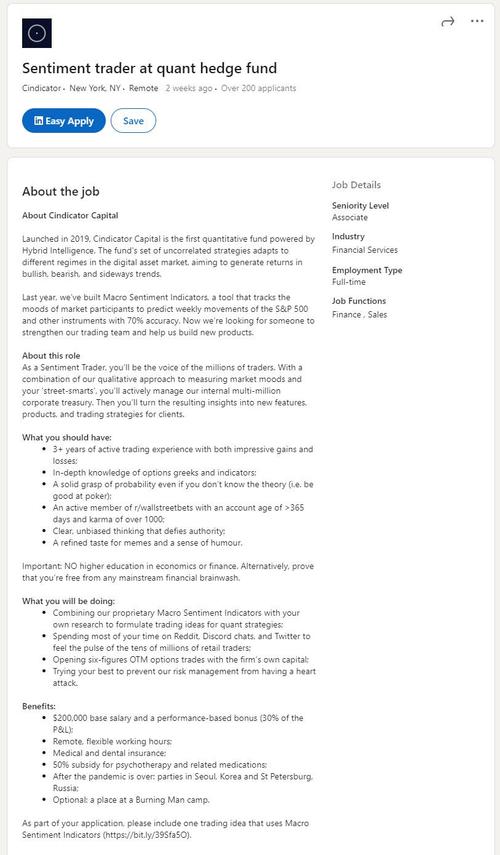

Last week we reported that in the aftermath of the Reddit Rebellion (and short squeeze raids) demonstrating the power the tremendous power of the online stock forum, one recently launched quant fund, Cindicator Capital, was looking to hire “sentiment traders” who had extensive prior experience on Wall Street Bets, i.e., someone with “3+ years of active trading experience with both impressive gains and losses, in-depth knowledge of options greeks and indicators, a solid grasp of probability even if you don’t know the theory (i.e. be good at poker)” and to be “an active member of r/wallstreetbets with an account age of >365 days and karma of over 1000″.

Of these, the last requirement was most important, because what the fund was really hoping to do was hire someone with WSB “street cred” who would submit trade ideas as a “veteran” WSB account, and hope that at least one reco sparks a buying (or selling) frenzy.

Or maybe we are too cynical, and the aptly misnamed Cindicator Capital was indeed just looking for someone who can read WSB “sentiment” (similar to what Citadel does each and every day, a privilege for which it pays Robinhood $350 million per year), to divine which way the market will move. For that particular skill, the fund said it would pay $200,000 plus 30% performance bonus.

Well, if that is the case then we have good news, because we can save Cindicator $200,000 (excluding bonus).

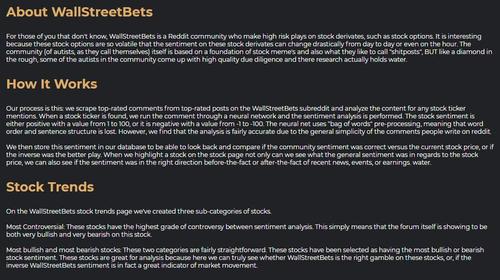

There is now a website – call it a Robintrack for the WallStreetBets crowd – called SwaggyStocks.com which scours through the popular forum and publishes “the top trending stocks mentioned by the popular sub-reddit, WallStreetBets, over the last 24 hours.” Here is a snapshot of “how it works” from the website itself:

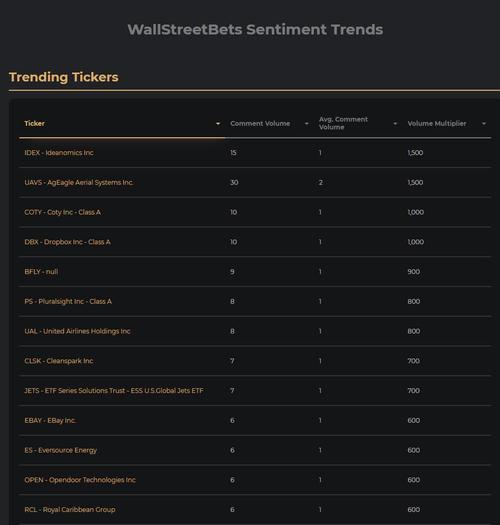

The website provides a broad based look at overall sentiment, broken down either by Trending Tickers…

