Why is the Fed STILL buying Mortgage-Backed Securities? The pandemic may have brought an end to the longest economic expansion in U.S. history, but it did not depress asset prices for years after as the recessions of 2008/09 or 2001 did, which took over five years before markets(S&P 500)to fully recovered. In 2020, it took less than 5 months before markets were at new all-time highs—again, this is after the longest expansion EVER.

So why is the Fed conducting monetary policy as if the recession is ongoing? The vast amount of financial commentary surrounding the Fed draws their conclusions under the assumption that the Fed is transparent and forthright. This has made an easy mark for Fed critics, believing themselves to be more intelligent as they belittle a collective of the most educated economists. Yet the critics can only see one step ahead and fail to examine the CB’s actions further beyond or grasp the fact that the Fed is playing you.

Ridiculous?

In some regards it is their job to lie to the public if it’s necessary to protect financial markets, a fact Ben Bernanke and Alan Greenspan made abundantly clear. Since 2008, expanding forward guidance is an important part of policy and to guide markets. Is it not plausible the Fed would consider massaging the truth? When Powell announced the emergency facilities in March of 2020, do you believe they intended on buying a trillion dollars of corporate bonds and ETF’s? No. It was important markets believed it so investors regained confidence and did their work for them(it’s actually not their work at all but apparently I’m a FED/MP extremist er something). If you believe the Fed to be the manipulative, deceitful, and corrupted institution history has proven it to be(a fact your economics department will not discuss because the Fed has worked for decades to ensure they’re seen as close to omniscient as possible)then their actions begin to make sense. .

