WTI Dips After Worrisome Surge In Gasoline Stocks, Demand At 5-Month Lows

Tyler Durden

Wed, 11/25/2020 – 10:37

WTI extended gains overnight, after dipping on a surprise crude build reported by API, pushing to 8-month highs above $45 on mounting optimism that recent breakthroughs on a Covid-19 vaccine will lead to a swift recovery in global energy demand next year.

“The recent news around Covid-19 vaccines has boosted crude prices as markets start to look to a return to some sort of normality in 2021,” said HSBC Bank analyst Gordon Gray. “We expect OPEC+ to err on the side of caution as it evaluates how the market evolves.”

Notably, prices have also been supported by renewed geopolitical tensions, with recent attacks on a fuel depot in the Saudi city of Jeddah and on an oil tanker in the Red Sea.

API

-

Crude +3.8mm (-300k exp)

-

Cushing -1.4mm

-

Gasoline +1.3mm

-

Distillates -1.8mm

DOE

-

Crude -754k (-300k exp, +475k whisper)

-

Cushing -1.721mm

-

Gasoline +2.18mm

-

Distillates -1.441mm

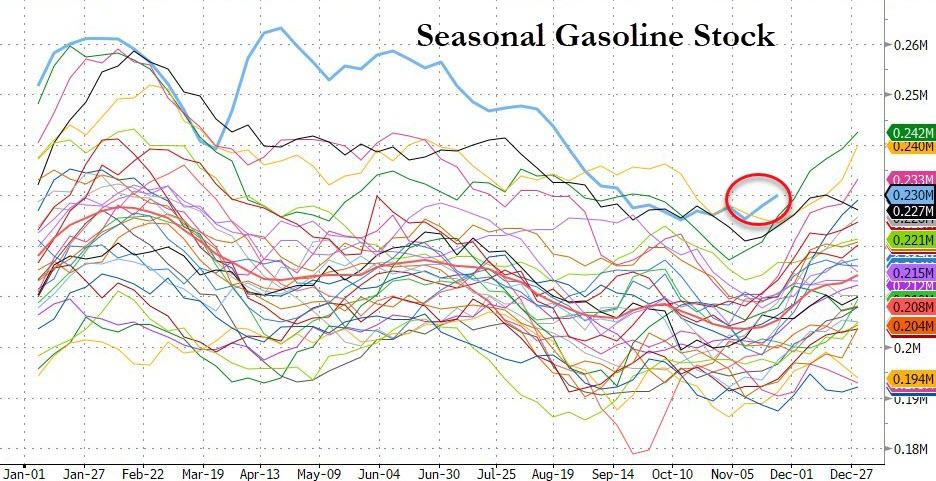

Official inventory data flipped the script from API with a 754k draw (vs 3.8mm build). Gasoline stocks rose more than expected (for the second week in a row), which is worrisome…

Source: Bloomberg

Crude production rebounded from storm shut-ins…

Source: Bloomberg

WTI was hovering around $45.30 ahead of the official inventory data, and limped modestly lower after the print…

Bloomberg Intelligence Energy Analyst Fernando Valle notes that gasoline-demand headwinds loom large ahead of the Thanksgiving holiday due to restrictions on travel, with the potential for an extended build in inventories and more pain.

Source: Bloomberg

Gasoline demand remains well below fall 2019 levels at its lowest since June.

Most ominously, Bloomberg reports that the national inventory is at a seasonal high since 1994.

Stockpiles rose 2.2 million barrels to go over 230 million barrels — the U.S. is swimming in gasoline right now.