Blackknightinc released their Mortgage Monitor Report for February 2021 today.

The housing market appears to be stronger than ever. Certain areas of the market are providing returns that rival tech and small-cap stocks. Home price appreciation (HPA) for 2020 was 10.8%, which is just below 04 and 05 record setting years during the housing bubble. While 2020 price appreciation is still below the all-time high during the bubble, Blackknightinc data by zip code shows that the market is hotter than 04 and 05.

Lending standards during the bubble were essentially nonexistent, especially in the last years. At present, the boom is quite the opposite and, in fact, has slightly improved. Problem areas that underpin the growth are the consequences of Covid policies, which the Federal Government continues to push down the road, and are slowly creating cracks in the foundation of this recovery. The question that remains is: will they be effective in transitioning all the problem areas back into the market without damaging the recovery? The Federal Government and members of Congress are experts at doing this. They have successfully continued to expand their power or role over the economy by using this to their advantage as the consequences become less apparent further down the road.

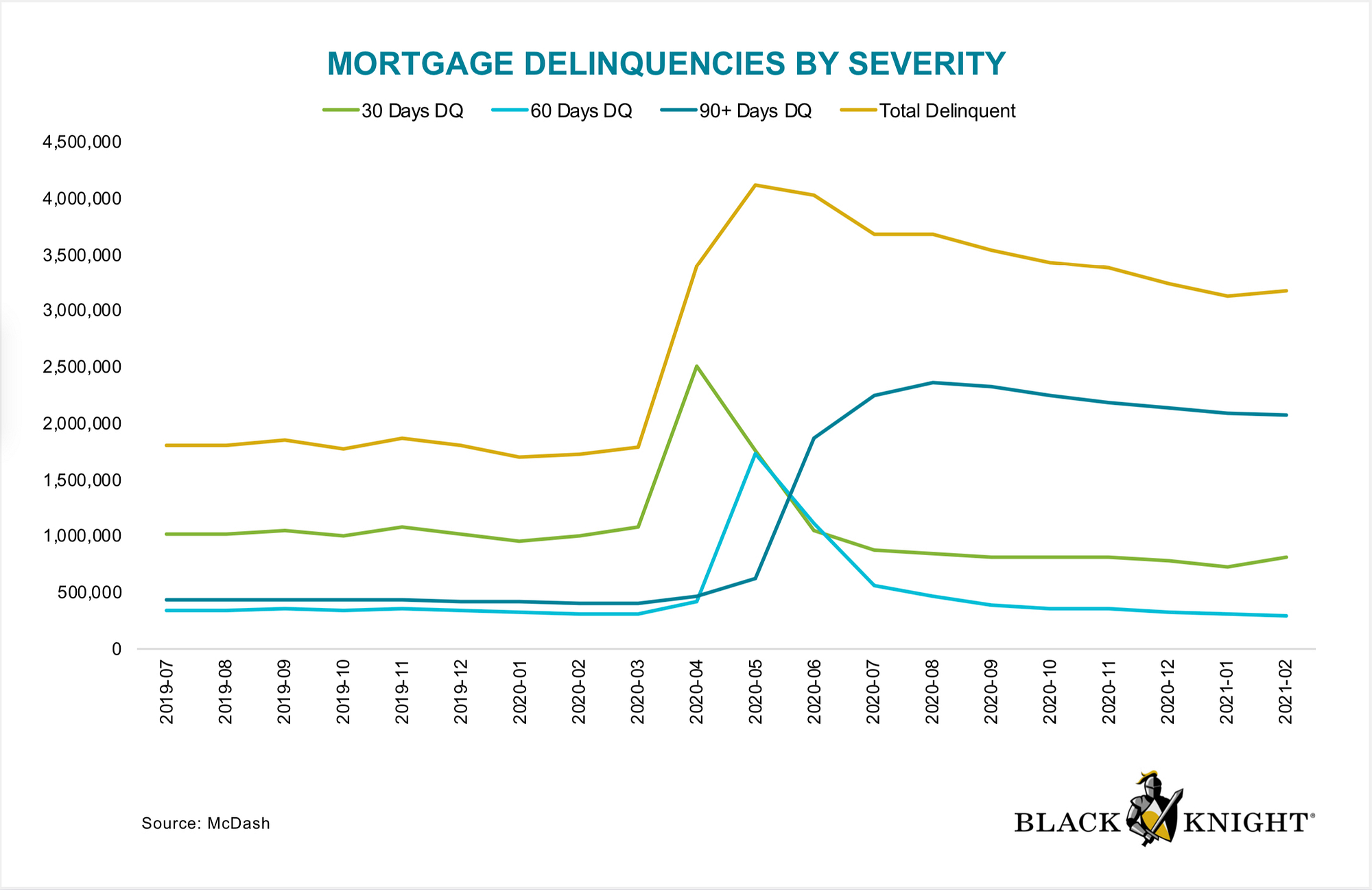

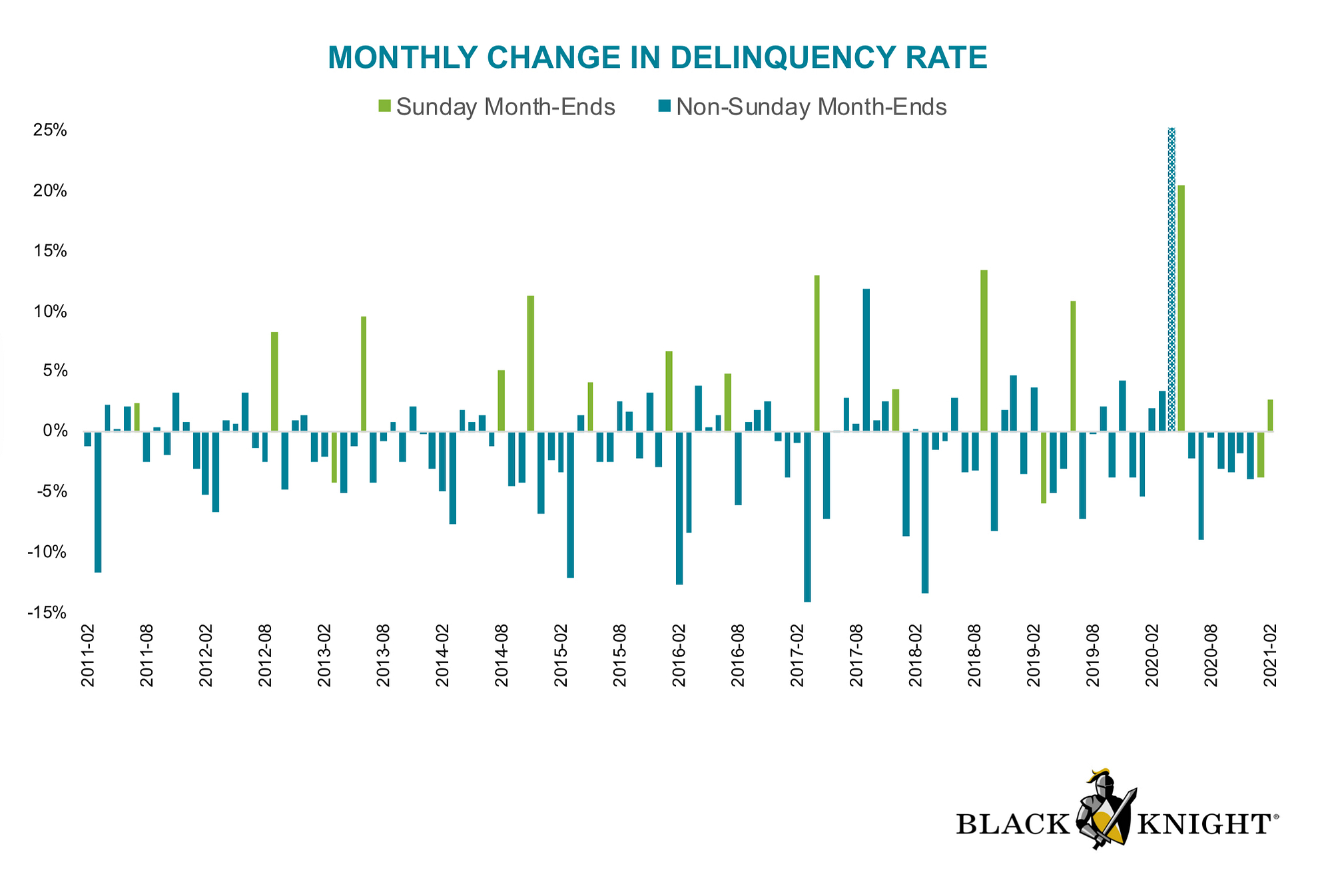