U.S. Home Prices

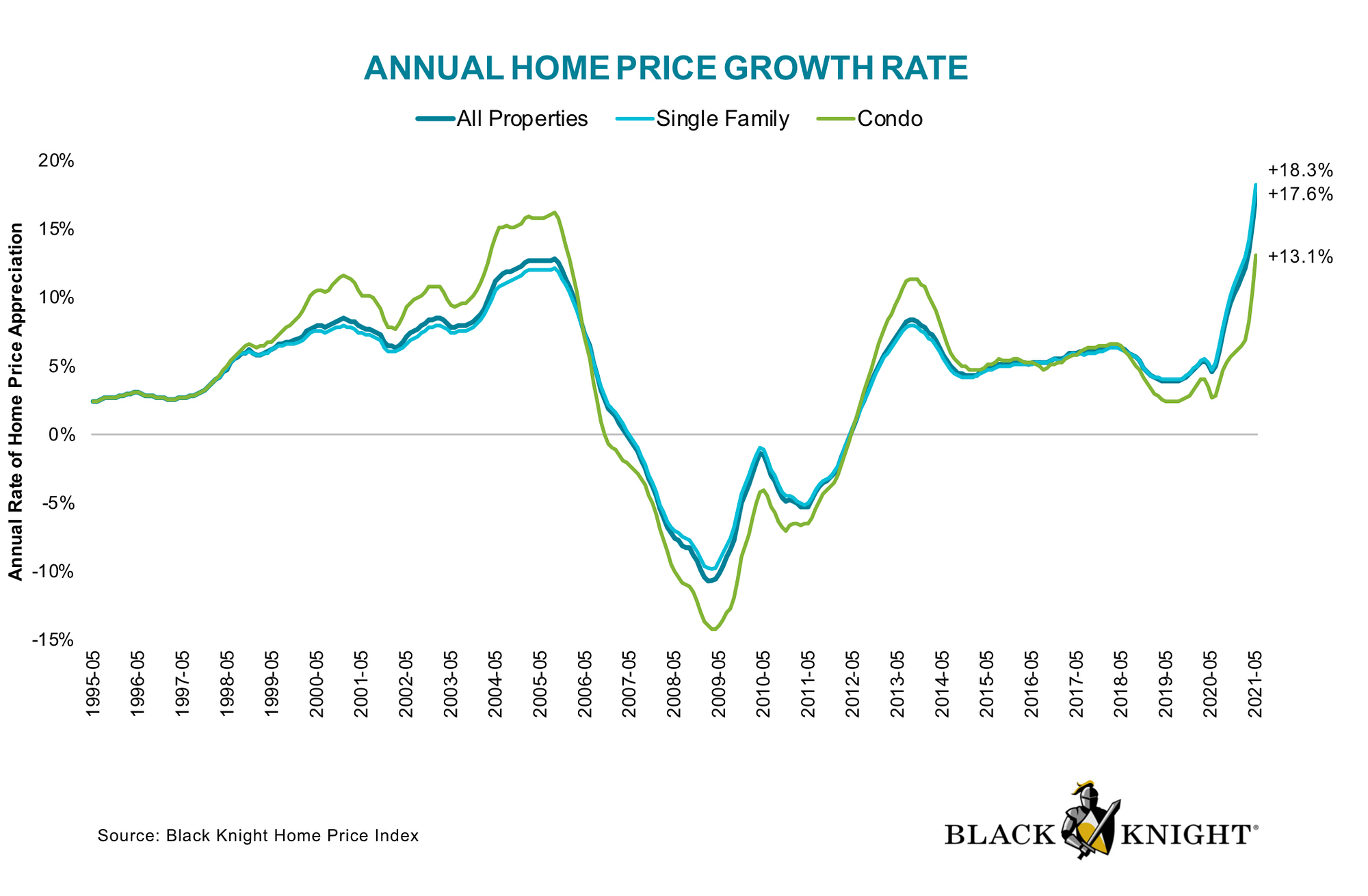

May 2021-Annual Home Price Growth Rate

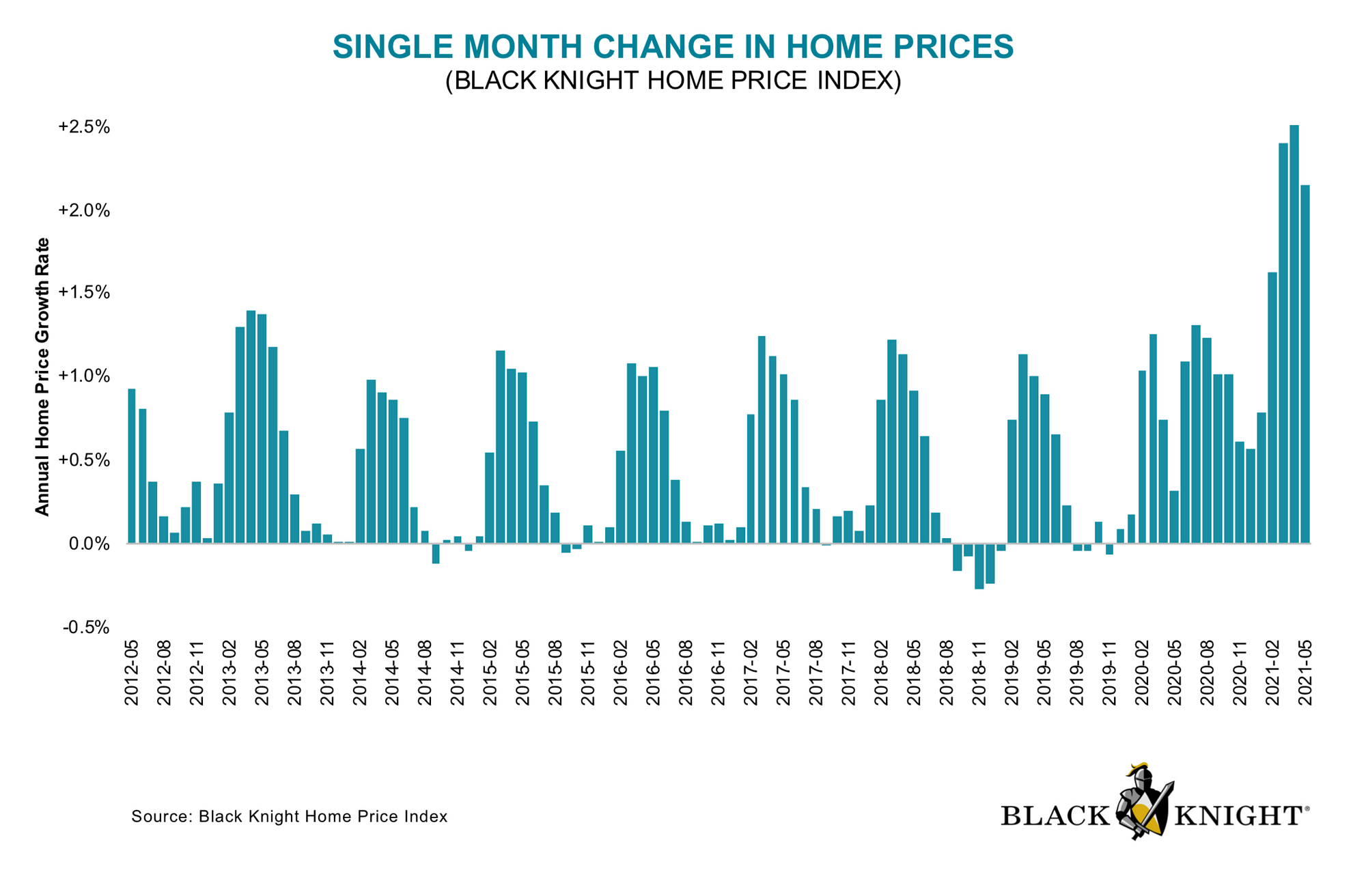

May 2021-Single Month Change Home Prices

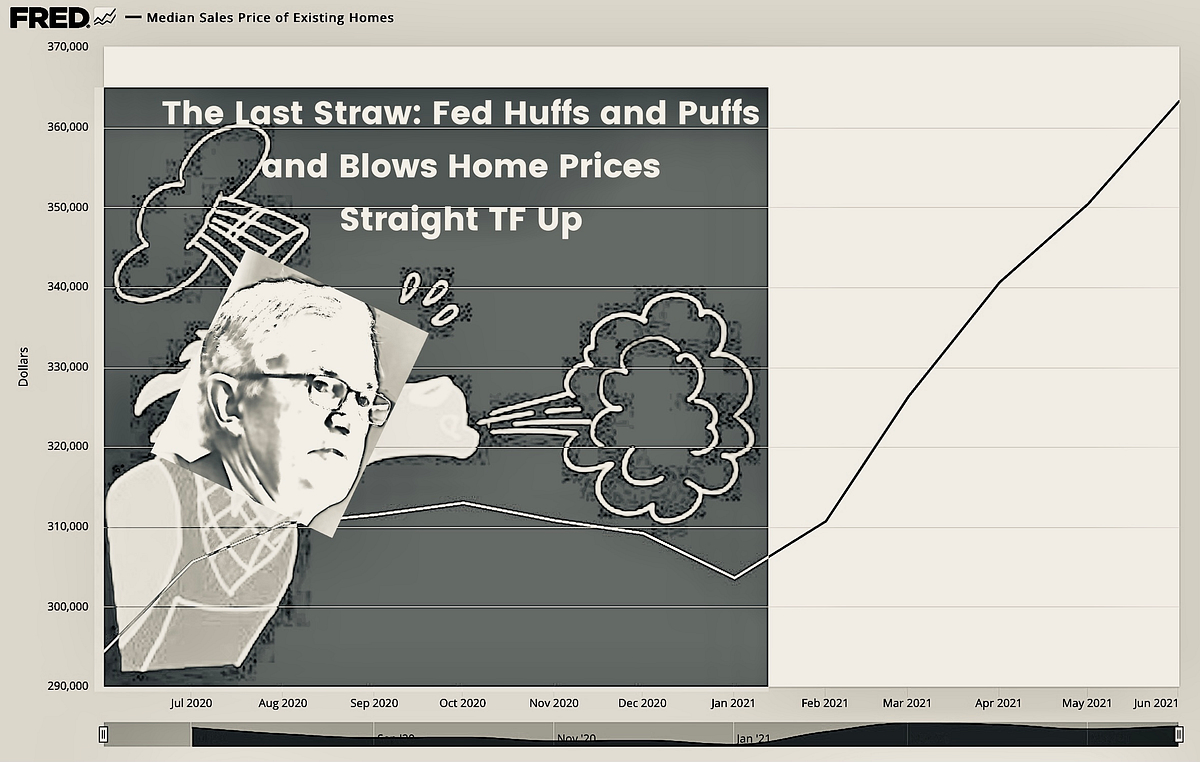

FRED: Median Sales Price – June $363,000

In the last three months, “annual home price growth rate ” set astonishing records and in the latest month(May) another all-time high at 17.4%.

Housing prices slowly rebounded in the decade following the Global Financial Crisis. The Federal Reserve’s policies recapitalized the financial sector and lifted the stock market creating an uneven recovery. How can the Central Bank ensure economic growth when financial markets are already at nosebleed levels?

The Federal Reserve’s purchases may be infinite and indefinite but the types of assets are limited: treasuries and agency securities(securities backed by the U.S. government) Only during periods of “unusual and exigent circumstances” can asset purchases extend beyond these guidelines. Thankfully, a majority of mortgages are backed by the government. So why not create another housing bubble to top off the greatest bubble of all-time? It is the most effective method of increasing “wealth” for all Americans. At least, it is until it isn’t.