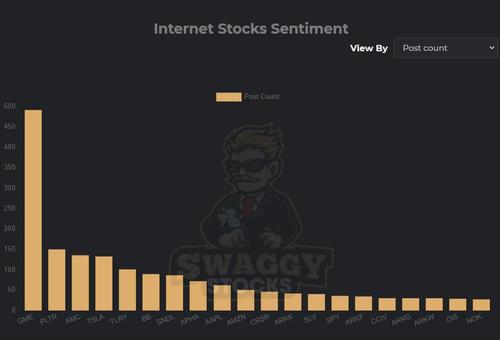

… the quantity and quality (engagement) of discussion posts mentioning various tickers…

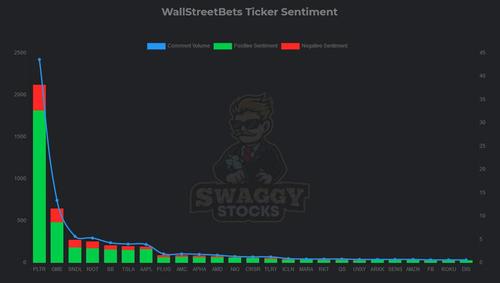

… or by total comment volume, positive and negative sentiment…

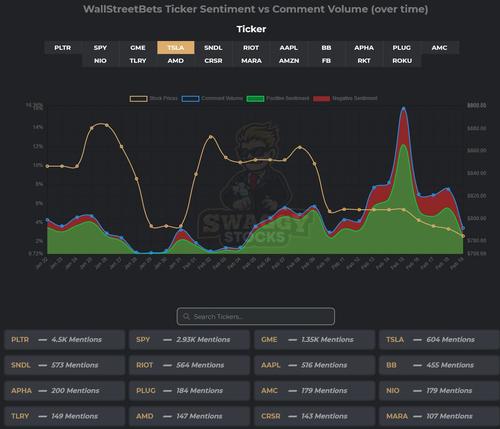

… a cross reference of ticker sentiment vs comment volume…

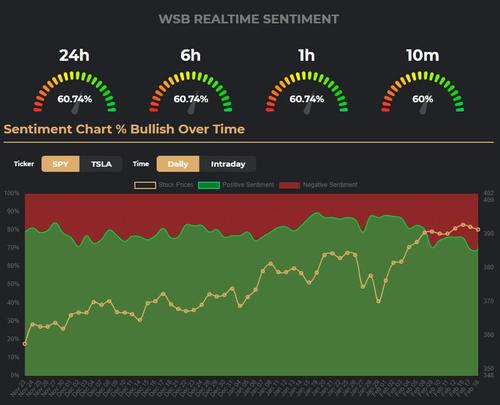

… and, more importantly to traders who care about current data, a page on realtime sentiment and how it changes over time.

The website provides various other useful services including a la carte research reports (which are free, so you get what you pay for) on various tickers…

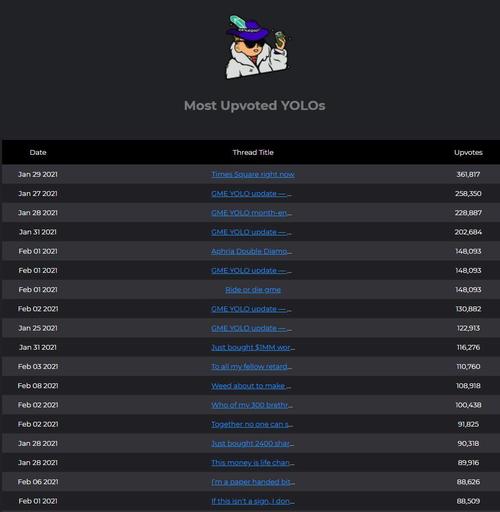

It also tracks the most upvoted “YOLO” posts for those curious which tickers may be getting critical mass…