Rent moratorium, mortgage forbearance, stimulus, PPP, federal unemployment benefits, eviction moratorium, and the Federal Reserve’s influence on interest rates have all contributed to building this “strong” housing market. What happens when these stop? If mortgage lenders can renegotiate terms, forbearance periods can exit smoothly, rent back pay can be forgiven or implemented with subsidies (Fed or State–Fed has thrown enough money around that even states with real housewives “budgets” can pay for back rent), and other free money is slowly leaking out like inflating a tire with a small enough hole that it only requires you to stop at the station once every few weeks… If that happens then all of this will be viewed as a success. The 33% of fraudulent paid unemployment benefits will be looked over. The Paycheck Protection Program(still going strong) giving millions to hedge funds, celebrities, and members of Congress will be forgotten, along with the rampant fraud the SBA continues to ignore according to a recent report by the GAO (did you know… PPP was the only lending (grant/free loan) program that did not include a clause prohibiting use by politicians and their family members).

What I’m trying to make my far and few between readers aware of are the up and downside risks to home prices. The housing market as it currently stands is not much of a market at all. This is true for multiple sectors of our economy. Market forecasts for any sector usually requires forecasting government policy and not the market; the housing market has been this fucked up (H**)

Blackknightinc February Chart Gallery of the “strongest most bizarre is it strong?” housing market: