U.S. NATIONALIZATION: The Fuel, The PandEmic, & A PanDErer

On January 21st, the first case of coronavirus was confirmed in the United States; two months later the number of cases would pass 100,000 leading to the declaration of a national emergency; four months later the US President, and the ever so ominous “they”, recommended a nationwide lockdown whereas all non-essential businesses closed operations, travel restrictions were instituted, and in some area’s a curfew was in effect. In response to the economic downturn Donald Trump, Congress, and the Federal Reserve used unprecedented measures to prevent the economic system from collapsing and seemingly will continue to do so into the foreseeable future; the reach and depth of these actions are on an entirely different scale relative to our countries past. The economic calamity that the entire world will endure – some suffering far worse depending on a variety of mitigating circumstances – will not be as bad as the Global Financial Crisis in 2008; it will not be as bad as the renowned Great Depression; it will be far worse than any US economic decline; it will be far wider, longer, and come at a variety of speeds deteriorating our economic output and standard of living.

The Economy is currently in the midst of being NATIONALIZED.

This isn’t hyperbole; this isn’t a stretch; it’s not fabrication to stir up attention and make a dollar from selling fear – they’re the only reasonable views to hold.

The reason this depression does not seem as drastic as the Great Depression, or even the Global Financial Crisis, is because the Federal Reserve and Congress acted quickly and with huge amounts of stimulus and intervention – this has temporarily patched the economy but cannot and will not last long. Also, the economic advancements, technology, etc., have provided the data and tools for the government and banking system to slow such rapid declines – unfortunately this has led to politicians and the Federal Reserve delaying the consequences for decades. And this is why we have an economy that only stays afloat through rapid stock market appreciation, wealth inequality, and government handouts – these all have to increase at a faster rate to provide the same economic growth.

So, my gentle few and far between readers, please allow me to provide a summary of the state of the U.S. economy. After depicting the record negative U.S. data, I will delve into the actions of the Federal Reserve – which is the main purpose of this website. In the coming weeks to months I plan on revealing the intricacies and dangers(corruption) of the Fed’s new facilities; I will review similar facilities used in the last crisis and start connecting the dots for how the banking sector/Wall street has been and will continue to be the most dangerous institution to America; that the entire U.S. economy will undoubtedly be nationalized; and from there the dominoes fall one by one until we all work for the state for “the greater good.”

