Key Events In This Holiday-Shortened Week: PMIs, Spending, GDP And CapEx

Tyler Durden

Mon, 11/23/2020 – 09:31

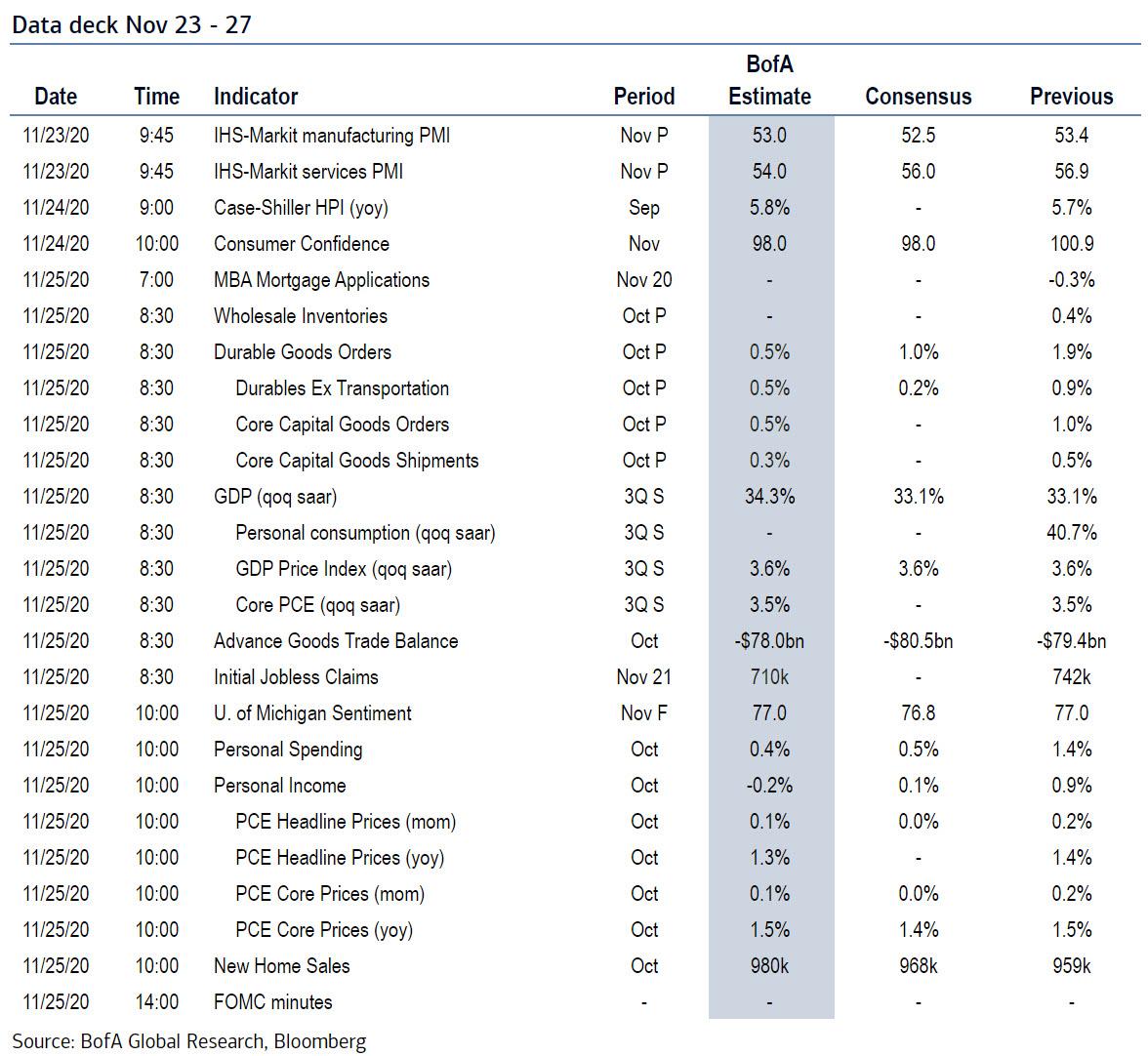

In the holiday-shortened week ahead, the key economic data releases will be the second Q3 GDP estimate, the personal income and spending report, and the durable goods report on Wednesday. There are also a lot of speaking engagements from Fed officials this week.

