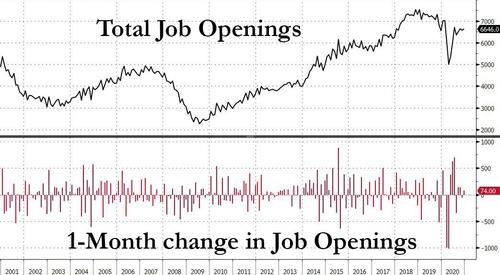

While we already knew that the US labor market closed 2020 with a puke and started 2021 with a whimper after Friday’s January jobs report missed big for a second month, moments ago the BLS reported that in December the labor market was unexpectedly solid in terms of new hiring and job openings – a now meaningless indicator considering all the much more recent data – with job openings in the US unexpectedly jumping by 74K to 6.646MM from an upward revised 6.572MM, well above the 6.4 MM consensus estimate (which in turn was predicted by the December payroll decline). Of course, as everyone knows this is a stale number – JOLTS is 2-months delayed – and as such we can only imagine the December print when it is unveiled in February will be far uglier.

Delayed as it may be, the data showed that according to the BLS, job openings increased in professional and business services (+296,000). Job openings decreased in state and local government, excluding education (-65,000); arts, entertainment, and recreation (-50,000); and nondurable goods manufacturing (-30,000), while geographically, the number of job openings was little changed in all four regions.

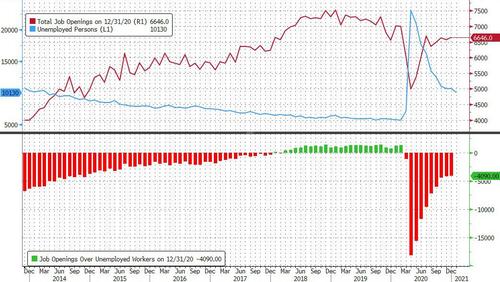

Separately, while it has long been the case that the series of 24 consecutive months in which there were more job openings than unemployed workers ended with a thud last March, in April it was an absolute doozy with 18.1 million more unemployed workers than there are job openings, the biggest gap on record. Since then the the gap has closed somewhat, and in December there were 4.1 million more unemployed than available job openings (after 4.2 million in November).

As a result, there was continued improvement in the job availability series, and in December there were just under 1.6 unemployed workers for every job opening, down from 4.6 at the peak crisis moment in April.

Meanwhile, after a positive month for hiring in November, when 5.935MM people were hired, in December the pace of hiring crashed, plunging to just 5.539MM, a drop of 396K for the month after a 23K increase in November. The coincides and validates the 227K drop in payrolls on December, the first contraction since April.

Hires decreased in accommodation and food services (-221,000); transportation, warehousing, and utilities (-133,000); and arts, entertainment, and recreation (-82,000). Hires increased in retail trade (+94,000). The number of hires in December (not seasonally adjusted) edged down over the year (-237,000). Hires decreased in accommodation and food services; arts, entertainment, and recreation; and educational services. Hires increased in a number of industries with the largest increases in wholesale trade, nondurable goods manufacturing, and durable goods manufacturing. The number of hires decreased in the West region.

While hires plunged, the number of total total separations was little changed at 5.5 million, and the total separations rate was little changed at 3.8 percent. The total separations level decreased in federal government (-86,000). Total separations increased in arts, entertainment, and recreation (+68,000). Also notable, 1,812,000 people were fired or laid off in Dec. vs 1,893,000 in Dec. last year, while an additional 362,000 people left their employer due to retirements, transfers to other locations, death, and separations due to disability.

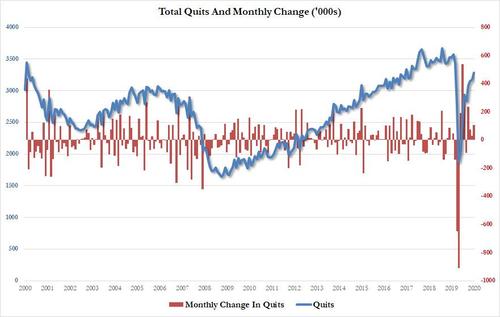

Finally, after the record surge in the number of American quitting their jobs reported back in June, the number of quits in December rose by 106K to 3.3 million, the highest number since February even as the number of quits decreased in federal government (-4,000). Over the year, quits decreased in accommodation and food services and state and in local government education. Quits increased in durable goods manufacturing.

Tyler Durden

Tue, 02/09/2021 – 10:25