The U.S. Economy and Spending

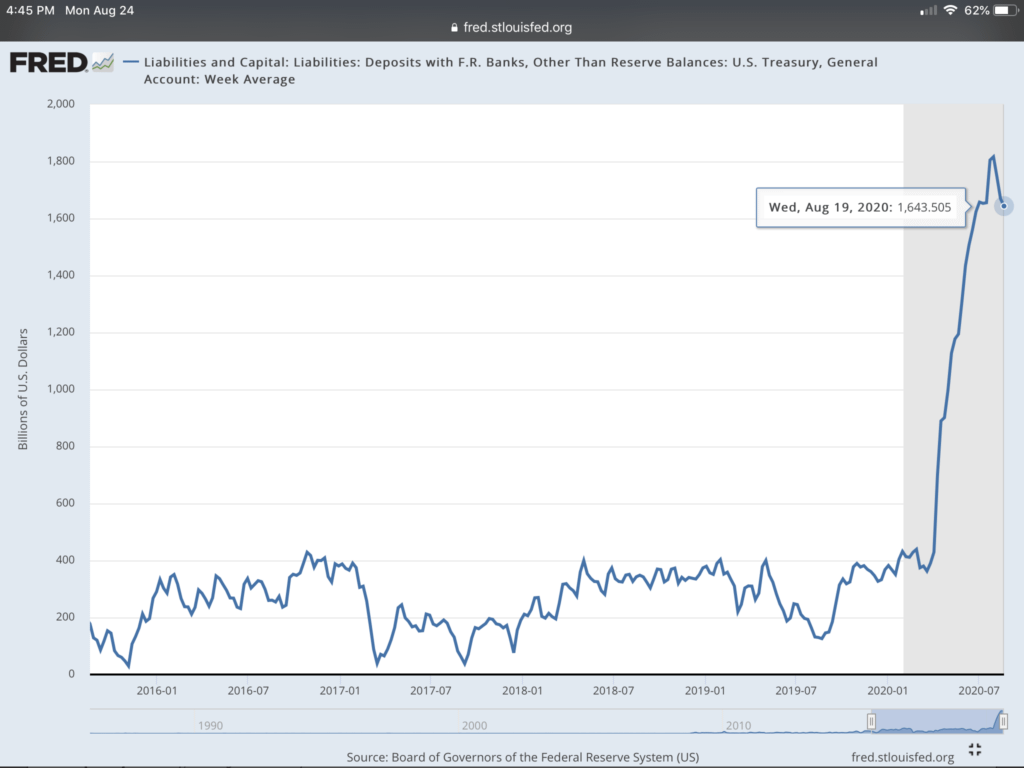

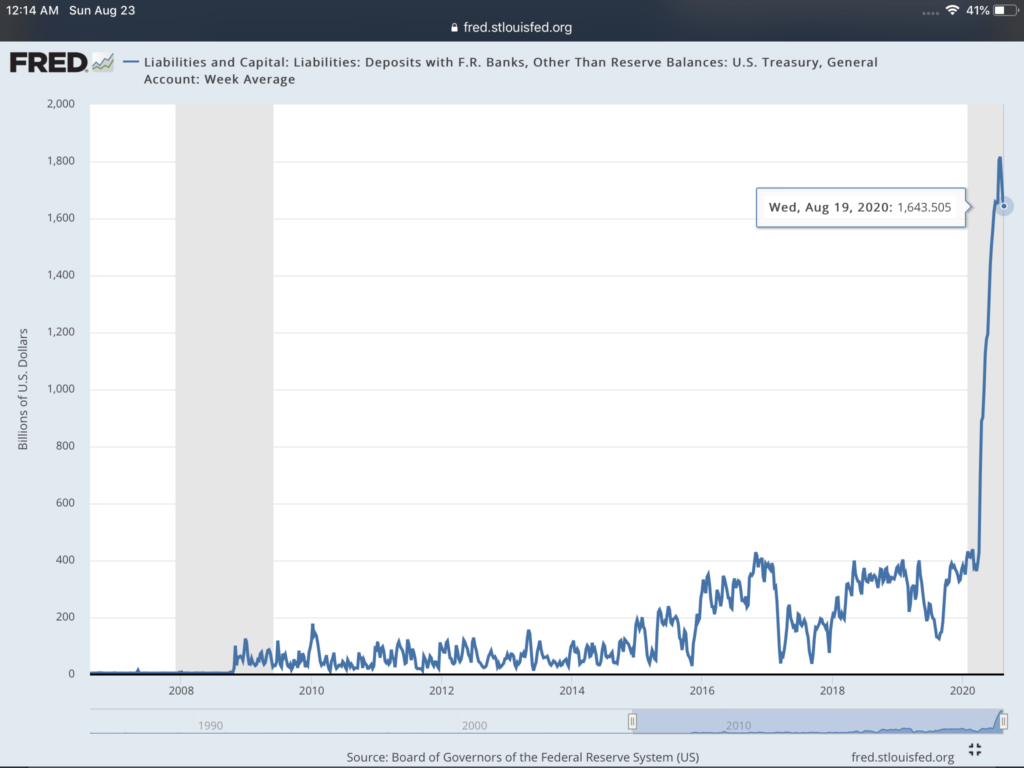

The Treasury General Account(TGA): This is essentially the checking account of the U.S. Below are two charts(30+ years & 5yr)which detail the balance of that account. On July 29th, the balance surpassed 1.8 trillion dollars – that’s +900% higher than the peak amount after the housing crisis.

Who is in charge of the U.S. Treasury? The Secretary of Treasury is Steve Mnuchin. If you have any cash on hand, and it is 2016 or newer, you will find his signature on the bottom right – and by signature, I mean it’s the one that is written with a mix of capital and under case letters as if his mother had to stand over him and guide his pen as he kept looking back and forth between the paper and her to know if he was spelling it correctly. He also worked at one of the most prestigious financial firms in the United States for 17 years: Zee Goldman Sachs(The Vampire Squid). He has a net worth of over 400 million and 6 homes for the wife he bought.

I bet his first priority is serving the American people.

With the Treasury spending so much money we finally have an answer to that old philosophical question: if all the trees are cut down in a Forest because of US spending, and only Steve Mnuchin is around, does anyone give a shit? Apparently not.

Since that was the account for the U.S. Spending, what is our deficit with so much funding?

