Federal Reserve Board announces it will extend for a final time its Paycheck Protection Program Liquidity Facility, or PPPLF, by an additional month to July 30, 2021

JUNKie

BONDs

Notes

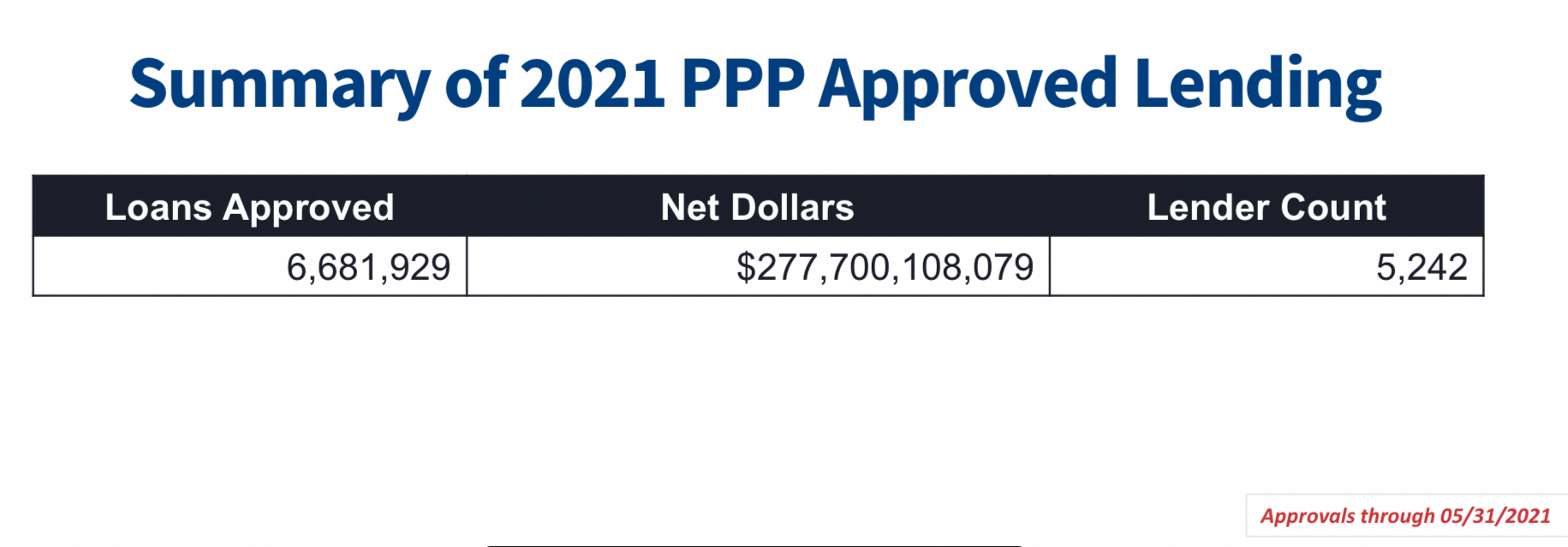

The Paycheck Protection Program is ending at the end of July. The program handed hundreds of billions of dollars to small businesses under the name of lending. Its impact and effectiveness is difficult to ascertain if the working papers by our beloved Fed and Universities are a reliable indication. How important is/was PPP for employers and employees? The conclusions vary so widely that medians or averages serve no purpose. However, it’s probably safe to assume that 300 billion dollars of grants in the first half of 2021 made a difference.

The image above reflects lending details on May 31st. In the first five months of 2021 the program provided an annualized 664 billion dollars of loans. That’s roughly equivalent to 3% of U.S. GDP. According to the Fed, Harvard, NBER, and other experts the cost per job was $43,000–$350,000…so it’s obvious nobody has an accurate idea of its benefits nor the ability to forecast the economic impact as it ends.

There is one certainty about the Paycheck Protection Program. It was an abundant slush fund that gave money to politicians, hedge funds, and celebrities while occasionally helping a small business in need. Making the program even more lucrative than receiving a lump sum of free money, two lump sums of free money, AND a benefiter/borrower still qualifies for the Main Street Lending Program—actual loans of up to $250,000,000. Unfortunately, politicians cannot use the MSLP because of a conflict of interest clause. As I pointed out in the Federal Reserve Newsletter, PPP—the only facility giving no payment loans—doesn’t contain the same restriction.

Lastly, the GAO conducted a review of the SBA’s internal processes for PPP and EIDL. Below I’ve listed the important highlights:

• We also cited the results of SBA’s most recent financial statement audit, in which the auditor issued a disclaimer of opinion on SBA’s financial statements because SBA was unable to provide adequate documentation to support a significant number of transactions and account balances related to PPP and EIDL.

• In June 2020, we reported that SBA’s initial interim final rule for PPP allows lenders to rely on borrowers’ certifying their eligibility and the use of loan proceeds.

• At that time, SBA had announced that it would review loans of more than $2 million to confirm borrower eligibility after the borrower applied for loan forgiveness and that it may review any PPP loan it deemed appropriate. However, SBA provided few details on these reviews at that time. Therefore, we recommended that SBA develop and implement plans to identify and respond to risks in PPP to ensure program integrity, achieve program effectiveness, and address potential fraud, including in loans of $2 million or less. SBA neither agreed nor disagreed with our recommendation at that time.

• A senior official with SBA OIG told us that, as of January 2021, the OIG had opened over 260 investigations related to CARES Act loans, at least three times the number of investigations the office would typically open in a year. Similarly, SBA OIG reported receiving over 70,000 hotline complaints related to CARES Act programs, compared to the 700 to 800 it would receive in a typical year.

• In its discussion of material weaknesses related to PPP, the auditor noted there were over 2 million approved PPP loans (with an approximate total value of $189 billion) flagged by management that were potentially not in conformance with the CARES Act and related legislation. SBA management flagged the loans for one or more of 35 reasons (such as borrowers with criminal record or inactive businesses)…..In addition, the auditor noted there were over 896,000 errors from lender reporting that were identified but not reviewed or processed

• Officials told us that 4 months after SBA started using the service organization’s automated validation system to approve loan applications in batches, they realized that these applications contained alerts that should have been reviewed by loan officers.

The next few months will bring an end to other relief measures worth hundreds of billions, possibly trillions, of benefits for Americans.

Federal Unemployment Benefits – 15 million (in the early stages of enhanced Federal UE benefits roughly 50% were fraudulent claims)

Mortgage Forbearance Plans – 2 million

Rent Eviction Moratorium – Roughly 11 million Americans are behind on rent.

Student Loan Deferment – 42.9 million Federal student loan borrowers resume payments October 1st—according to Forbes, +50% of borrowers say they’re “not ready” to continue payments(admittedly this is likely no indication of their ability to pay)

So…

Transitory or whatever