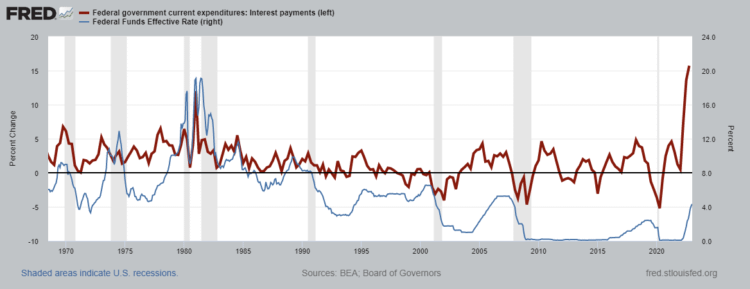

As the Federal Reserve embarks upon the path of raising interest rates, a new challenge will play out for the Federal Government; interest payments. While the Federal Reserve has raised interest rates at one of the fastest paces ever, historically the rate is still low, as interest payments are at screaming highs.

A quarterly percentage change of interest payments is at the highest rate ever, even compared to the 1980’s when the Federal Funds rate was near 20%. As of right now, the Federal Funds Rate is below 5% as the percent of interest payments reach an all time high of 16%.

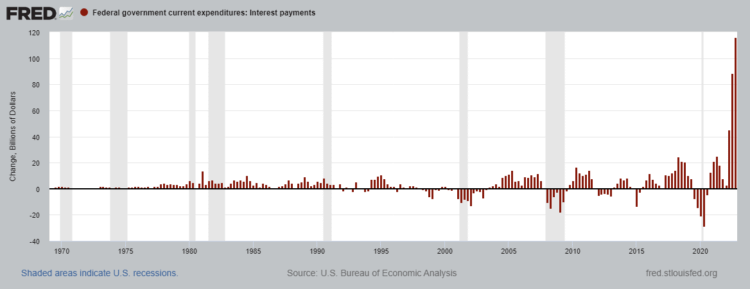

If we look at the difference in terms of billions of dollars the scenario seems much more dire.

Fortunately, the Federal government owes a large portion of these interest payments to domestic lenders or the folks at the Federal Reserve. Unfortunately, if the Federal Reserve continues to increase their demand(they will) foreign buyers will be placed into a very difficult decision of having to either continually realize losses each year, as inflation outpaces the yield of treasuries(real yield), or sell their holdings and possibly face the repercussions of the U.S. and our military; just as other countries trying to abandon the dollar have(tariffs, bombs, the installment of a new leader after we takeover the country, etc.) The benefits of a world reserve currency are almost innumerous as we tax the entire world through inflation and trade them paper for real goods, which a lot of times just ends up invested right back here in the U.S.! Those benefits will run out when foreigners, who suffer from inflation more than Americans, will eventually say, no more!