World’s Largest Model Agency Attempt To Go Public Via SPAC Collapses

Tyler Durden

Tue, 11/24/2020 – 19:25

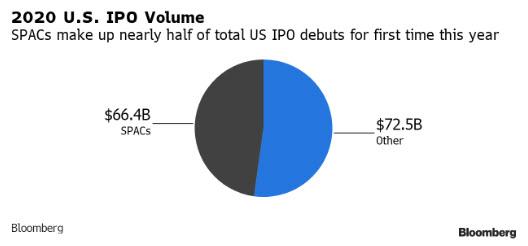

Just how ridiculous is the blank check IPO fever that has gripped markets in 2020? Consider this: SPACs, or blank-check companies which go public for the express purpose of buying an existing firm and which also exploded in 2007 just before the housing/credit bubble burst, now make up a record share of U.S. initial public offerings this year. According to Bloomberg, SPACs have collectively raised $66.4 billion year-to-date, accounting for nearly half of all the $138.9 billion raised in U.S. IPOs (SPACs only accounted for 19% of the $71.4 billion IPO pie last year).

And while there is no stopping the blank check juggernaut absent a full-blown market crash – so far in November, the SPAC pipeline has continued to grow with 18 more filings on deck to list on U.S. exchanges – one company that won’t be going public via a SPAC merger is the world’s largest model agency, Elite Model World, whose merger discussions with blank-check firm Galileo Acquisition have fallen apart without a deal being reached according to Bloomberg, which reported that Elite informed investors this month that the talks had collapsed.

Maybe the models demanded that the SPAC be denominated in Euros?

In any case, with the deal dead, Galileo is searching for a new merger target. The $138 million SPAC is focused on “the consumer, retail, food & beverage, specialty industrial, technology or medtech sectors which are headquartered in Western Europe, with an emphasis on Italian family-owned businesses, portfolio companies of private equity funds, or corporate spin-offs, and that have significant North American exports and a clearly defined North American high growth strategy.” That’s a real kitchen sink, so for simplicity’s sake, let’s just say “Western Europe/Italy”.

Elite Model has in recent years diversified into representing social media influencers, as well as its traditional fashion model clientele. Unfortunately, judging by the sudden collapse of the SPAC, it does not appear to have diversified into actually being profitable.

Galileo and Elite Model held talks last month with potential investors about raising new equity for a merger that would have taken the agency public, Bloomberg reported at the time.