Tyler Durden

Thu, 12/17/2020 – 10:10

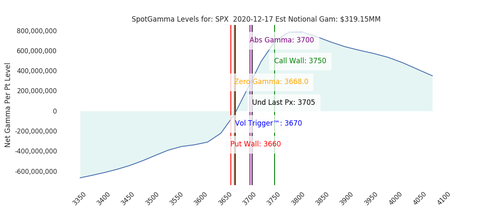

With futures trading just around 3710 following a quiet overnight session, out partners at SpotGamma note that their indicative levels have made some significant moves resulting in the options range shifting north, with 3750 now the Call Wall which provides a higher available target in the SPX. Meanwhile, 3700 remains the largest gamma area on the board, and key support/resistance “pivot” area. Finally our our key risk line (Volatility Trigger) has filled in at 3675. As SpotGamma notes, “we generally consider this type of range shift to be healthy.”

Based on this, Spotgamma writes that the odds of the market staying >3700 into Dec. 18 “seem pretty strong” but they flag two things:

- First, the quad-witching and S&P rebalance tomorrow could cause some uninitiated movement. One potential hiccup: index funds must sell $50BN of S&P to sell in order to buy TSLA.

- Second is the VIX, which still holds 22: this elevated VIX level presents a “clean setup” into 12/18, because with lots of implied vol already priced in, if the VIX breaks lower then “the odds of the SPX trying for 3750 increases.” Of course, should the VIX spike and SPX break below 3675, is where SpotGamma sees market risks increasing substantially.

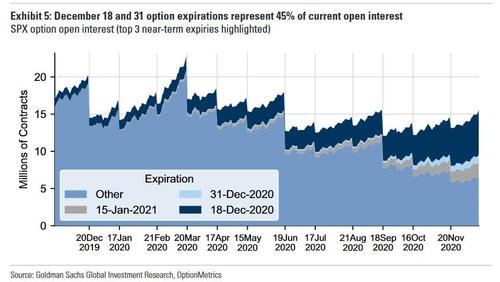

Incidentally, speaking of tomorrow’s quad-witching expiration as well as the upcoming year-end, Dec 31 expiry, these contain 45% of outstanding SPX option open interest, totaling more than $2.5tln of notional. However, since the concentration of strikes is below the current spot level and will thus have limited potential gamma impact, “the expiration of these positions will leave investors with cleaner portfolios to deploy risk into in early 2021”, according to Goldman.

Finally, as is typical, following these expirations SPX option open interest will be near a multi-year low, although Goldman expects open interest to start building up again as we enter 2021.