On Fumes Of Stimulus & Frustration: California Legal Cannabis Sales Explode

Tyler Durden

Tue, 11/24/2020 – 22:05

Authored by Wolf Richter via WolfStreet.com,

You just knew this would be coming. It was bound to show up in the data. And California is cashing in…

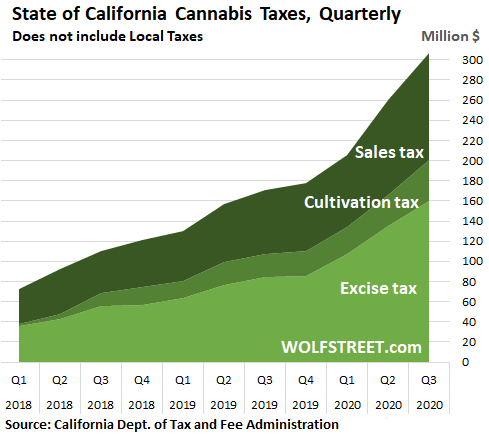

Cannabis tax revenues in Q3 collected by the State of California soared by a record 80% year-over-year, and by a record of $136 million year-over-year, to a $307 million, the California Department of Tax and Fee Administration reported Monday afternoon. This does not include tax revenues collected by cities and counties. All three categories surged: Excise Tax (+89%), Cultivation Tax (+80%), and Sales Tax (+67%).

This brought California’s cannabis taxes during the first nine months of 2020 to $775 million, and on track to exceed $1 billion for the whole year, a sorely needed injection of moolah during these trying times:

Cannabis has always been a popular product and business in California in a huge black market that persists today, but what we’re looking at is the shift of black-market weed to regulated and taxed legal weed, much of it locally grown, and sold at retailers that are paying rent, unlike other retailers that have shut down or stopped paying rent.

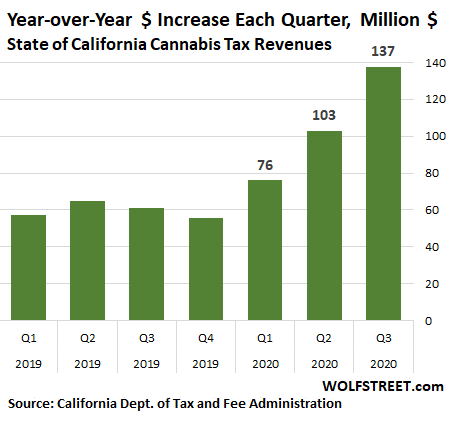

California cannabis tax revenues had been surging by around $60 million every quarter compared to the same quarter a year earlier, since the beginning of legalization in January 2018. This rate of growth was fairly stable through the fourth quarter 2019.

Then in February 2020, Covid was beginning to run around in California, and people began to react. On February 26, San Francisco declared a state of emergency. By that time, traffic had already died down. On March 17, the five most populous counties of the Bay Area began the lockdown. And people, to soothe their pains and anxieties…

In Q1, cannabis tax revenues surged by $76 million year-over-year to $206 million. In Q2, the stimulus money and extra unemployment benefits of $600-a-week kicked in, and cannabis tax revenues surged by $103 million to $260 million. And in Q3, the stock market gains were ladled on top of it, and the state started sending out the additional $300-a-week in unemployment benefits in $900-lumpsum payments, and cannabis tax revenues exploded by $135 million to $307 million.

This chart shows the year-over-year increases in millions of dollars for each quarter. Note how through 2019, the year-over-year increases were roughly stable at around $60 million, and then they surged:

With the cannabis sales tax rate of 7.25% (state 6% and mandatory local 1.25%), and $106 million in sales taxes reported, we can figure that $1.46 billion in weed was retailed by regulated retailers in the quarter. For the year 2020, legal weed retail sales will likely exceed $5 billion, and at this rate, exceed $6 billion in 2021. This is starting to add up.

The regulations that followed California Proposition 64, approved by voters in November 2016, legalized the production, distribution, sale, and use of recreational cannabis by adults as of January 2018. The regulations are complex. Three regulatory offices are in charge: The California Bureau of Cannabis Control; the California Department of Food and Agriculture; and the California Department of Public Health. And things are not always clear-cut and have led to legal entanglements, one of which a judge just ruled on: Advertising cannabis products and businesses on highway billboards.

Proposition 64 included a ban on highway billboards that advertise cannabis products and businesses. The California Bureau of Cannabis Control had interpreted the language to mean that there could be no cannabis billboard within 15 miles of the California border, but were OK elsewhere. Soon, cannabis billboards started popping up everywhere, including on along 101 Freeway, near San Louis Obispo, where a construction contractor with two kids that frequently used the freeway decided enough was enough and sued.

On Friday, a San Luis Obispo County Superior Court Judge said in a ruling that the Bureau of Cannabis Control had improperly allowed these cannabis billboards along California highways and that the bureau and its director “exceeded their authority in promulgating the advertisement placement regulation.”

The ruling prohibits billboards along 4,315 miles of interstate highways and along state highways that cross state borders, according to one of the attorneys for the plaintiff, cited by the Los Angeles Times (state law allows cannabis ads on city streets, subject to local ordinances, but not within 1,000 feet of daycare centers, K-12 schools, or playgrounds). The bureau said it was “still reviewing the ruling” and hadn’t decided if would appeal. No one said it would be smooth sailing to bring the huge weed business out of the black market and integrated it into legal commerce. But it seems to have been worth the effort.

* * *