Whale Accumulation Sends Bitcoin Above $19,000 As Gold Tumbles

Tyler Durden

Tue, 11/24/2020 – 08:32

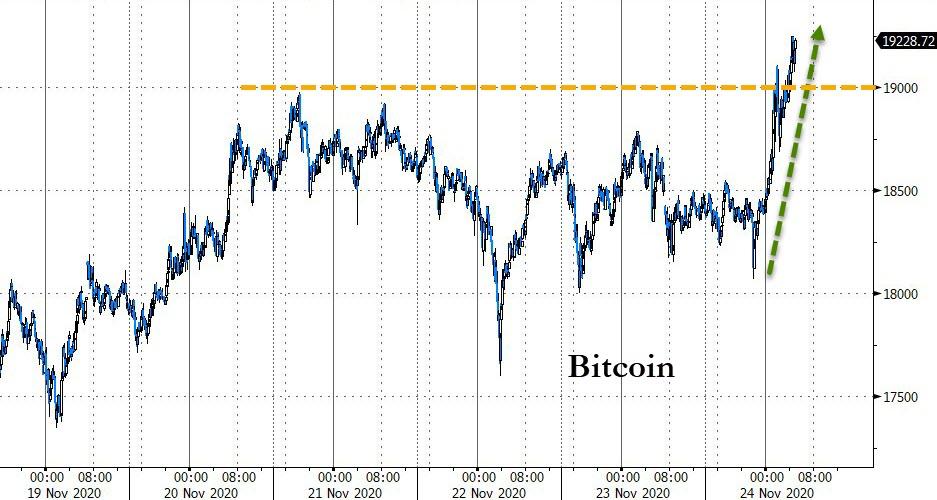

For the first time since 2017, Bitcoin price pushed above $19,000, and multiple indicators suggest the rally may continue. There’s less good news for lovers of more traditional economic-curmudgeon plays with gold dropping for a second day to trade at $1,815

Source: Bloomberg

Within $400 of the record high from Dec 2017…

Source: Bloomberg

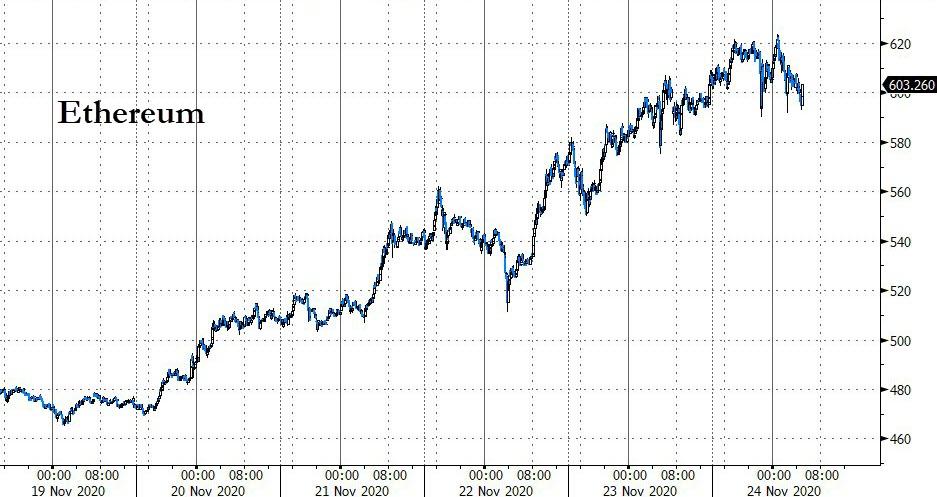

Ethereum is steady today after yesterday’s surge as Eth2’s beacon chain genesis has been confirmed for Dec. 1 following the transfer of 524,288 Ether (ETH) from 16,384 validators into the Eth2 deposit contract since it went live on Nov. 4.

