Treasury Injects A Record $271 BIllion In Cash In One Day, Sending ST Rates Negative

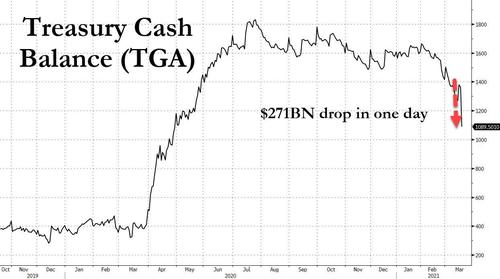

A little over a month ago we explained that in line with the Treasury’s forecast for huge net debt drawdown in the current quarter, a record $1.1 trillion in cash and reserves was about to hit the market. Fast forward to today when catalyzed by the latest Biden stimulus bill, this flood has officially begun, and as the latest Daily Treasury Statement showed, on March 17, the Treasury cash held at the Fed in the Treasury General Account dropped by from $1.361 trillion to $1.090 trillion, the lowest since April 2020…

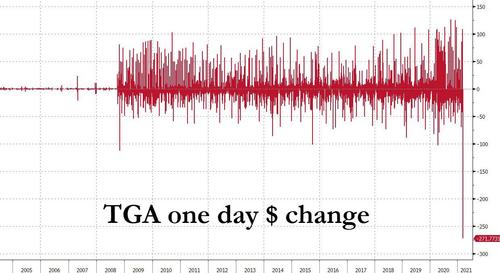

… and a massive $271 billion injection of cash in one day!

The offset to the drain in the TGA was a surge in bank depository cash, which soared to a record $3.873 trillion, a $220BN increase in one week.

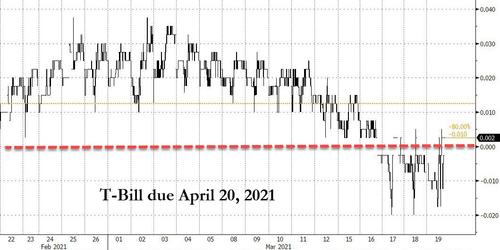

As a reminder, we said that once this avalanche of liquidity in the form of cash and reserves hits the system and once deposits soared, it "would trigger a multi-faceted domino effect across assets, potentially pushing funding rates (FRA-OIS, repo, etc) negative", and sure enough that’s precisely what happened today, with the rate on overnight general collateral repurchase agreements sliding below zero amid the monthly influx of cash from both the Treasury and GSEs:

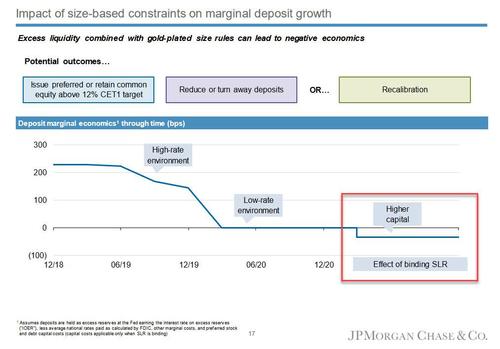

None other than JPMorgan warned in its Q4 earnings presentation that a flood of new deposit activity could push rates even more negative.

Meanwhile, Treasury bills maturing through mid-May are yielding between -0.015% and 0%.

The scramble for collateral is so aggressive that direct bidders in Thursday’s 4-Week Bill were awarded the largest share of the takedown in seven years despite the near-zero stopout yield, an indication that investors expect it may become more difficult to find positive-yielding short-term assets. For those who missed it, the Treasury sold $40BN four-week bills at 0.05%, the lowest stopout yield since March 26, 2020, and as Jefferies economist Thomas Simons wrote, the direct bidder award of 21% – largest since February 2014 – is an “extraordinarily large takedown that essentially defies explanation.”

“It is not clear why a bidder who participates in auctions so regularly as to justify bidding directly would want 4-week bills at half a basis point, but it seems like positive-yielding assets in this area of the curve are about to become harder and harder to find,” Simons said.

Which means to expect even lower negative rates: as Bloomberg’s Alexandra Harris notes, even when GSE cash exits, funding rates may remain pinned near zero as banks’ reserve balances at the Fed swell due to ongoing asset purchases and a faster deceleration in the Treasury General Account. It’s also what Zoltan Pozsar predicted, especially now that we know that the SLR won’t be extended, potentially forcing banks to shrink their balance sheets.

One more point: keep an eye on the Fed’s RRP facility as the combination of an “ever- expanding Fed portfolio” and a declining TGA releases more cash into the system, “some of that is likely to end up in the RRP facility rather than in bank reserve balances,” Wrightson ICAP economist Lou Crandall says in note.

Finally, as a reminder, earlier today the Fed announced that it will let exemptions to the supplementary leverage ratio expire at the end of the month; as a result, Treasury yields rose and long-end swap spreads widened.

And, as Zoltan also warned, it now appears that year-end turn funding stress indicators are starting to emerge in the front-end rates market according to Bloomberg’s Edward Bolingbroke, who notes that the December 2021 eurodollar futures contract is underperforming vs its peers on the curve as the December/year-end FRA/OIS widened out through 18bps since the Fed confirmed SLR relief will expire March 31. The spread has widened close to 2bp since the announcement while Dec21 eurodollar futures contract dropped as much as 2bp to 99.73 session lows.

In other words, for now the SLR announcement has not lead to any adverse plumbing shocks, but keep an eye on on negative rates, which may continue to drift ever lower as the Treasury continues to pump hundreds of billions of liquidity into the system for the coming weeks.

Tyler Durden

Fri, 03/19/2021 – 12:00