Stocks Give Thanks For Fed Liquidity As Dollar, Gold, & Bitcoin Dumped

Tyler Durden

Fri, 11/27/2020 – 13:01

Greed, Greed-er, and Greed-est…

This level of extreme greed didn’t end well last time.

Interestingly, as the week progressed, Nasdaq caught up with Small Caps early-week outperformance, stalling the ‘rotation’ trend. The Dow was the week’s laggard but still managed solid gains…

As a reminder, the recent vaccine headlines have put global and european-specific stock markets on track for their best month ever…

Source: Bloomberg

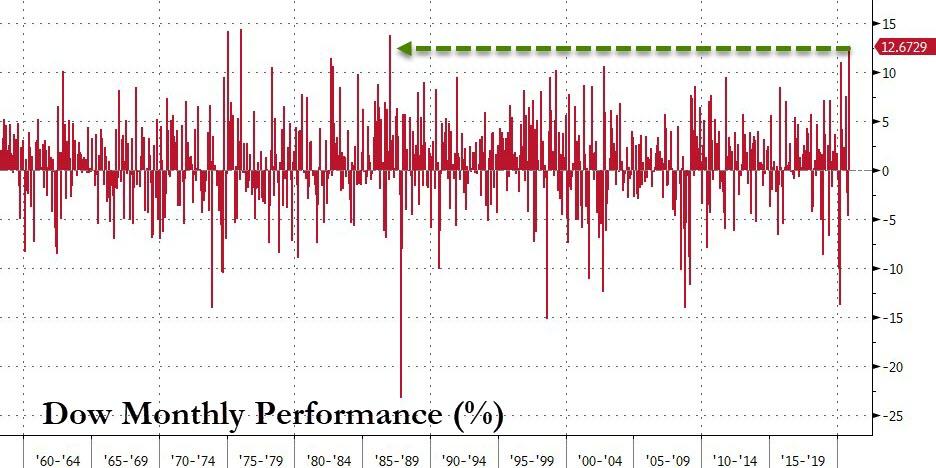

And the major US equity indices on track for their best month since 1987…

Source: Bloomberg

The Dow broke above 30k for the first time ever early in the week but was unable to maintain it…

It’s not the economy; it’s central bank liquidity, stupid!

Source: Bloomberg

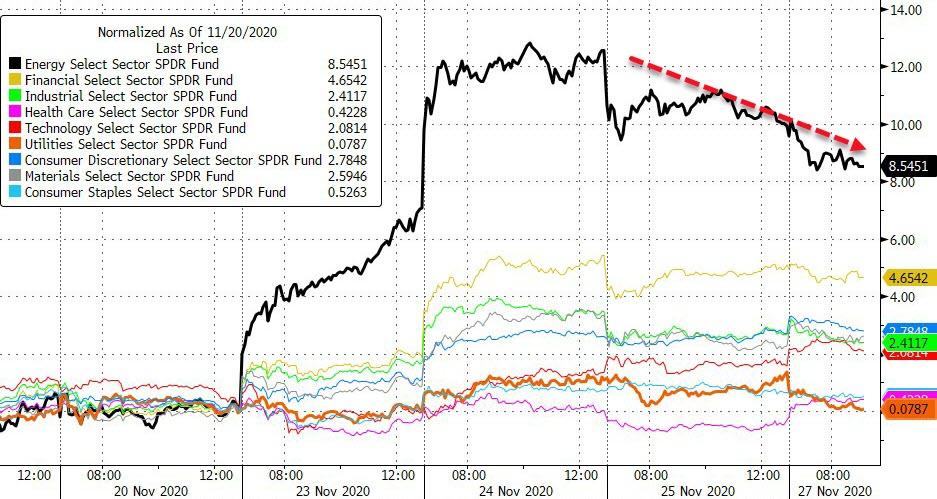

Energy stocks continued their massive surge this week (though faded a little today) as Utes lagged…

Source: Bloomberg

And as we noted earlier, Tesla surpassed Berkshire Hathaway in market cap for the first time ever…