In this clip, Peter Schiff argues with Art Laffer over the state of the U.S. economy just before the 2008 housing crisis. A collapse in home prices was unthinkable as it had never occurred to the degree seen in 08. Peter details how the wealth of Americans isn’t real because it’s dependent on a housing market that was similar to a ponzi scheme.

Today’s housing market is entirely different. Housing prices are appreciating at an unsustainable pace but it’s not due to deteriorating lending standards. Yet there’s still a clusterfuck of data and/or variables that can negatively impact the housing market. For example, consider foreclosures…

The Federal government’s mortgage forbearance led to a steep decline in foreclosure activity. The amount of borrowers 90+ days past due and not in foreclosure increased +1000%. It is still unclear how many of the borrowers under forbearance will be unable to modify or restructure their mortgage. Due to the flexibility of forbearance plans—the ability of borrowers to temporarily stop and restart—exits will slowly occur into the end of 2022, allowing a slow and steady departure to prevent a major wave of foreclosures or other issues that could potentially impact the market.

The amount of forbearance plans fell below 2 million for the first time since April 2020. By the end of the year, at least 50% of plans will expire, and a majority will occur in September(+400,000) and October(+225,000). Unlike previous periods, none of the plans can be extended. In October of 2020, +700k borrowers exited forbearance and delinquency rates declined from the previous quarter. It’s reasonable to conclude that financially distressed borrowers will utilize their full forbearance period, while those able to continue making their mortgage payment will not. Therefore, delinquency rates will likely be much higher starting in September.

A report by the Government Accountability Office(GAO), “COVID-19 Housing Protections”, details the status of borrowers upon exiting forbearance plans:

The data from June 2020 to February 2021 indicates 14% of exits are delinquent and with no loss mitigation plan. Again, this is well before a borrower could reach the expiration of their plan, making it the best case scenario for future exits. Although, there’s yet another factor to consider because of the rise in home prices: Home Equity.

This image captures a major difference in today’s housing market relative to 2008. Almost 50% of borrowers had no home equity as the housing bubble burst. This is another reason that may explain why the Fed is still furiously purchasing Mortgage-Backed Securities. In the first quarter of 2021, home equity increased 800 Billion dollars(23%YoY) from 7.3T to 8.1T. Consider the potential “growth” if homeowners utilize just 1/4 of their equity; at an annualized rate the 1Q increase is equivalent to 15% of U.S. GDP; this quarter alone is greater than the increase of annual GDP in 2010-2017!

