’s hearing before the Senate Banking Committee that the US economy remains in a damaged and uncertain state, though recent news on the vaccine front “is very positive for the medium term.” More this afternoon but there were no real surprises.

On the virus, the main news yesterday came from Moderna, which announced that it would be requesting an Emergency Use Authorization from the FDA in the US, as well as a conditional marketing authorisation with the European Medicines Agency. Their vaccine is 94.1% effective and all of the severe Covid cases occurred in the placebo group. In response, the company’s share price rose by a further +20.24% yesterday. In other vaccine news, Novavax’s announced that the company’s study in the U.K. reached full enrollment and would have results soon. The news caused the shares to rise +10.99% on the day after being down -9.60% premarket after worries about delays in reporting elsewhere. Sticking with vaccines, Axios has reported overnight that the White House has summoned the US FDA chief Stephen Hahn to justify why he hasn’t moved faster to approve the Pfizer vaccine.

In terms of the other developments yesterday, the UK saw its 7-day average of confirmed cases fall below 15k for the first time since mid-October. It comes ahead of the regional tier system coming back in England tomorrow, with today being the last day of the England-wide lockdown. Elsewhere France saw positive news as well with the lowest daily rise in cases since August, as ICU and general hospitalisations stats continued to trend lower as well. Meanwhile, Turkey has announced a nationwide weekday curfew starting at 9 pm and ending at 5 am as the country copes with about 30,000 new cases per day. Similarly, the US news was not so positive even as daily counts are currently clouded by lower testing capacity around the Thanksgiving holiday weekend. New York City, at one point the epicenter of the virus in the US, saw their weekly average positivity rate rise over 4%. Meanwhile New York state overall is seeing elective surgery halted in northern counties as the Governor anticipates possible stress to the hospital system during the winter. In fact the number of Americans hospitalised with Covid-19 is at the highest at any point of the pandemic. California is considering a return to stay-at-home orders as hospitalisations soar, with projections showing that intensive-care demand will exceed capacity.

Back to yesterday and there was a reasonable selloff in sovereign bond markets especially in Europe. Yields on 10yr bunds (+1.7bp) and BTPs (+1.4bps) rose. The one exception was Greek debt, where the country’s spread over 10yr bunds fell -3.0bps to 1.21%, its tightest since 2009 before the sovereign debt crisis kicked off.

On Brexit, we’ve now reached the final month of the transition period, which is set to conclude at 11pm London time on December 31. Yesterday didn’t see anything concrete from the negotiations, though an EU source told Reuters that talks in London over the weekend had been “quite difficult” and there were “massive divergences” on the long-standing sticking points. In separate remarks, German Chancellor Merkel said that it would be a bad example for the rest of the world if the UK and the EU didn’t manage to reach an agreement.

In terms of yesterday’s data, UK mortgage approvals soared to 97.5k in October, which was their highest level since September 2007. It comes amidst a temporary cut in the tax on home purchases, which is set to last until the end of March and is seeing a number of buyers bring forward transactions so as to avoid it. Otherwise, preliminary inflation data for Germany in November showed an accelerating decline in consumer prices, having fallen by -0.7% year-on-year on the EU-harmonised measure, matching the post-GFC low set in July 2009. Italy saw more moderate deflation of -0.3% over the same period, up from the previous month’s -0.6% reading. Finally in the US, the data slightly underwhelmed expectations, with pending home sales falling -1.1% in October (vs. +1.0% expected), while the Dallas Fed’s manufacturing index fell to 12.0 (vs. 14.3 expected).

To the day ahead now, and there are a number of highlights including the release of the November manufacturing PMIs from around the world, Fed Chair Powell testifying with Treasury Secretary Mnuchin before the Senate banking Committee, and ECB President Lagarde speaking at an Atlantic Council event. Otherwise, data releases include the ISM manufacturing reading in the US, the flash estimate of the Euro Area’s CPI for November and Canada’s GDP for September. Other central bank speakers include the Fed’s Brainard, Daly and Evans.