March 23, 2021 Data & Analytics

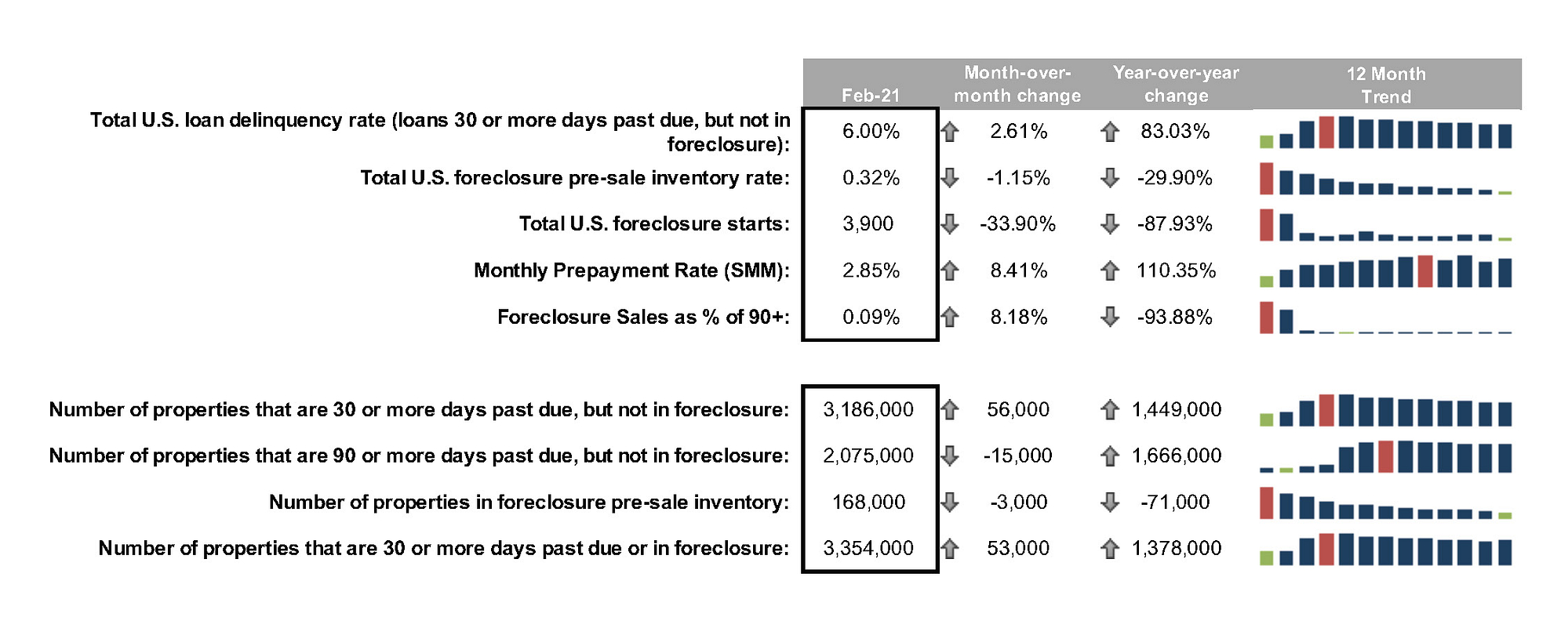

- After eight consecutive months of improvement, the national mortgage delinquency rate rose in February from 5.85% to 6.0%

- The rise was largely calendar-related, as February is both a short month and ended on a Sunday – cutting the days on which payments can be processed – which has historically impacted performance metrics

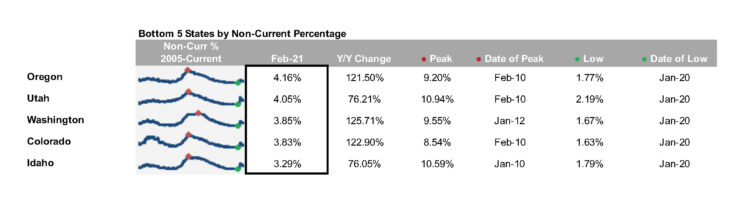

- Delinquency rate increases were seen broadly across portfolios, geographies and asset classes

- The increase was primarily seen in early-stage delinquencies, while the number of loans 90 or more days past due but not yet in foreclosure (including those in active forbearance) saw a modest decline

- Prepayment activity edged upward in February as well, but recent 30-year interest rate increases are likely to put downward pressure on prepayment rates in the coming months

- Both foreclosure starts and active foreclosure inventory again hit new record lows, as recently extended foreclosure moratoriums continue to suppress activity

JACKSONVILLE, Fla. – March 23, 2021 – Black Knight, Inc. (NYSE:BKI) reports the following “first look” at February 2021 month-end mortgage performance statistics derived from its loan-level database representing the majority of the national mortgage market.