Mortgage rates determine the state of the housing market. Rates remained around record lows over the past decade causing some investors to believe the Fed lacked ammunition for the next recession—they were wrong. The average 30yr mortgage rate peaked just below 5% at the end of 2018 and hit a record low in the first week of 2021 at 2.65%; the 2.3% drop is the fastest decline(CAGR) since the 80’s.

Conclusion:

Wave Goodbye to Wave

of Foreclosures and

Say Hi to Days of

Fed Overexposure

There is a lot of discussion about the coming side effects from mortgage forbearance and rent moratoriums. These policies led to foreclosure activity declining 95% YoY nationwide—that’s from an amount not seen since the early 2000’s—and some expect a “wave of foreclosures” as plans end later this year. I was one of these “some”, predicting massive instabilty in the housing market towards year end because of mortgage relief, volatility in prices and inventory. It appears the wave will be a ripple if it occurs at all.

The Fed and Federal Government deserve a modicum of praise for their near perfect handling of the housing market. Unless you consider the long term consequences of their actions, which doesn’t exist in politics nor monetary policy, the pandemic giving lemons were turned into lemonade. I expected a disruption at a time before the Federal Government made a few alterations to their policies—yet again I’ve failed to learn that politicians and the Fed are experts at selling solutions that “fix” the short term but destroy the market in the long term. Now I’m certain that there will be no disruption from mortgage forbearance plans ending. Here’s why:

- Home Equity – only a few percent of homeowners do not have home equity. From 1/1/20 – 4/1/21, mortgage holders have seen their equity increase roughly 30%(2 TRILLION DOLLARS). Foreclosure is the worst option for owners with equity but lenders are more likely to find a solution.

- Mortgage Relief Then More Relief – Borrowers +90 days delinquent will likely qualify for a modification that reduces their monthly payment at least 25%. Even if the homeowners income declines there is a solution—i.e. there are just a few circumstances that lead to F/C; borrowers with no equity or little equity and/or drastic reduction of income.

- Inventory – record low inventory will allow for an easy sale and is another incentive to avoid F/C.

- Free Money – with half of all forbearance plans ending after October, there’s a good chance borrowers improved their financial situation due to the broad assistance from the Federal government; child tax credit, mortgage forbearance, student loan deferral, stimulus, etc.

The Fed is buying MBS at a similar pace during the worst of the GFC. Day after day I see another article or discussion where people seem dumbfounded over this extreme policy measure. Our Central Bank is about to set another record surpassing 2014’s 30.7% ownership of agency MBS outstanding. The Fed cannot allow another sharp decline in home values because they’d begun to suffer huge losses. They and you needn’t worry for their plan is to prevent asset values from declining in perpetuity. Inflation may be on a stampede but its Federal relief legs will be cut off, perhaps just badly bruised, from underneath it. Housing is the Fed’s last Hoorah of its unconventional made conventional monetary policy. Finally, a policy that mildly helps other people besides the rich(eventually it helps only the rich).

Extra thoughts

A 2 percent rate reduction combined with covid policies created the largest annual increase in housing prices ever. Which is more important for the continuation of a robust housing market? Due to the consensus often deciding inventory, there’s a unique difference to consider in the effect rates are having during this period, for the most part, it has never occured. Demand from Institutional and private investors increased notably over the past year because the borrowing rate is less or close to the rate of inflation and some expect long term inflation to remain elevated or worse—i.e. the affordability influenced by rates is not the primary concern for investors. So a 50-100 basis points increase in rates may affect demand more than any time before; institutional demand increases exponentially as rates near the average rate of inflation over the past few decades. The Fed is committed to inflation running above their target because they’ve been unable to reach 2% in recent years but the risks are likely too great for most institutions considering this investment strategy. It’s not clear how much demand is and will be the result from those hedging inflation via mortgage debt but the strategy is increasingly mentioned in financial commentary.