Source: Bloomberg

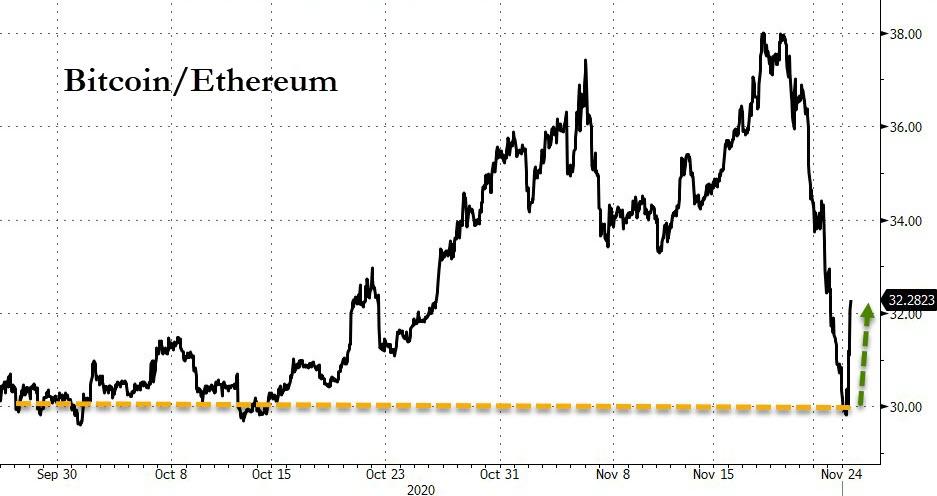

Bitcoin bounced off support versus Ethereum…

Source: Bloomberg

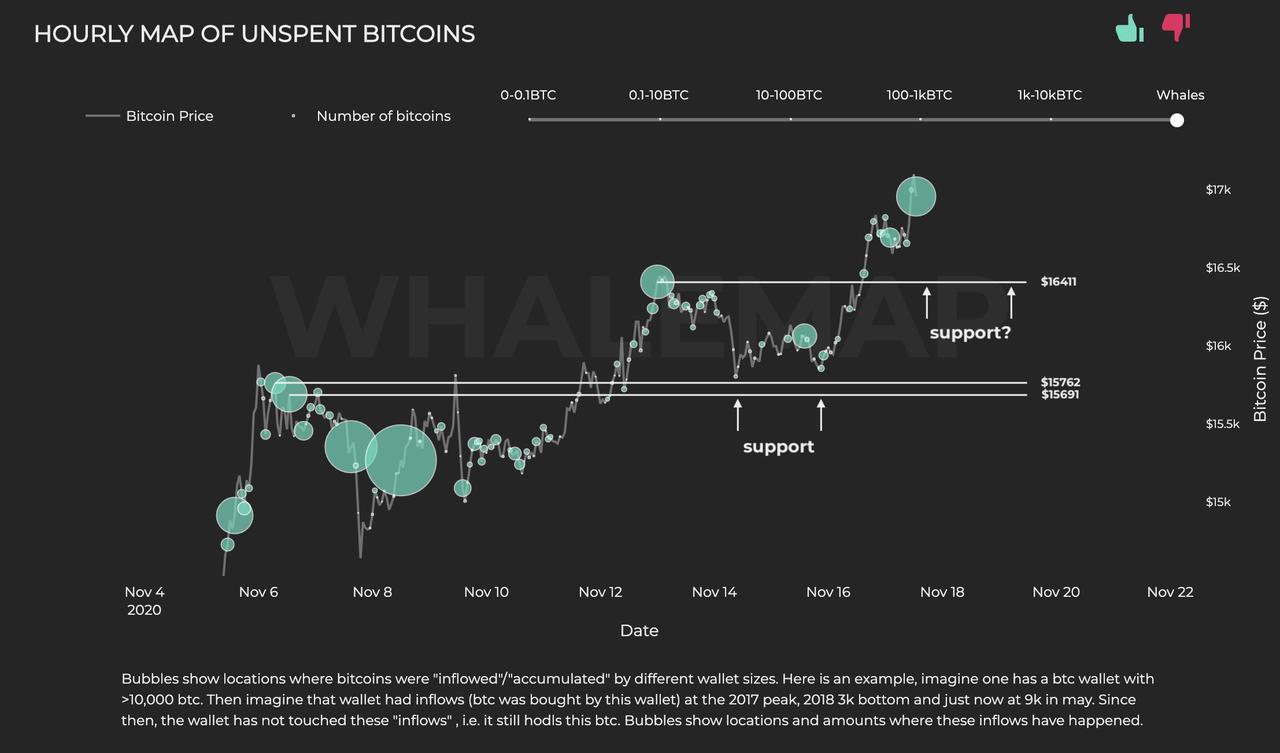

CoinTelegraph’s Ray Salmond points out that the main factors buoying BTC’s ongoing rally is whale accumulation, decreasing exchange supply and explosive volume trends.

image courtesy of CoinTelegraph

Whales are still accumulating Bitcoin

All throughout November, Cointelegraph reported that whale clusters were steadily forming as the price of Bitcoin rallied.

These clusters emerge when Bitcoin whales buy BTC at a certain price point and do not move them. Analysts have interpreted this as a signal that whales are accumulating and that they have no intention of selling in the near term.

The difference between the ongoing Bitcoin rally and previous price cycles is that the recent uptrend has proven to be more sustainable. In fact, each whale cluster shows that every major support level BTC reclaimed was accompanied by whale accumulation.

Unspent Bitcoins at each whale cluster. Source: Whalemap

On Nov. 18, when Bitcoin dropped to as low as $17,200, analysts at Whalemap said that the new whale support is located at $16,411. They said:

“Bubbles indicate prices at which whales have purchased BTC that they are currently holding. Bubbles also visualize support levels. Last time we bounced from $15,762 and had a 15% price increase. Is the new bubble at $16,411 going to hold this time as well?”

Since then, Bitcoin has seen several more dips below $18,000 but has since recovered above $18,800, sustaining its strong momentum.

