We have been following the “unicorn” that has been ARK Funds over the last couple weeks, noting the firm’s massive inflows and questioning whether or not its astronomical run would continue, given numerous “law of large number” problems that Bloomberg’s Eric Balchunas pointed out the fund could face (not to mention Tesla’s S&P inclusion potentially taking a gamma squeeze thesis off the table).

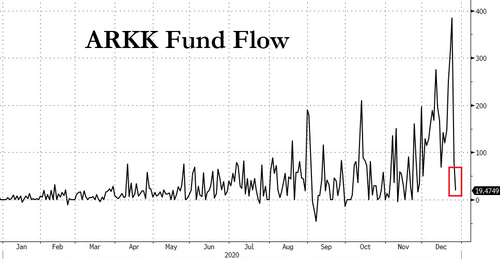

Noting the most recent data on ARKK fund flows heading into the last few trading days of 2020, it appears a trend of cash pouring into the fund may have reversed in a meaningful way. ARKK inflows appear to have made a lower low:

This suggests the obvious: that we may have witnessed a blowoff top of cash pouring into the ETF this month.

In addition to inflows potentially drying up, the beta trade isn’t helping ARKK out during Tuesday’s session either. It appears that ARKK may have peaked alongside of the NASDAQ this month:

Which means if inflows dry up at the same time the NASDAQ finally decides it wants to correct, ARKK holders could be in for a rough start to 2021.

Recall, last week we published a report highlighting Bloomberg’s ETF expert Eric Balchunas’ take on how ARK Funds could wind up becoming victims of their own success.

Many of Balchunas’ assumptions pointed out sustained massive inflows into the ARK family of ETFs – notably its ARKK ETF – which we noted last week was seeing inflows of about $400 million per day. In fact, ARK’s haul has been so massive that Balchunas noted that it has a chance of taking in more cash than Blackrock in December. The funds are on pace to bring in $11 billion, he said last week.

“This one ETF has more in assets than the other 240 actively managed equity ETFs combined,” he pointed out.

And as we know, what goes up, must come down…

Tyler Durden

Tue, 12/29/2020 – 12:20