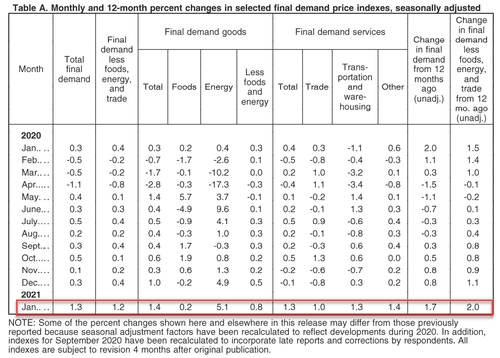

Along with soaring retail sales, US Producer Prices exploded higher in January. Against expectations of a 0.4% MoM rise, headline PPI rose 1.3% MoM. That is the biggest MoM jump in history…

Source: Bloomberg

And for core PPI (up 2.0% YoY vs +1.1% exp), this is by far the biggest beat vs expectations in the history of forecasting PPI…

Source: Bloomberg

Energy costs were the biggest driver on the goods side and Transportation costs soared on the services side.

As one macro guru noted, “PPI numbers are something else… This is consistent with multiple CEOs complaining of accelerating inflation for their inputs.“

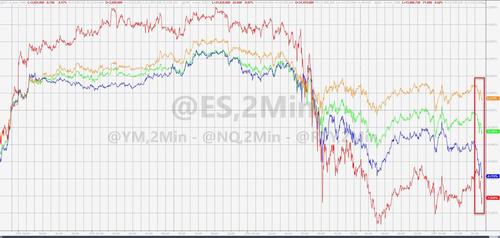

The surge in retail sales and inflation has sparked a “good news is bad news” effect, sending stock prices reeling…

And extending the recent rise in yields…

The question is – what will Jay Powell do?

Tyler Durden

Wed, 02/17/2021 – 08:51