“Investors Are On Their Own” – BofA Says Fed Won’t Intervene On Rates, Fears 1987 Replay

While hedge fund honchos David Tepper and Kyle Bass were adamant yesterday that, as we have previously explains, The Fed/US Government duopoly cannot afford to allow rates to rise too much further and overseas demand for what are now extremely ‘cheap’ USTs will stall any ongoing selloff (suggesting stability is coming for rates), BofA’s Fixed Income Research group disagree and say US Treasury yields will keep rising with real yields breaking out on good economic, COVID news.

The reason for Tepper’s sudden bullishness is straightforward and we have discussed numerous times recently – demand for US Treasuries as yields offer asset allocators more options (and spark CTA reversals).

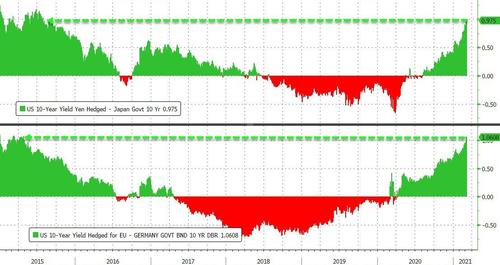

Tepper’s positive view is predicated on support for bonds from overseas buyers, who, as we have previously noted, now benefit from over 100bps of pick-up by buying FX-hedged Treasuries over their local bonds…

And if proof was needed, the avalanche of buying by Japanese investors (as Kuroda decided not to widen the band on their yield curve control program, thus maintaining the yields lower and under more control) has already started…

Why yields are about to reverse hard: FX hedged DM rates are now a huge bargain for Japanese investors, as seen in record inflows into UK debt pic.twitter.com/q1kyOleLRV

— zerohedge (@zerohedge) March 8, 2021

But, countering that, BofA warns that The Fed currently has little reason to intervene and investors on their own for now…

The Fed currently has little reason to respond to market volatility created by rate shock: monetary, fiscal policy are exceptionally accommodative; financial conditions remain very loose; credit spreads are near post-crisis tights; good economic news is exactly what the Fed is trying to achieve.

Further BofA offers this “Reminder”:

The Fed’s focus is the economy (jobs, inflation), not markets – until meaningful credit spread widening and financial conditions tightening, investors are likely on their own.

Which did make us laugh a little. In a seperate note, from technical strategist Paul Ciana, BofA looked at the size, duration, technical patterns and momentum of previous trends, finding support for its “view that there is still no 10Y yield top and a bearish bias remains; increasingly so on the 5Y and even the 2Y.”

Meanwhile, Ciana says the 30-year yield “may peak from August 2021 to January 2022 between 2.24-2.69%.”

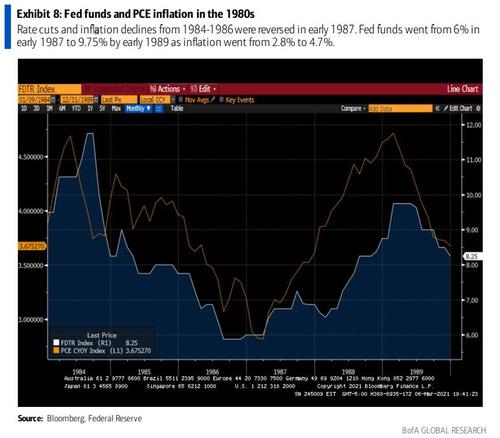

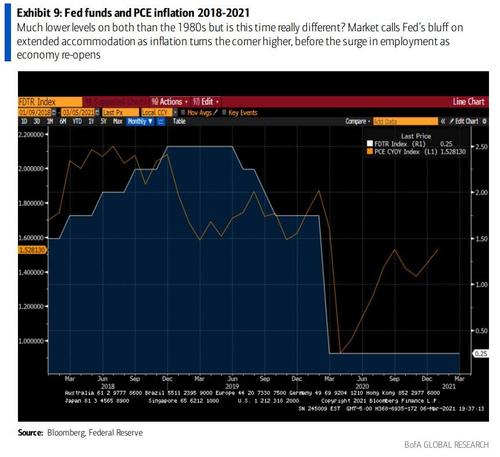

Finally, and more ominously, BofA warns that a 1987 bond selloff (culminating in October 1987 crash) replay underway.

Current bond selloff similar to 1987 bond selloff that started in April and culminated in October stock market crash:

1) after two years of easy monetary policy, inflation has turned higher, with further gains expected due to rising employment – Phillips curve not dead;

Then…

And now…

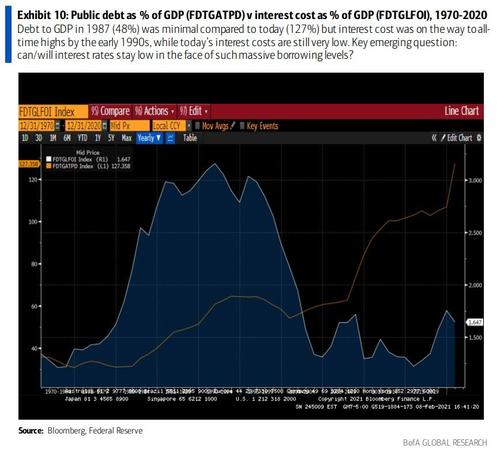

2) fiscal policy driving debt to GDP ratio to new highs, raising sustainability concerns – $2.5 trillion net treasury supply in 2021 vs only $960 billion Fed buying;

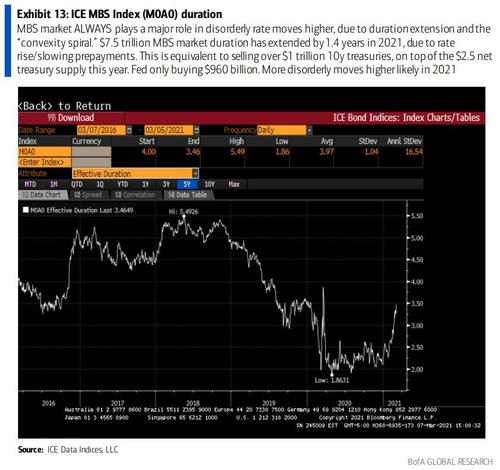

3) MBS market duration rapidly extending after historic refinancing wave winds down, adding significant duration into the market (over $1 trillion 10y treasury equivalents already in 2021, more to come).

Negative returns the new normal in fixed income.

BofA expects a near-term (next 1-2 months) countertrend rally in bonds, if the 1987 script is followed. But warns, it won’t last – with a disorderly overshoot to 2%-2.5% 10y yield likely this year… and that would not be pretty for big-tech and the momo markets... which in a circular way, will bring The Fed back in to save the world again and jawbone moar to manage rates.

Tyler Durden

Tue, 03/09/2021 – 14:38