Party’s Over: Bank of America Sees Stagflationary Mess Slamming Markets In Second Half

While today’s jobs report came in a bit on the weak side despite its impressive headline beat of 850K jobs created in June (a majority of which were teachers and bartenders) with wage growth slowing and the unemployment rate rising, we expect the Fed to look at today’s jobs data and try to again kick the can although whether this month or next, the inevitable taper announcement is coming not too long ater, the first rate hike as well. The only question is when.

Meanwhile, until that happens, Bank of America’s CIO Michael Hartnett reminds us that every day for the foreseeable future, as has been the case every day for the past 6 months, central banks bought $10 billion of bonds every day, the US federal government spent $20 billion every day, global stock market cap grew $73 billlion every day, and US bond & stock issuance averaged $20 billion every day.

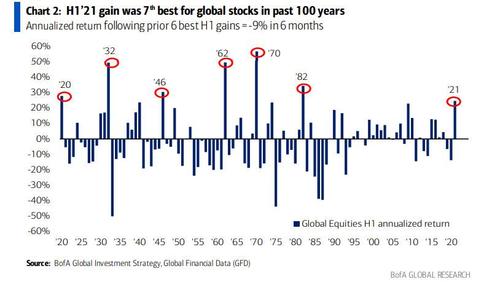

The result: the just completed first half of 2021 was the 7th best for global stocks in the past 100 years…

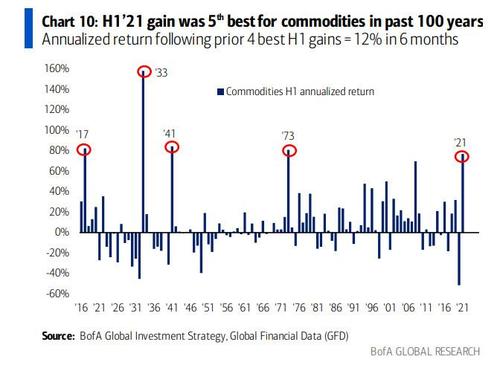

… although as BofA cautions, the annualized return following prior 6 best H1 gains was a 9% drop in the next 6 months. The first half of 2021 was also the 5th best start for commodities in past 100 years…

… and unlike stocks, returns in the subsequent 6 months far more solid, with BofA calculated that annualized return following prior 4 best H1 gains was 12% in 6 months.

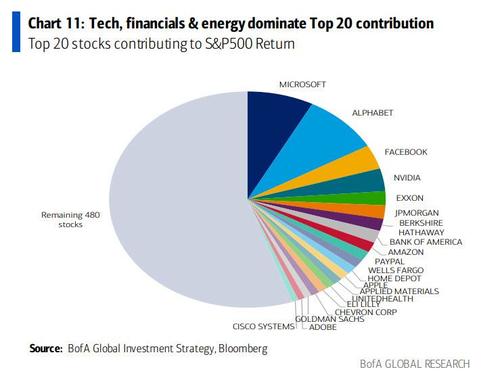

Some more details: 50% of the S&P500’s 15% YTD gain was generated by just 29 stocks (oh which, the top 20 are shown below).

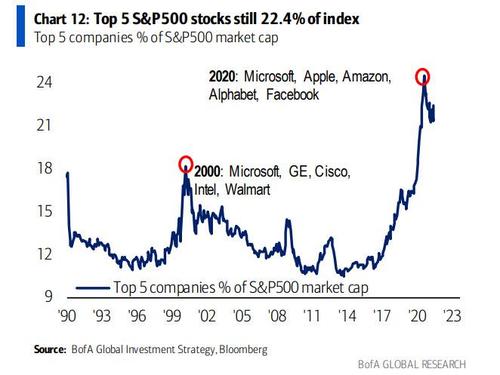

And while Hartnett mocks that everyone’s favorite H2 “contrarian” trade (an oxymoron) is long FAANG – because supposedly the reflation trade is now out of favor – the top 5 S&P500 stocks, the tech gigacap FAAMGs, still account for 22.4% of index (down from 24.5% peak in Aug’20 – Chart 12).

What about the economy: Well, during the past 6 months, global COVID-19 vaccinations surpassed 3 billion…

… which helped US GDP grow at the fastest pace in 70 years, while US CPI surged 8% annualized, the fastest pace since ’82; or as Hartnett correctly predicted about one year ago, "vaccine = boom."

But if H1 was a stellar "boom" quarter for markets and the economy, H2 will be far bumpier: here are the “known unknowns” according to BofA:

- China eases (bullish),

- US payrolls/labor market recovery weak (bullish + no taper + productivity “miracle” + “carry trades” carry-on);

- bubble in stimulus = bubble in asset markets;

- cost-push inflation (higher oil + huge impairment to global supply chains – see US manufacturing goods inventories vs deliveries, chart below) hits profit margins (bearish);

- Biden infrastructure deal collapses (bearish);

- New Fed Chair nominated Oct/Nov (bearish);

- Inflation ends Fed’s “strategic ambiguity” on monetary tightening (bearish);

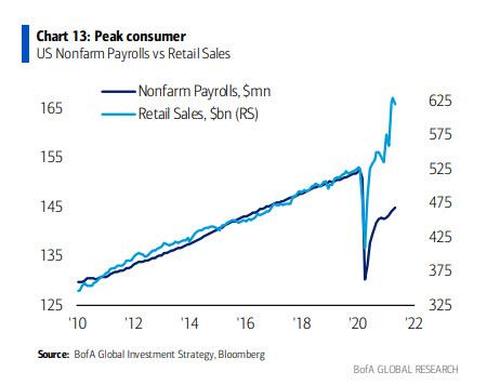

- Peak US consumption as artificial supports end & labor/tax/health uncertainties + demographics keep US savings rate at high (Japanese/European) levels (bearish).

What does Hartnett think happens next? Looking at the second half, the BofA CIO sees:

- inflation to stagflation,

- QE to QT,

- combo of rising Rates, Regulation, Redistribution (3Rs) & peak Positioning, Policy, Profits (3Ps) = low/negative stock/credit H2 returns;

- optimal barbell long inflation & long quality;

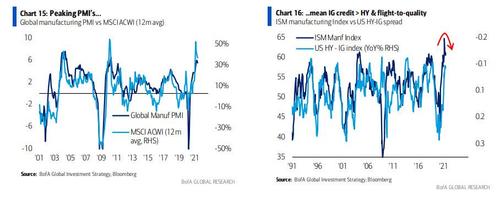

- note June global PMI’s…1st time since Apr’20 more countries posted monthly declines than gains + US ISM prices paid index @ 92.1, highest since Jul’79; peaking PMI’s = IG credit > HY & flight-to-quality

In short, a stagflationary mess is about to unfold.

Tyler Durden

Fri, 07/02/2021 – 13:40