According to BofA, core PCE inflation is likely to inch up 0.1% (0.07%), leaving the % yoy rate unchanged at 1.5% (1.49% unrounded), while October capital expenditure data should be solid with core capital goods orders rising 0.5% mom and core shipments increasing 0.3% mom.

Across the Atlantic, Brexit talks will move to a virtual format after one of the EU negotiators tested positive for Covid-19. As DB’s Jim Reid notes, there had been reports last week suggesting that we may see a deal reached by the start of this week but it doesn’t feel we’re there yet. For a few months it’s felt like a case of five steps forward and four back on the path to some kind of deal. So progress but painfully slow… which is remarkable considering Brexit is still a thing. The Telegraph reported last night that PM Johnson is set to make a “significant Brexit intervention” whatever that means and speak to EC President Von Der Leyen “in an attempt to clear away final barriers” towards a deal. The article suggested that a week tomorrow is the new deadline. Face to face negotiations apparently begin again on Thursday, and so on until another 5 years pass and there is zero progress.

On the central bank front, there isn’t a great deal taking place this week, though we will get the minutes from the FOMC’s November meeting on Wednesday. The focus will be on what the committee are thinking about in terms of changes to QE and perhaps on shaping future forward guidance, especially with consensus that the Fed will unveil an extending in the duration of QE purchases (although Deutsche economists’ base case is that the Fed would prefer to gather a bit more information on the fiscal outlook and the economy before eventually extending the duration of purchases early next year).

We also got a holiday-abbreviated Treasury issuance schedule with a 2Y and 5Y auction today, followed by a 7Y tomorrow.

Below is a day-by-day calendar of events courtesy of Deutsche Bank:

Monday

- Data: Preliminary November manufacturing, services and composite PMIs from France, Germany, Euro Area, UK and US, US October Chicago Fed national activity index

- Central Banks: BoE Governor Bailey, BoE’s Haldane, Tenreyro and Saunders, ECB’s Schnabel, Fed’s Daly and Evans speak

Tuesday

- Data: Germany final Q3 GDP, France November consumer confidence, business confidence, Germany November Ifo business climate indicator, US September FHFA house price index, November Conference Board consumer confidence Richmond Fed manufacturing index

- Central Banks: BoE’s Haskel, ECB’s Rehn, Schnabel, Fed’s Bullard speak

Wednesday

- Data: US weekly MBA mortgage applications, weekly initial jobless claims, preliminary October wholesale inventories, durable goods orders, nondefence capital goods orders ex air, second Q3 GDP reading, October personal income, personal spending, new home sales, final November University of Michigan consumer sentiment index

- Central Banks: Federal Reserve release minutes of November meeting, ECB’s Holzmann speaks

- Politics: UK Spending Review

Thursday

- Data: Japan final September leading index, final October machine tool orders, Germany December GfK consumer confidence, Euro Area October M3 money supply

- Central Banks: Monetary policy decisions from the Riksbank and Bank of Korea

- Other: Thanksgiving holiday in the US

Friday

- Data: China October industrial profits, France preliminary November CPI, final Q3 GDP, Italy November consumer confidence index, Euro Area final November consumer confidence

* * *

Finally, looking at just the US, the key economic data releases this week are the second Q3 GDP estimate, the personal income and spending report, and the durable goods report on Wednesday. Below is a summary of key expectations from Goldman:

Monday, November 23

- 08:30 AM Markit Flash US manufacturing PMI, November preliminary (consensus 53.0, last 53.4)

- 09:45 AM Markit Flash US services PMI, November preliminary (consensus 55.0, last 56.9)

- 12:30 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will speak about the economy in an online forum hosted by Greater Winston-Salem Inc.

- 01:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will discuss the pandemic’s effects on cities. Audience Q&A is expected.

- 03:00 PM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will take part in a moderated Q&A on the economy hosted by the Iowa Bankers Association.

Tuesday, November 24

- 09:00 AM FHFA house price index, September (consensus +0.5%, last +1.5%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, September (GS +0.7%, consensus +0.65%, last+0.47%): We estimate the S&P/Case-Shiller 20-city home price index rose by 0.7% in September, following a 0.5% increase in August.