Source: Zerohedge.com

A Fiscal Year for the U.S. is October 1 – September 30. The chart above was the current path at the end of 2019(beginning of Fiscal Year 2020). And now…

Source: Zerohedge.com

Brrrr, brrr, Gucci!

We’re going to end the 2020 Fiscal Year deficit around 5 trillion dollars. In June, our MONTHLY deficit was bigger than:

2013..

2014…..

2015………..

2016……………………

2017………………………………

2018.

June, 863 BILLION.

Despite the U.S. Congress and the Monetary System being extremely corrupt and designed to inherently increase the wealth of a certain class of people, relative to the rest of the world our system still allowed individuals more freedoms – i.e. although many countries have a much greater population, we had the right formula to let an economy and its people prosper – freedom, individual rights, and capitalism. And I would beg to argue with those who claim to support such(I imagine you’ve moved towards the left since the entire country – republican or democrat – has moved in that direction) that the reason for this is because of the Federal Reserve and wealth inequality – these terms may as well be synonymous. Any government will either bring about compliance by fear or lies. The United States was one of few lies(relative) but not so much as to heavily interfere with the individual and their prosperity. Due to this, we became the most powerful nation within a very short period. Yet today we have a majority of the populace forgetting the history and instead choose to focus on the atrocities of our nation – and I’m not denying their existence, for they’re in abundance – but they believe it right to force a nation of individual states to bow to the majority; they see it as a revolution overthrowing the patriarchal and institutional powers; they fail to see what history has taught for eternity and what man may never be able to overcome: The greater a power the greater an evil. For evil will always desire that power more than the good or righteous. Ironically, those that seek to correct this behavior through government are just as cowardly and greedy as the people you believe are the cause for your destitution.

Where were we? How could I forget? Back to explaining the fall of the United States of America.

There seems to be a common misconception about the United States and our debt debacle. The U.S. dollar is used as the World Reserve’s Currency – meaning that other nations often trade goods using the dollar. All of these countries, relative to all of the other world currencies, use the dollar vastly more than other currencies. In fact, our currency is still well above and beyond any other nation – the closest currency held among global central banks is the Euro, a common currency amongst 27 countries! Sixty percent of Global Central Banks reserves are held in Dollars.

If a country has an excess amount of dollars, they’ll purchase U.S. treasuries so interest can be received rather than suffering a loss from inflation. This means the benefit for the U.S. is twofold; we send dollars for goods; they lend those dollars back to us for further consumption. For years now we’ve been giving other nations our paper – particularly China – in return for the goods they produce. We’ve also benefited from inflation since we not only get to tax our citizens but the entire world. How long will that last considering the real yield on a 10yr Treasury(yield – rate of inflation)?

Currently foreign central banks and others using the dollar to transact global trade are roughly losing 1% a year – this is assuming they’re invested in a 10 year Treasury. Which may explain the drastic reduction in foreign demand over the past few years…

Source: Zerohedge.com

The chart below – which is directly from the treasury.gov website and therefore is the reason its data is not easy to dissect – shows Japan holding the most Treasuries with 1.26 trillion(the data is in billions) and China with the second most totaling 1.08 trillion. As tensions increase with China our imports will decrease but exports may begin to increase as they attempt to get rid of their dollars for real goods – and this is going to be one out of many problems the Fed will have controlling prices/inflation. Have you been shopping lately? Prices have gone up quite a bit thanks to the latest pandemic. Now imagine what happens when we no longer can import goods from China. It will cause a higher demand for US goods(higher prices) and foreign demand for our goods/services also increases as they increasingly rid dollar holdings. This is going to cause prices to soar even when our economy has high unemployment/low consumer demand – stagflation. And because the US is mostly a service sector economy we will have to start creating goods we do not produce. – inflation.

Japan currently holds the highest amount of U.S. debt: 1.26 trillion / YoY: 139 billion

China has steadily reduced their Treasury holdings albeit at a slow rate: 1.07 trillion / YoY: -38 billion

How do we stop inflation? The Federal Reserve must raise interest rates – this slows borrowing since buying a house, car, etc. now costs more and incentivizes people to save/invest due to a higher rate of return.

