Submitted by Ronan Manly, BullionStar.com

Less than a week ago in ‘Houston, we have a Problem”: 85% of Silver in London already held by ETFs’, we explained how with the emergence of the #SilverSqueeze, the silver-backed ETFs which claim to hold their silver in London, now account for 85% of all the silver claimed to be stored in the London LBMA vaults (over 28,000 tonnes of the LBMA total of 33,609 tonnes). This, for anyone who can out 2 and 2 together, does not leave very much available silver in London for silver ETFs or for anyone else, especially the largest silver ETF in the market the giant iShares Silver Trust (SLV), which let’s not forget has the infamous JP Morgan as custodian.

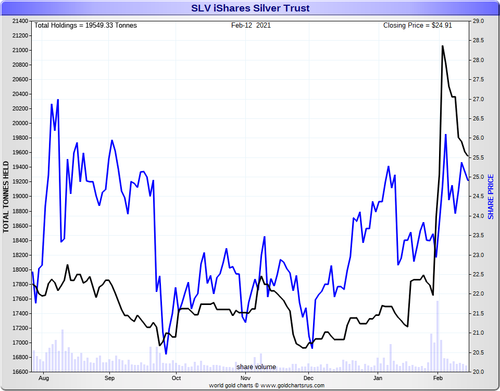

That SLV has seen massive dollar inflows in late January and early February with corresponding jumps in claimed silver holdings is now widely known, but is worth repeating here, for what’s about to come next.

3,416.11 Tonnes of Silver?

The intense market interest in the iShares Silver Trust (SLV) started on 28January when a huge volume of 152 million shares traded on NYSE Arca. Again on Friday 29January, SLV traded a massive volume of 113 million shares. This led to an increase in SLV ‘Shares Outstanding’ on Friday 29 January of 37 million shares, and a same day claim by JP Morgan, the SLV custodian, that it had increased the silver held in the SLV by 37.67 million ozs (1,171 tonnes), all claimed to be sourced in the LBMA vaults in London.

On Monday 01 February, an even larger 280 million SLV shares traded on NYSE, and by end of day SLV shares outstanding jumped by 20 million. On that day SLV claimed to add another 15.376 million ounces of silver (478.25 tonnes) within the LBMA vaults in London, about three-quarters of the value of the new SLV shares created on that day.

On Tuesday 2 February, with SLV trading still elevated on NYSE, the iShares Silver Trust created a massive 61,350,000 new SLV shares, bringing the SLV shares outstanding to 729.1 million. On the same day, JP Morgan and Blackrock claimed to have added a huge 56.783 million ozs of silver (1,766 tonnes) to the SLV (again all in London), an incredible amount by any measure, but still short of reflecting the total of 118.45 million total of new shares that had been created between Friday and Tuesday (which led them to adjust down shares outstanding by 8.6 million on Wednesday 3 February).

Over this time, you can see a nearly one for one relationship between the change in number of SLV shares outstanding and the amount of silver ounces claimed to be added to SLV.

Between Friday 29 January and Wednesday 3 February inclusive, SLV shares outstanding increased by a net 109.85 million. Over the 3-day period from Friday 29 January to Tuesday 2 February, SLV claimed to have added an incredible 109.83 million ozs of silver (3,416.11 tonnes), with holdings of silver bars rising from 567.52 million ozs of silver to 677.35 million ounces (from 17,651.77 tonnes to 21,067.88 tonnes).

According to the SLV daily bar lists, this extra 3,416.11 tonnes of silver added to SLV between 29 January and 2 February was in the form of 113,501 Good Delivery silver bars (the bars weighing approx. 1000 oz each). Again, according to the SLV bar list, these bars were added in five London vaults which SLV uses, namely Brinks vault in Premier Park London (45.5%), Loomis London vault (27.7%), Brinks Unit 7 vault Radius Park London (15.5%), Malca Amit London vault (6.0%) and JP Morgan’s own London vault (a measly 5.3%).

In fact, according to the bar lists, SLV only started tapping into silver in the Brinks Premier park vault on Monday 1 February, and only started tapping to silver held in the Loomis London vault on Tuesday 2 February. Which to some people may look like a case of desperation or maybe even panic.

Unable to Acquire Sufficient Silver

Adding 3,416.11 tonnes of silver to SLV between 29 January and 2 February is not something that JP Morgan can easily claim to do again.

Which is why it’s particularly interesting that on Wednesday 3 February, right after claiming to add 3416 tonnes of silver to SLV by frantically tapping the LBMA vaults in London, the iShares Silver Trust prospectus was changed, and the following wording added:

“The demand for silver may temporarily exceed available supply that is acceptable for delivery to the Trust, which may adversely affect an investment in the Shares.

