US Producer Prices Soar Most Since 2018 As Gas Prices Spike

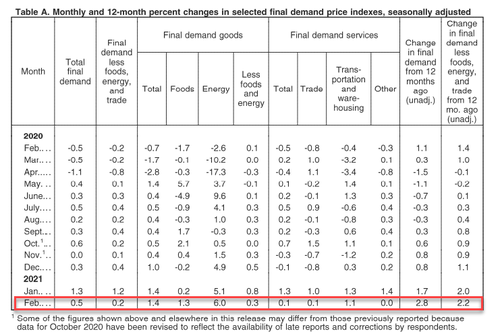

After January’s record surge in producer prices, analysts expected February inflation to slow and it did, rising 0.5% MoM as expected. That sent the year-over-year change in producer prices to +2.8% – its highest since Oct 2018.

Source: Bloomberg

However, core PPI disappointed, rising 2.5% YoY vs +2.6% YoY expected.

Consumers should brace…

Under the hood, energy and transportation costs led the move higher in producer prices…

Forty percent of the February increase in the index for final demand goods is attributable to gasoline prices, which jumped 13.1 percent. The indexes for diesel fuel, beef and veal, basic organic chemicals, residential electric power, and chicken eggs also moved higher. Conversely, prices for fresh and dry vegetables fell 16.7 percent.

A 3.6-percent increase in the index for transportation of passengers (partial) was a major factor in the February advance in prices for final demand services. The indexes for securities brokerage, dealing, and investment advice; machinery and equipment parts and supplies wholesaling; health, beauty, and optical goods retailing; and hardware, building materials, and supplies retailing also moved higher

Powell’s gonna need to print more oil!

Tyler Durden

Fri, 03/12/2021 – 08:37