- 10:00 AM Conference Board consumer confidence, November (GS 98.0, consensus 97.2, last 100.9): We estimate that the Conference Board consumer confidence index declined by 2.9pt to 98.0 in November. Our forecast reflects the deteriorating virus situation and mixed signals from other consumer confidence measures.

- 10:00 AM Richmond Fed manufacturing index, November (consensus 21, last 29)

- 11:00 AM St. Louis Fed President Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will take part in a Bank of Finland monetary policy webinar. Prepared text and audience Q&A are expected.

- 12:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will take part in a moderated discussion at an online event hosted by the Wall Street Journal.

Wednesday, November 25

- 08:30 AM Initial jobless claims, week ended November 21 (GS 715k, consensus 730k, last 742k); Continuing jobless claims, week ended November 14 (consensus 6,000k, last 6,372k); We estimate initial jobless claims decreased to 715k in the week ended November 21.

- 08:30 AM Advance goods trade balance, October (GS -$81.0bn, consensus -$80.0bn, last -$79.4bn): We estimate that the goods trade deficit increased by $1.6bn to $81.0bn in October compared to the final September report, as imports and exports likely rose further.

- 08:30 AM Wholesale inventories, October preliminary (consensus +0.3%, last +0.4%)

- 08:30 AM Retail inventories, October preliminary (last +1.6%)

- 08:30 AM GDP, Q3 second (GS +33.4%, consensus +33.1%, last +33.1%); Personal consumption, Q3 second (GS +40.9%, consensus +40.8%, last +40.7%): We estimate a three-tenth upward revision to Q3 GDP growth to +33.4% (qoq ar). Our forecast reflects upward revisions to intellectual property investment and goods consumption, but net softness in the consumer services categories included in the Census QSS survey.

- 08:30 AM Durable goods orders, October preliminary (GS +1.0%, consensus +0.9%, last +1.9%); Durable goods orders ex-transportation, October preliminary (GS +0.7%, consensus +0.4%, last +0.9%); Core capital goods orders, October preliminary (GS +0.5%, consensus +0.7%, last +1.0%); Core capital goods shipments, October preliminary (GS +0.5%, consensus +0.3%, last +0.5%): We expect durable goods orders will increase 1.0% in the preliminary October report, reflecting upbeat commentary from industrial company management and fewer seasonally adjusted aircraft cancellations. We expect a 0.5% increase in core capital goods orders and a 0.5% rise in core capital goods shipments.

- 10:00 AM Personal income, October (GS -0.8%, consensus 0.0%, last +0.9%); Personal spending, October (GS +0.7% consensus +0.3%, last +1.4%); PCE price index, October (GS +0.06%, consensus flat, last +0.16%); Core PCE price index, October (GS +0.06%, consensus flat, last +0.18%); PCE price index (yoy), October (GS +1.24%, consensus +1.2%, last +1.37%); Core PCE price index (yoy), October (GS +1.47%, consensus +1.4%, last +1.55%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.06% month-over-month in October, corresponding to a 1.47% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.06% in October, corresponding to a 1.24% increase from a year earlier. We expect a 0.8% decrease in personal income and a 0.7% increase in personal spending in October.

- 10:00 AM University of Michigan consumer sentiment, November final (GS 76.0, consensus 77.0, last 77.0); We expect University of Michigan consumer sentiment to move 1.0pt lower from the preliminary estimate for November, in which the index declined by 4.8pt. The report’s measure of 5- to 10-year inflation expectations rose by two-tenths to 2.6% in the preliminary report.

- 10:00 AM New home sales, October (GS +0.5%, consensus +1.4%, last -3.5%): We estimate that new home sales rose by 0.5% in October, in part reflecting a slowdown in mortgage applications.

- 02:00 PM Minutes from the November 4-5 FOMC meeting: At its November meeting, the FOMC left the target range for the policy rate unchanged at 0-0.25%, as widely expected, and made no changes to its asset purchases. In the minutes, we will look for discussion on asset purchases.

Thursday, November 26

- Thanksgiving holiday. NYSE closed. SIFMA recommends bond markets also close.

Friday, November 27

- NYSE will close early at 1:00 PM. SIFMA recommends an early 2:00 PM close to bond markets.

Source: Deutsche Bank, BofA, Goldman