To the extent that demand for silver exceeds the available supply at that time, Authorized Participants may not be able to readily acquire sufficient amounts of silver necessary for the creation of a Basket.

Baskets may be created only by Authorized Participants, and are only issued in exchange for an amount of silver determined by the Trustee that meets the specifications described below under “Description of the Shares and the Trust Agreement— Deposit of Silver; Issuance of Baskets” on each day that NYSE Arca is open for regular trading. Market speculation in silver could result in increased requests for the issuance of Baskets.

It is possible that Authorized Participants may be unable to acquire sufficient silver that is acceptable for delivery to the Trust for the issuance of new Baskets due to a limited then-available supply coupled with a surge in demand for the Shares.

In such circumstances, the Trust may suspend or restrict the issuance of Baskets. Such occurrence may lead to further volatility in Share price and deviations, which may be significant, in the market price of the Shares relative to the NAV.”

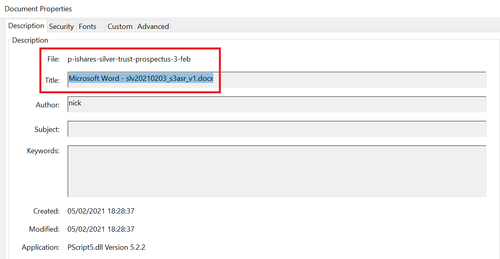

That the prospectus change was first drafted on Wednesday 3 February is clear by looking at prospectus pdf filename which is ‘p-ishares-silver-trust-prospectus-3-feb.pdf’ and the pdf title ‘Microsoft Word – slv20210203_s3asr_v1.docx’, which was authored by someone called ‘nick’. While the draft started in Word, the final version was saved as a pdf on 5 February.

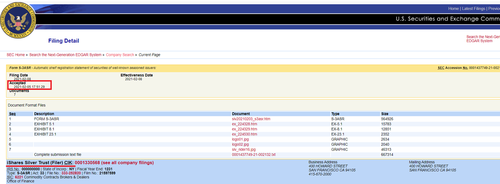

The final pdf date is the same day, 5 February, that the amended prospectus was quietly uploaded to the SEC Edgar website here with an effective date of 8 February. The previous version of the SLV prospectus was from 14 January

Below you can see the changes in the new 8 February version of the SLV prospectus compared to the 14 January version.

BullionStar picked up on the fact that there was a new prospectus with the suspicious 3 February date, and then a twitter user (h/t Roelzns) compared the two prospectus versions to pinpoint the amended text

iShares Silver Trust (SLV) published a new Prospectus dated 08 February 2021. From the link on its website, this is a document saved as “slv20210203_s3asr_v1.docx”, with a date of 03 February, the day after massive 3 day inflows into SLV. Suspicious timing on updated prospectus!

— BullionStar (@BullionStar) February 13, 2021

In addition to the paragraph above about silver demand exceeding available silver supply, the SLV prospectus also added into two further paragraghs under the first, one of which ominously predicting volatile share price movements that could be uncorrelated to the silver price:

“Risks Related to the Shares

A sudden increase in demand for Shares that temporarily exceeds supply may result in price volatility of the Shares.

A significant change in the sentiment of investors towards silver may occur. Investors may purchase Shares to speculate on the price of silver or to hedge existing silver exposure. Speculation on the price of silver may involve long and short exposures. To the extent that the aggregate short exposure exceeds the number of Shares available for purchase, investors with short exposure may have to pay a premium to repurchase Shares for delivery to Share lenders.

In turn, those repurchases may dramatically increase the price of the Shares until additional Shares are issued through the creation process. This could lead to volatile price movements in Shares that are not directly correlated to the price of silver.“

Humorously, the third new paragraph inserted into the SLV prospectus explains that the silver price, which don’t forget is a paper price set by the dominance of bullion bank trading on COMEX and LBMA London, is subject to extreme fluctuations which are unrelated to physical silver demand and supply, but alas there is no mention of the years long silver price manipulations that JP Morgan and other LBMA cronies have been recently prosecuted for:

The trading price of the Shares has recently been, and could potentially continue to be, volatile.

The trading price of the Shares has been highly volatile and could continue to be subject to wide fluctuations in response to various factors. The silver market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to factors such as silver’s uses in jewelry, technology, and industrial applications, or cost and production levels in major silver-producing countries such as China, Mexico, and Peru. In particular, supply chain disruptions resulting from the COVID-19 outbreak and investor speculation have significantly contributed to recent price and volume fluctuations.”

If the short squeeze on GameStop caused fireworks among a few hedge funds on Wall Street, we hate to think what a short squeeze on the global silver supply will look like as hedge funds wake up to the possibility that SLV “cannot acquire sufficient silver acceptable for delivery to the Trust”.

Tyler Durden

Sun, 02/14/2021 – 18:44