It’s not plausible for the Fed to raise interest rates – since the beginning of the 1980’s they’ve been steadily dropping rates. It’s obvious they’ve made mistakes because a sound monetary policy wouldn’t have such a predictable trend; sound monetary policy wouldn’t have had rates at 0 for the longest period in history. It’s hard not to believe the Fed isn’t purposely enriching their friends at Wall Street because they could have advised Congress to enact stimulus measures similar to some of the latest legislation during this pandemic. They’re aware that reversing this trend is all but impossible unless all of congress, the President, and the Fed agree to an extremely long and hard recession to liquidate the malinvestments – politicians and those within government would never choose such an option because it’s not politically feasible and it reduces their own power and control. Their plan is to further state control and always blame your problems on the greed of capitalism and free markets.

There’s no other solution for the Federal Government. This is an unfortunate conclusion to all great empires – the Romans essentially evolved in the same way – and America is and will suffer from abandoning its principles and its people. Depending on your race, gender, or an array of other circumstances, this line may be hard to swallow – the only way to ever truly understand something is to experience it yourself; this is not possible for a majority of things life. And because of this, it is always best to not impose your will or ideology unto others; in the long run, nothing will ever be changed by force – entire civilizations, nations, or even continents may for a brief period endure what has been forced upon them but only through mutual voluntarism will we all move forward – this can only be achieved by limiting power. I understand the motives and good intentions behind a lot of the current movements, but it seems to me resentment, vengeance, or perhaps incompetence still leads most of those who seek betterment for mankind.

Government can never right wrongs or solve peoples problems because it is the ultimate power – therefore the rich and powerful will claim and use it every time! The Federal Reserve is not buying assets to help the economy nor the American People; the Federal Reserve is buying assets to protect the people it serves and has always served: Wall Street. I’ve hardly touched upon the Fed in this article – don’t you worry my friends(assuming you also dislike the Fed, and if not, fuck you.) for I will be covering with great detail all of their actions from 2008 until present. No matter your opinion in regards to the Federal Reserve, you will learn something new if you follow our material – prepare yourself for the source from THE SOURCE of almost all of the problems that plague our nation.

It’s time to bring this article to a conclusion since long articles are rarely read anymore. Here are a few more charts that detail the severity of our current crisis that is sure to continue and worsen in the months and years to come. By the end of September, I will have a series of articles further pushing the U.S. Nationalization claim – although I think it’s practically fact considering the banking sector is on the cusp of collapse and even the huge corporations, which are in no need of government assistance, are having their bonds bought up by the Federal Reserve. The Federal Reserve will be the main focus of attention going forward; there will be no politics; there will be assessment of politicians and government because investing will no longer be dependent upon fundamentals – if that isn’t glaringly obvious by now – it’s all government; it’s all men who sip tea in fancy rooms; it’s all men who walk over ants and feel bigger. So ultimately what’s important is deciphering what these men and women will do going forward – inside information. What’s obvious is they want more control and continue to gain more ground every day. And this is what will happen in the coming years…

They will come for the banks when they fail(Nationalization) – for the greater good.

They will come for other companies and sectors thereafter(Nationalization) – for the greater good.

And they will come for your pension, retirement, 401k, etc.

You’re a fool to believe otherwise. But if you don’t believe me, give me 60 days. And if you still aren’t convinced please find me on Twitter @JUNKieBonds

Initial Claims – How many persons have filed for Unemployment Benefits. March 28, 2009 was the peak: 665,000. The latest number in August was 963,000. It is estimated to stay relatively flat in the coming months.

Source: U.S. Employment and Training Administration / St. Louis Federal Reserve

Personal Current Transfer Receipts: Consists of income payments to persons for which no current labor/services are performed and net insurance settlements.

Source: BEA

The chart above depicts the monthly outlays for the U.S. Treasury. There are 7 different categories and typically the bulk of the outlays are in Social Security or Medicare. I’ve added red rectangles to highlight “Income Security.” April and May are multiples larger than the year and half before; the outlays for these months are bigger than social security and Medicare combined! And lik*e the CBO, you believe these will steadily erode awa

Federal Reserve Balance Sheet – After 2008, The Federal Reserve embarked on a path of asset purchases; bring down long Treasury rates and help the mortgage market through long term Treasury purchases and Mortgage Backed Securities(MBS). And in my factual opinion, it is more about helping the banks patch up their balance sheets, as they put all the toxic mortgage debt onto the taxpayer and provide the banks with cash/reserves. From the beginning of 2009 it took until 2015 until the Federal Reserve had bought 3 trillion worth of assets; in 2020 they increased their balance sheet 3 trillion in just over 2 months – this is the equivalent pace of buying all of the goods and services(GDP) that the US will produce this year.