Source: Bloomberg

VIX flash-crashed intraday below 20 – its lowest since February…

As traders dumped puts in favor of calls by the most since 2010…

Source: Bloomberg

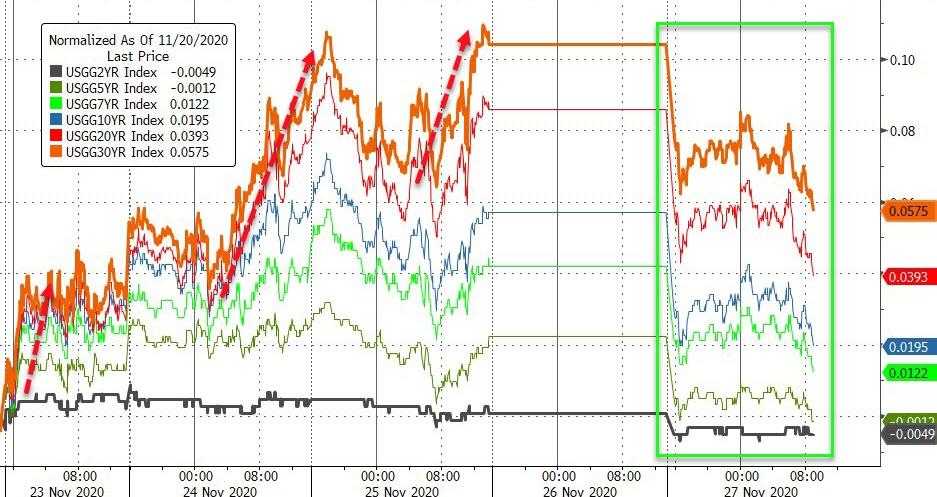

Treasury yields fell today after rising into Thanksgiving. 30Y remains up around 5bps on the week, 2Y unch…

Source: Bloomberg

10Y yields rolled over at pre-election-spike levels (around 90bps) once again, shrugging off any vaccine growth hopes…

Source: Bloomberg

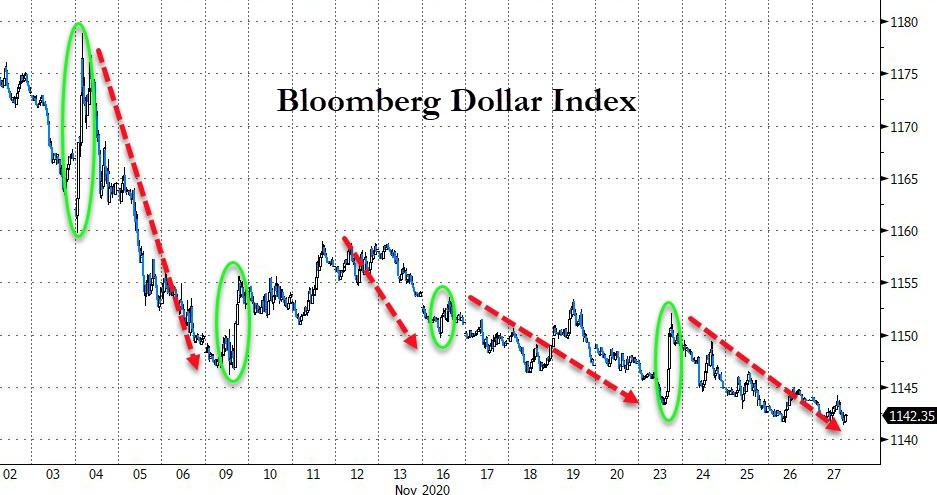

The dollar tumbled for the 3rd week in the last 4, having plunged almost non-stop since the election…

Source: Bloomberg

…closing at its weakest vs its fiat peers since April 2018 (and unchanged since Jan 2015)…

Source: Bloomberg

Cryptos started the week strongly with Bitcoin closing at a record high, but ended weak with ETH flat and BTC -10% (and yes Ripple was up 140% on the week on Tuesday!)…

Source: Bloomberg

Bitcoin fell from $19500 to $16500…

Source: Bloomberg

On the week, copper and crude surged as PMs were purged…

Source: Bloomberg

Gold and Silver were monkeyhammered this morning (coinciding with a forceful flash-crash in VIX)…

Gold is heading for its 3rd straight weekly decline, its 4th straight monthly drop and worst month since Nov 2016, breaking (and closing) below its 200DMA…

Source: Bloomberg

Finally, some historical context from Michael Markowski. Two stock market sentiment anomalies have increased the probability of a correction near term.

The two anomalies are:

-

Thanksgiving Melt Up Anomaly. The average S&P 500 gain for 12 of the past 14 ten-day periods concluding November, was 3.5%. The only two exceptions, 2015 and 2018, were preceded by significant market corrections.

