Selling Prices Soar At Record Pace As US PMIs Hit Six-Year Highs

Tyler Durden

Mon, 11/23/2020 – 09:54

Analysts expected a modest retrenchment in US PMIs this morning, following Europe and UK’s plunge into contraction, especially as we have seen US Macro data consistently surprise to the downside for the last two months. But no! The preliminary November data showed a huge outperformance.

-

Markit US Manufacturing BEAT at 56.7 vs 53.0 exp vs 53.4 prior – 74-Month high

-

Markit US Services BEAT at 57.7 vs 55.0 exp vs 56.9 prior – 68-Month high

And all as US Macro “Real” data keeps surprising to the downside…

Source: Bloomberg

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said:

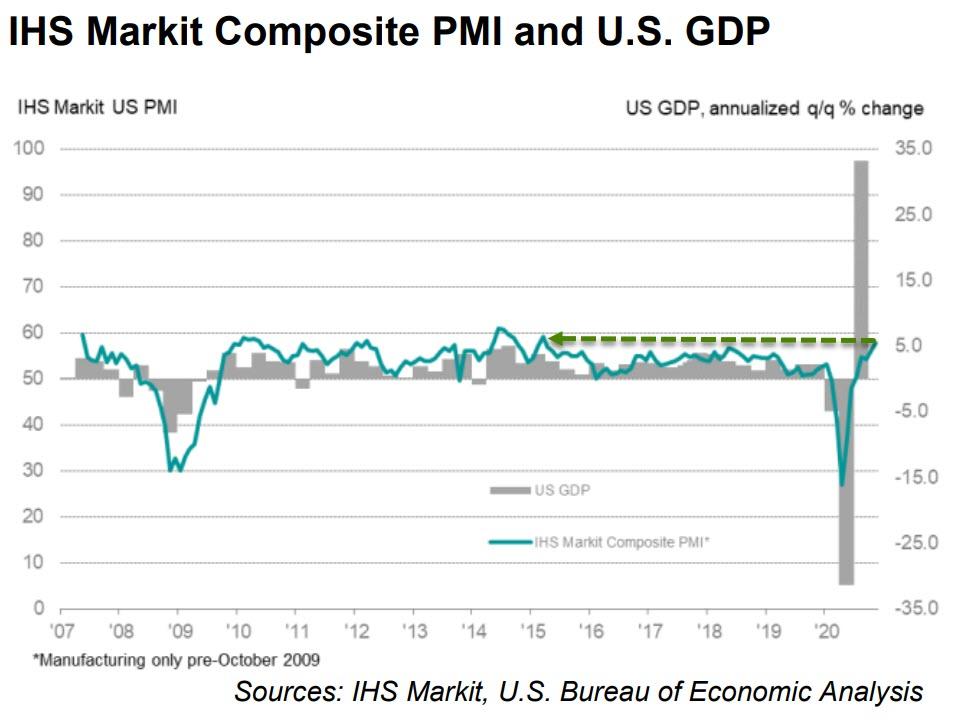

“The November PMI surveys provide the first post-election snapshot of the US economy, and makes for very encouraging reading, though stronger economic growth is quite literally coming at a price.

“First the good news: business activity across both manufacturing and services rose in November at the strongest rate since March 2015. The upturn reflected a further strengthening of demand, which in turn encouraged firms to take on staff at a rate not previously seen since the survey began in 2009.

“However, the surge in demand and hiring has pushed prices and wages higher. Average selling prices for goods and services rose at the fastest rate yet recorded by the survey, with shortages of supplies also more widespread than at any time previously reported.

“Firms are scrambling for inputs and workers to meet the recent growth of demand, and to meet rising future workloads. Expectations about the year ahead have surged to the most optimistic for over six years, reflecting the combination of a post-election lift to confidence and encouraging news that vaccines may allow a return to more normal business conditions in the not too distant future.”

On the inflationary surge, Markit notes that

“Service providers indicated a steep rise in input costs midway through the fourth quarter, with rising supplier prices and wage growth pushing the rate of inflation to the fastest on record.

Firms were able to partially pass on higher costs to clients, however, through a survey-record rise in output charges.”

So dclearly the only reason that suppliers have been able to pass on higher costs is stimulus. So what happens when that stimulus fades (and does not reappear any time soon)?

Finally, a quick glance across the world’s PMIs shows where the ‘problems’ are (or perhaps where the lies and propaganda remain the most impressive)…

Source: Bloomberg

Ignore China. Is the US just lagging the inevitable downturn as state lockdowns spread across the nation?