Furthermore, data from Santiment, an on-chain market analysis platform, shows a similar trend. Santiment researchers found that the number of BTC whales significantly increased in recent months. They explained:

“The amount of #Bitcoin whales with at least 10,000 coins (currently $185M or more) has ballooned to 114 the past couple days as prices soared above $18k. Additionally, the amount of holders with at least 1,000 $BTC ($18.5M) has hit an ATH of 2,449!”

Additionally, as Reuters reports, investors like Stanley Druckenmiller, founder of hedge fund Duquesne Capital, and Rick Rieder, BlackRock Inc’s chief investment officer of global fixed income, have recently touted bitcoin.

Retail investors though are still mostly sidelined due to the pandemic’s effect on the economy. But with the entry of Square and PayPal, Lennard Neo, head of research at crypto index fund provider Stack Funds, expects a deluge of retail demand more intense than in 2017.

Neo forecasts bitcoin to reach $60,000-$80,000 by the end of 2021., but that pales compared to Tom Fitzpatrick, a strategist at Citigroup, who forecast earlier this month the token could potentially reach as high as $318,000.

Going from $18,000 to $100,000 in one year is not a stretch, Brian Estes, chief investment officer at hedge fund Off the Chain Capital, said.

“I have seen bitcoin go up 10X, 20X, 30X in a year. So going up 5X is not a big deal.”

Estes predicts bitcoin could hit between $100,000 and $288,000 by end-2021, based on a model that utilizes the stock-to-flow ratio measuring the scarcity of commodities like gold.

That model, he said, has a 94% correlation with the price of bitcoin.

Bitcoin’s supply is drying up

One consistent trend throughout the 2020 bull cycle was the continuous drop in Bitcoin exchange reserves.

Investors and whales deposit BTC to exchanges when they want to sell BTC. Hence, the recent drop in exchange reserves means there are fewer sellers in the market.

A pseudonymous trader known as “Byzantine General” said that every time spot exchanges expand their BTC reserves, they get accumulated. He said:

“Everytime spot exchanges add to their $BTC reserves it gets depleted almost immediately. Don’t you get it? There’s literally not enough supply.”

Volume is surging

The volume of both institutional and spot exchanges has been increasing rapidly since September. Open interest on Bitcoin futures and options at CME surpassed $1 billion in November and Binance’s BTC/USDT pair has consistently delivered over $1.5 billion in daily volume.

Various data points also show that the spot market has been leading the rally, not derivatives or futures markets. This trend makes the rally more stable and reduces the risk of massive corrections.

When the futures market accounts for the majority of the volume during a Bitcoin uptrend, there is a large risk of cascading liquidations. This time, the spot market has been leading the rally, thus making it more sustainable.

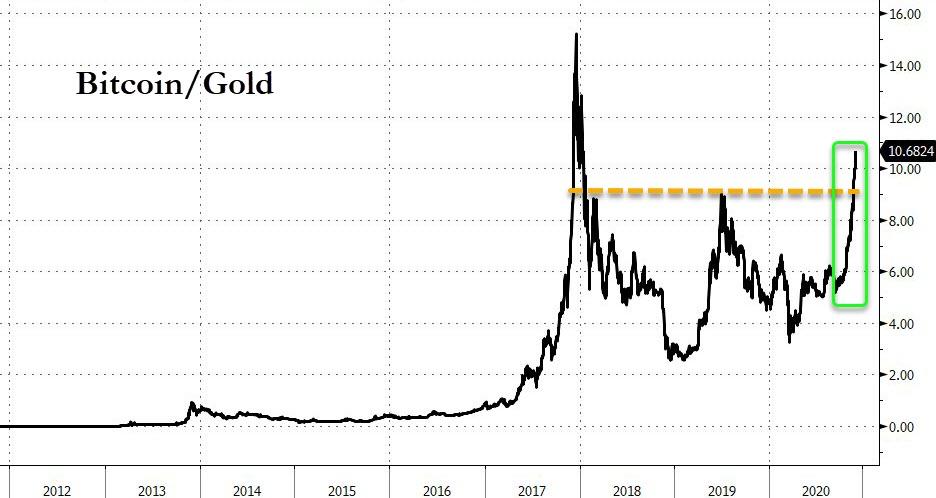

‘Digital’ Gold

Finally, there is one more factor worth noting. It appears there is a preference for ‘digital gold’ over the barbarous relic as the correlation between the two crashes into negative territory..

Source: Bloomberg

As Tom Luongo recently noted, the current rally in bitcoin is telling us clearly that there is a new premier store of value asset because of the current state of the world. Maybe that’s really what Schiff is decrying, a world that has passed him by.

What’s becoming clear even to me is that gold will only be valued in relation to bitcoin going forward, not the other way around.

It’s sad but true. In my heart of hearts I wish it were different and not because of the structure of my portfolio or the name of my business.

It’s sad because it proves that we are moving into a different age where technology is depreciating the value of an asset which materially improved the life of billions for millennia towards its commodity extraction value limit.

And while many gold advocates don’t want to admit that they have stood by while the fortune of two lifetimes has passed them by. That’s the bad news.