-

Bullish Sentiment Anomaly. Currently, there is a high probability for the S&P 500 to decline by 12.7%. Such would be from its recent 2020 high and would conclude by December 20, 2020. Based on the previous behavior, there is a 66% probability the S&P 500 could continue its decline in 2021.

The Thanksgiving Melt Up Anomaly is now driving the S&P 500 to a higher November all-time high.

The Bullish Sentiment Anomaly is the cause of a violent correction for the S&P 500 to begin in early December 2020.

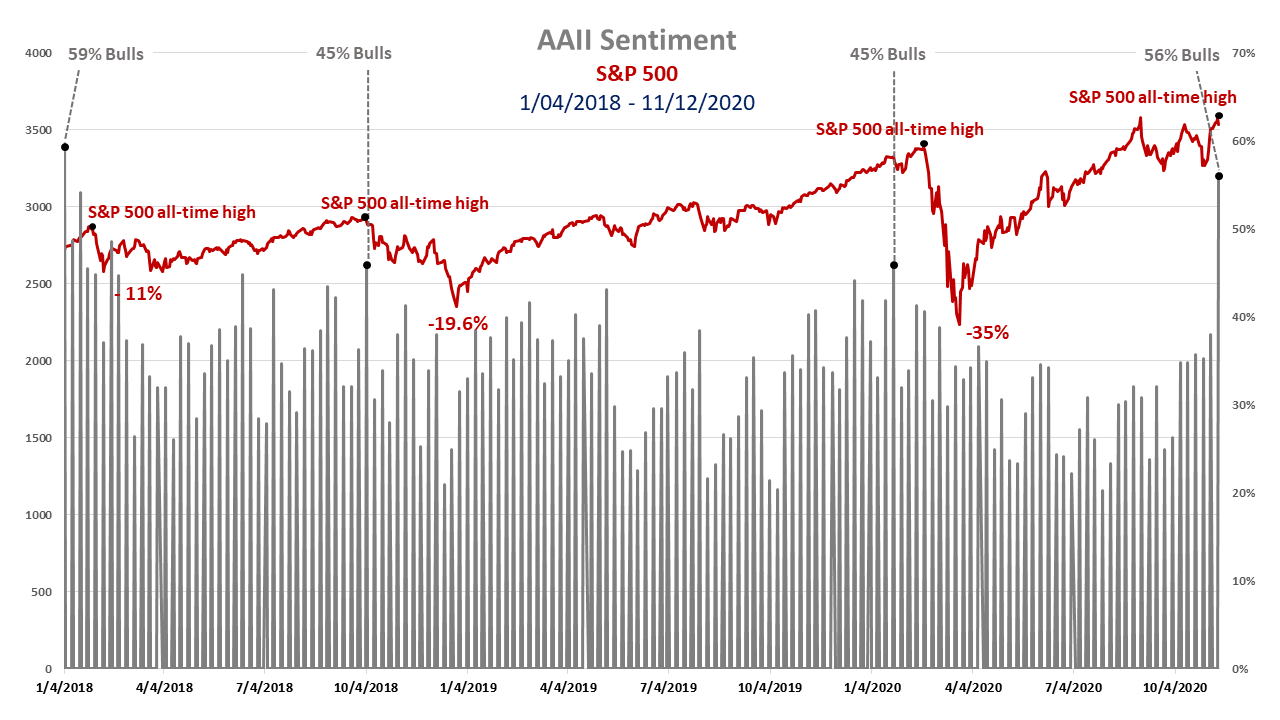

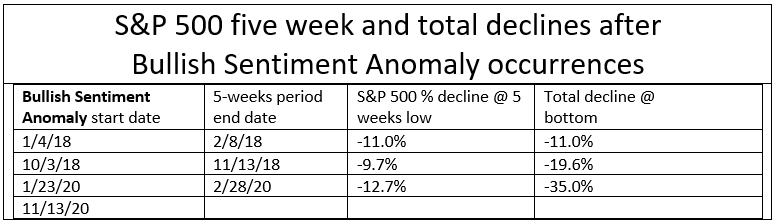

The chart below depicts the four 45% to 59% Bullish sentiment readings which occurred near the all-time highs for the S&P 500. (2018 to November 13, 2020)

Within five weeks of the three prior Bullish Sentiment Anomalies occurring, the S&P 500 declined by a minimum of 9.7%. Two of the three total declines depicted in the table below were more than 100% greater than the five-week drops.

There exists a risk of decline from November 13, 2020, through Christmas Day. Such is likely to occur precisely because no one expects it to.

Trade accordingly.