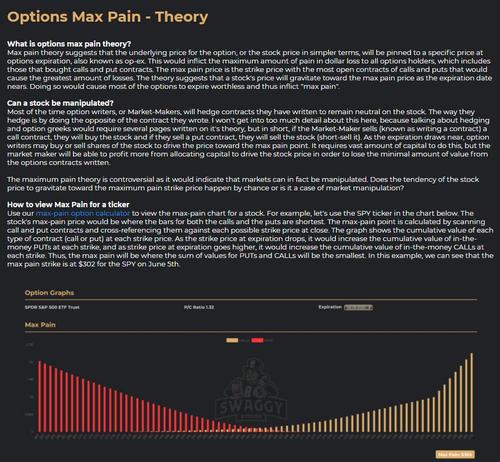

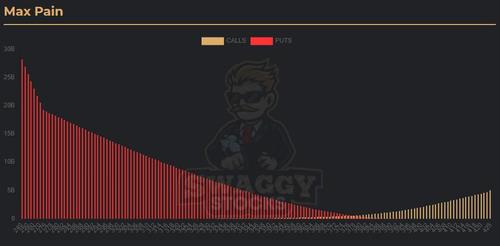

… and therr is also a feature which short squeezers may be especially interested in: an option calculator that looks at where the gamma pin, or “max pain”…

…. can be found…

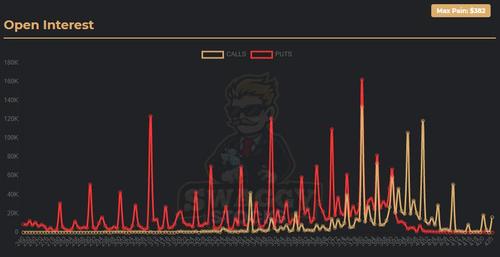

… coupled with open interest data broken down by price level…

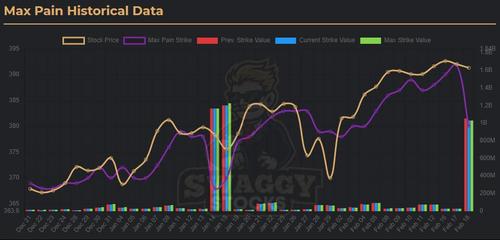

… as well as historical data.

A new experimental feature provides a ‘Buy The Dip’ paper-trading bot which runs backtests of buying into weakness and selling into strength:

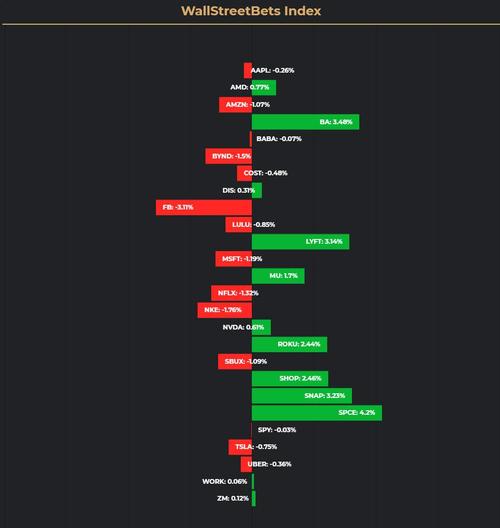

Finally, there is a WallStreetBets index showing performance relative to the most discussed names.

So has Wall Street sellside research finally met its match in the form of a free website which very few know about?

While it remains to be seen how useful this data will be to other traders, both retail and institutional, we will remind readers that at one point in the summer of 2020, RobinTrack – which provided a similar view of activity on the notorious Robinhood brokerage, became one of the most popular websites across trading desks before it suddenly stopped publishing any data in August, after Robinhood (or one of its biggest clients winkwink) decided that the value the site was providing was too much to be handed out for free public consumption. Should SwaggyStocks prove to be just as popular and useful, we expect it will similarly disappear.

Tyler Durden

Sat, 02/20/2021 – 07:14