US Manufacturing Surveys Send Mixed Signals As Employment Plunges

Tyler Durden

Tue, 12/01/2020 – 10:04

China’s overnight exuberance in its PMI surveys buoyed global stock markets but all eyes will be on US data this morning. As US ‘hard’ data has slumped for 4 straight months, ‘soft’ survey data has continued to surprise to the upside on the heels of hope.

-

Markit US Manufacturing PMI ROSE to 56.7 (vs 56.7 flash vs 56.7 exp vs 53.4 prior) – best since Sept 2014

-

ISM Manufacturing DROPPED to 57.5 (vs 58.0 exp vs 59.3 prior)

Source: Bloomberg

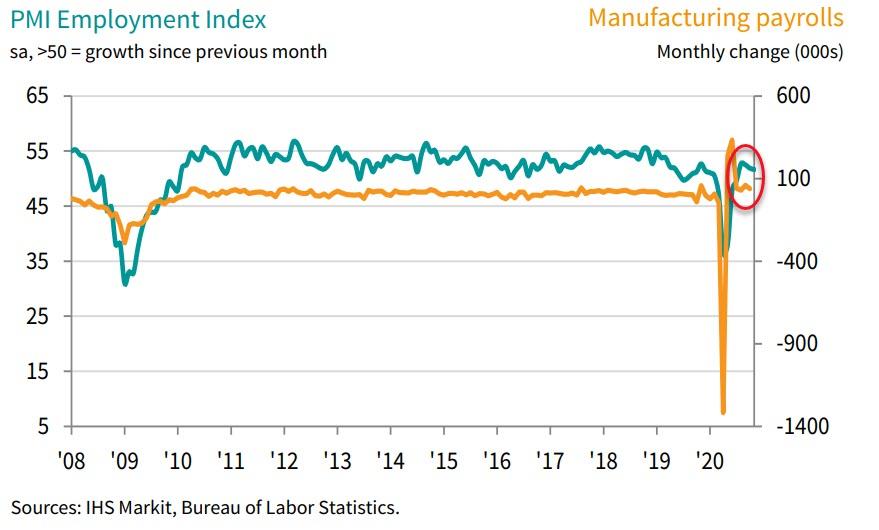

ISM notes that despite strength in new orders (even though its growth dipped), manufacturers registered notable weakness in employment (contracting on the month)…

According to Markit, the rate of job creation was only marginal overall, with some firms stating that short-term uncertainty over demand and efforts to rein in spending weighed on workforce numbers.

Chris Williamson, Chief Business Economist at IHS Markit said:

“The manufacturing recovery kicked up a gear in November, with production growth accelerating to the highest for over six years.

“Most encouraging was the breakdown of the rise in new orders which underpinned the expansion. Although demand for consumer goods remained somewhat subdued, mainly reflecting rising virus infection rates, demand for investment goods such as business equipment and machinery rose especially sharply.

“The rise in investment spending sends a welcome signal that companies have become more optimistic about longer term prospects, something that was reinforced by a surge in firms’ expectations about production in the year ahead – even in consumer-facing sectors – to the highest since early-2015.

“Confidence was boosted by encouraging vaccine news during the month, auguring well for life returning to normal at some point in the coming year, as well as hopes of increased stimulus spending and infrastructure investment following the election.”

However, as we noted above, ‘hope’ is starting to fade as ‘soft’ data reverts to ‘hard’ data overall…

Source: Bloomberg

Remember, “hope” is not a strategy!